Well, they said today’s OpEx would contain a lot of nonsense (that wasn’t the exact word; it actually rhymed with “truckery”), and they were not kidding. As of this moment, everything’s green, with equity markets up anywhere between 1% and 2%. The reason? Soybean purchases, of course!

More precisely, the China Trade Deal – – which was cited 3,398 times last year as a reason to buy stocks – – actually turned out to be totally meaningless. Indeed, only a tiny sliver of the promised purchases transpired. But now, the Chinese are promising – – honest, for realz this time – – to actually honor the meaningless agriculture agreement and buy stuff from U.S. farmers. Which explains why you should pay even higher prices to buy stock from Netflix and Amazon.

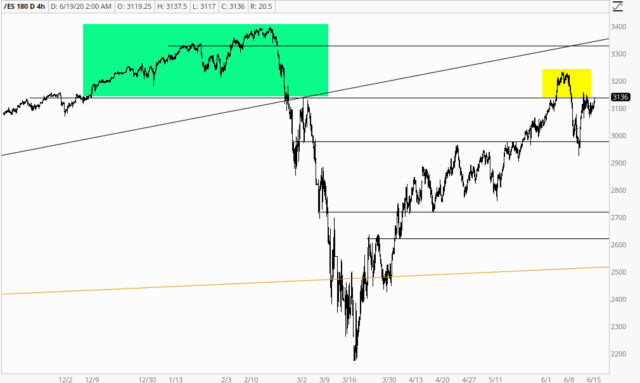

In any case, irrespective of the reason made, it worked, and the mean, green, bear-eating machine continues. Here’s what the ES looks like since late last year:

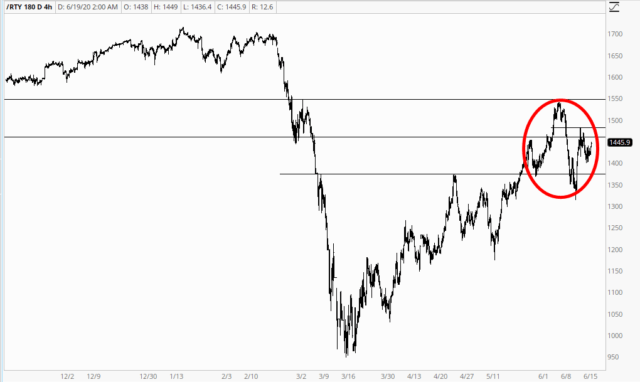

The small caps, much more of a fixation of mine, have spent the past month or more banging around a rather well-formed diamond pattern. It hasn’t broken out yet, but it’s a far more interesting setup than the ES.

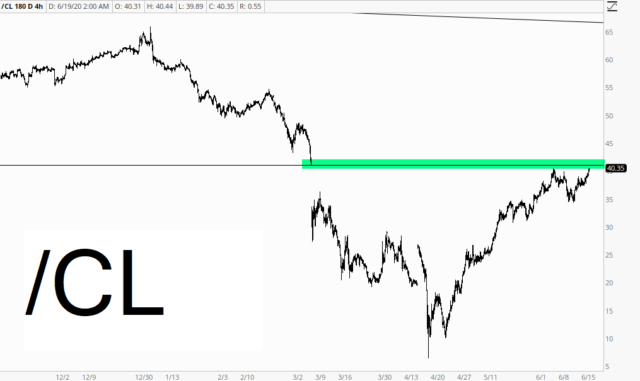

One standout today in terms of bouncing higher is crude oil (remember that? The stuff that was negatively priced last month?) We have sealed up the price gap squeaky-clean.

As for myself, as has been the case lately, I have been leaning toward cautious. I’m about 110% committed and made dial that back a little. I suspect things will loosen up considerably once we get this Opex out of the way.

Incidentally, the caching issue with respect to the blog pages (e.g. making it looked like you weren’t logged in, even though you were) got solved late last night due to some good problem-solving. It was tricky, but all is well now!