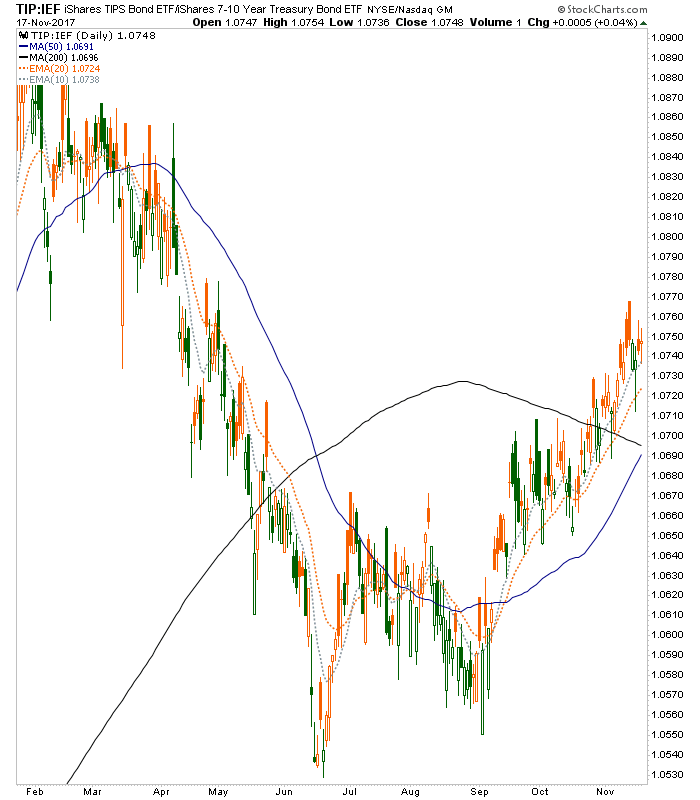

The TIP/IEF ‘inflation gauge’ is still motoring upward after breaking above the SMA 200. If this turns the 200 up along with the MA 50 it could indicate a mini hysteria about inflation.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Unintentionally Funny Covers

This stuff just writes itself these days…………

The Falling Megaphone on RUT

A very key pattern that I’ve been watching here for direction is the likely falling megaphone on RUT.This has been a slow developer and has now been forming for an impressive seven weeks. Assuming that this is indeed a falling megaphone then the next target within the megaphone is megaphone resistance, now in the 1511 area, with the main remaining obstacle on the way at the monthly pivot, at 1500 even and tested at the highs today.

Assuming that this is that falling megaphone, then that falling megaphone is a high probability bull flag pattern, and when that breaks up the minimum target will be a retest of the all time high at 1514.4.If that retest can be kept to a marginal higher high then that is the bears’ next decent shot at a larger retracement, though seasonality makes it questionable that we would see that retracement in what remains of 2017. RUT 60min chart: (more…)

Small Caps & High Yield Corporate Bonds Hint of Higher Volatility Ahead

As can be seen on the Daily comparison chart and percentage-gained graph below, the Russell 2000 Index (RUT) and the High Yield Corporate Bonds ETF (HYG) generally trade lock-step, although the RUT is accompanied by more volatility and larger swings.

At the moment, the RSI and MACD indicators are hinting of lower prices ahead for HYG and volumes have spiked over the past few days.

We’ll see if volatility ramps up and whether any significant weakness hits both of these in the near term…particularly as U.S. Republicans battle to reform and cut taxes before the end of the year. (more…)