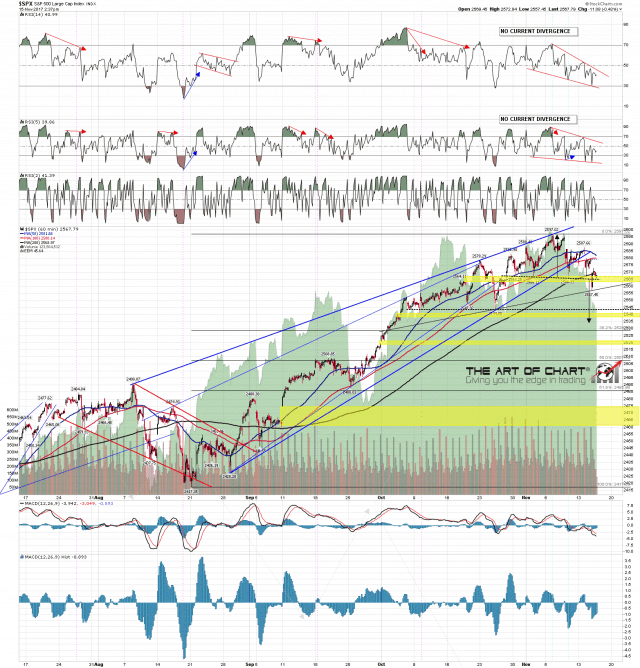

On November 6, we noted in our Mid-Day Markets update that a comparison of the SPY and IWM showed a deterioration in the Russell 2000 small-cap ETF relative to the big-cap SPY. We said that as long as IWM was trading below its 20 DMA at 149.11, we would view it as vulnerable to downside continuation off of its Oct 9 all-time high at 150.58.

We were watching and continue to watch this SPY-IWM relationship closely, as, historically, in the later stages of a bull market, a divergence is very likely. In other words, as a bull market loses steam, small companies lose upside momentum relative to the “go to” mega-capitalized companies. (more…)