No one knows precisely when the COVID-19 pandemic will end. Most experts are hopeful COVID-19 restrictions will end and life will begin returning to normal in the middle of 2021, coinciding with the widespread distribution of an effective vaccine.

Nobody knows what the recovery will look like once COVID-19 and its associated restrictions lift, but it will benefit you to pay attention to that shape. As more and more experts feel they can accurately predict the recovery’s shape, it will give us a better idea of the smartest investment strategy. Here are some economic recovery stages to keep an eye on:

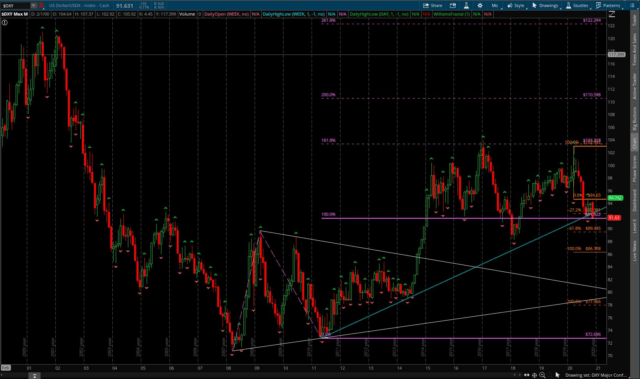

- A V-shaped recovery, where the economy recovers immediately and vigorously (likely already passed).

- A U-shaped recovery, where the economy is stagnant for a while, then recovers fully.

- A W-shaped recovery, where the economy experiences a false upswing, followed by a V-shaped or U-shaped trajectory.

- A K-shaped recovery, where some sectors and individuals experience a V, while others continue an elongated downswing.

- An L-shaped depression, with no clear sense of the economy recovering any time soon.