It’s the return of……….The Director! First, let’s examine American Airlines. (and, as always, click on any graphic for a bigger view)

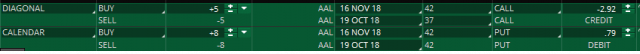

Based on Tim’s analysis, he believes it is more likely to go down. We can profit if the price goes down OR stays the same. Let’s do a combined diagonal spread AND calendar.

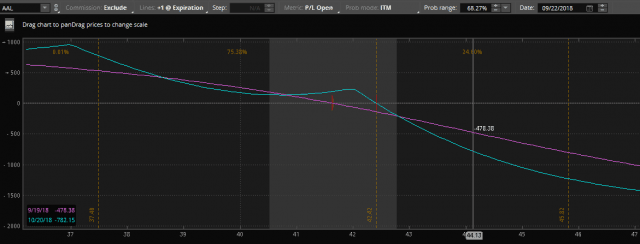

We now have a 75% chance of being profitable, on $1660 of risk by Oct 19th.

This trade will make money with time, with increasing volatility (more likely than not, with an implied volatility rank of 16), and price direction, or even with no change in price.

Trade #2.

Devon Energy corp has a low IV rank of 19. Here’s a look at Tim’s bearish disposition on DVN:

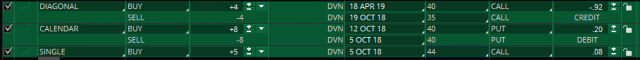

Here we can start with a diagonal spread, add a calendar, and then add a very cheap call.

Doing this, our max loss is about $800, and if no movement we will get approx $200 in profits, and if sig loss about $100-125 in profits. A massive drop in the prive would result in about a $500 gain. If attempting to fill this spread, I would leg in the diagonal, then the calendar, and last the cheap call. The cheap call can be omitted if desired for simplicity but that will add to your max loss (around $1800 without the cheap call, which is about $30 lessened profit)

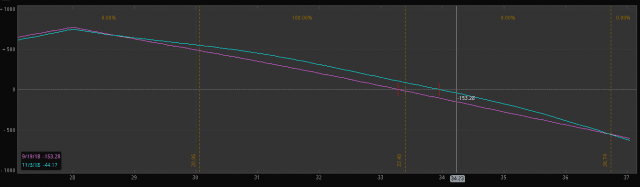

Again, the trade does well with increased volatility, time, and direction or no direction. Just not with an increase in the price of the stock.

The P/L:

Trade #3

Let’s look at AT&T (T) with a low IV rank of 17.4

CCI indicates it is overbought with a dying momentum, and low volatility, and more importantly, one of Tim’s shorts.

Again, we combine a diagonal with a calendar at a 1:8 ratio:

Max risk here is $1600, again makes a profit if moves in our desired direction, if no movement, if increased volatility, and if time passes.

Again, more discussion on options to come over the coming days to weeks.