Norm reads the final chapter of his book:

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Day One Lookback

The first of the approximately 250 trading days of 2022 is behind us, so let’s take a look at a few major indexes to see what’s going on. First up is the Dow Jones Composite, which has been drifting along its ascending channel. It is near its lifetime high, but it had quick a lackluster day – – indeed, it actually closed a tiny bit in the red.

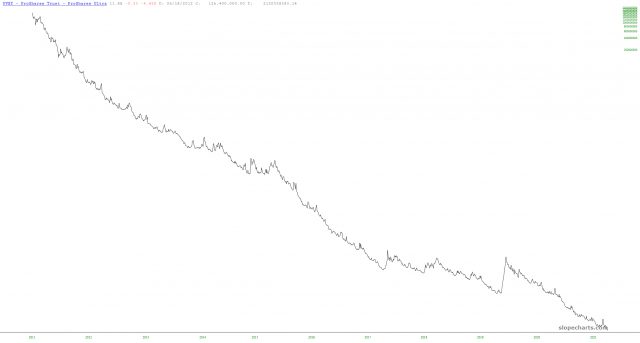

Craziest Ultra Ever

As most of you know, leveraged fund tend to degrade over time, unless there is a persistent trend in the desired direction of the fund. If the S&P goes up, let’s say, 10% in a given year, the double-bearish fund against the S&P doesn’t go down 20%. It may be down 50% (possibly) depending on how crazy the ride was. I think one of the craziest ones of all is UVXY, which is the ultrashort against voatility.

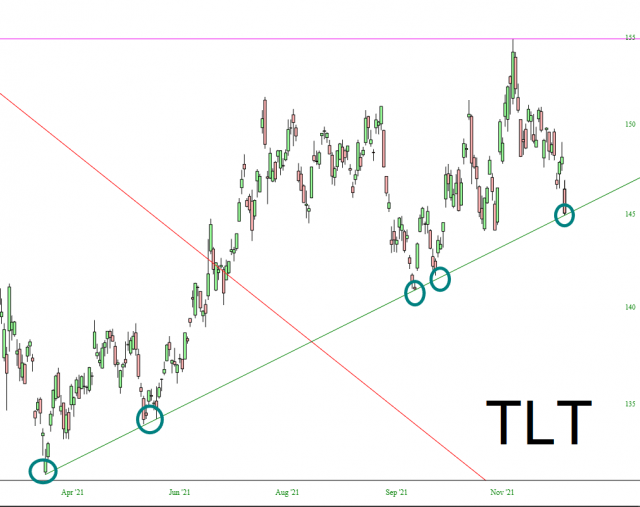

Rates & Houses

Bonds are getting hit very hard on this first trading day of the year. This is pretty much as low as TLT can go without breaking its intermediate-term uptrend. For ten months, this line has held fast, but given today’s move, interest rates are ripping higher (which lines up with the general idea that the Fed is going to be cranking rates for years to come).

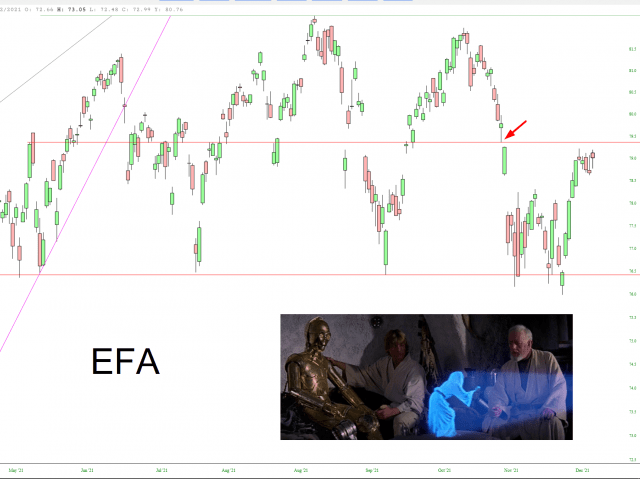

Overseas Hanging Tough

As I type this, on the first trading of the year, ES, NQ, RTY, CL, BTC, ETH, XLF are all bright green. So I’m sure all the bulls are happy as can be. As I mentioned this weekend, however, the first day isn’t exactly prophetic about the year ahead. I’m still focused on the basics: trendlines. support, and resistance.

It doesn’t merit repeating, but I’ll say it anyway: EFA is still a remarkable pattern, provided it does not pass the price gap at 79.37. Keep the faith, EFA brethren!