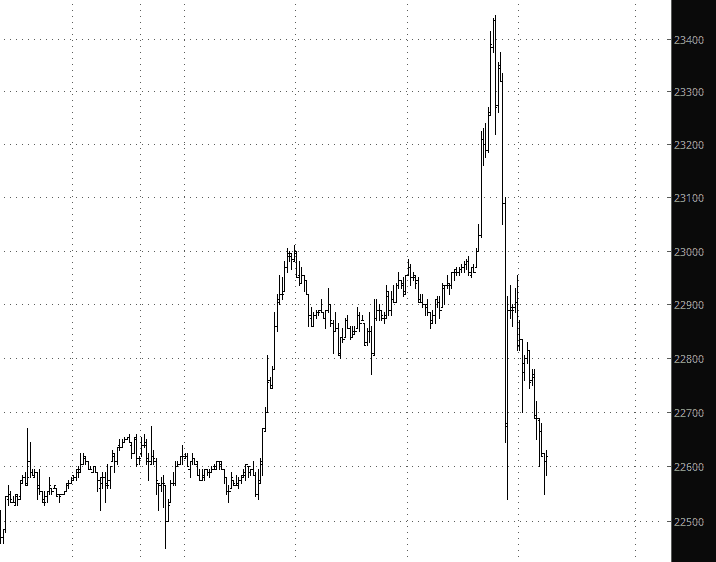

I’m about to toddle off to bed, but before I do, I wanted to mention what I see going on tonight with after-hours markets. Asia was apparently on fire, roaring skyward (for no apparent reason – – bulls haven’t needed one for years). However, that seems to have reversed, and (as of this moment anyway) the ES and NQ have turned into my favorite color, and the Nikkei looks like this:

Of course, who knows what it’ll be like when I wake up. Anyway, good night, Slopers!

UPDATE: Well, I’m up, and miracle of miracles, the selloff actually stuck. The NQ was down about 50 points when I woke up. So now we shall see if, for the 3,879th time in a row, the bulls simply bid things up again or if they actually suffer a tiny, tiny bit.