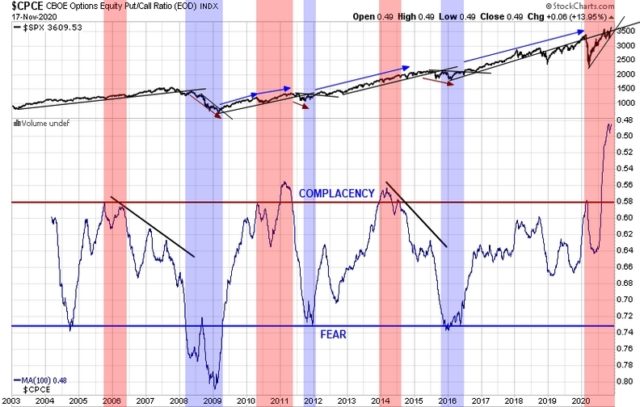

From last evening’s post regarding the measurement of complacency or fear in the markets by using the Equity Put/Call Ratio, I stumbled upon a way of timing when those transitions are underway.

It all started as I was comparing the large negative divergence in the SPX:VIX ratio to the large one I recall from 2007. As I began marking it up, a light bulb went off as I realized that ALL of the major Equity Put/Call reversals had a concurrent divergence on the SPX:VIX chart. I will plot them above each other for easier comparison.

Now essentially, the SPX:VIX largely reflects the VIX condition and all of these divergences are likely visible just by looking at the VIX chart itself, but I like it this way because it more closely matches the movement of the S&P500. Some of you may have noticed that despite the S&P500 being near ATH’s, the VIX has remained elevated. I believe this is all a part of the cycle of reversal from complacency back to fear.

That said, I see as I am writing that there was another large negative divergence in 2018 which did result in a strong sell off, but this did not reverse option sentiment all the way into fear territory and it would suggest that the complacency fear cycle shown above does not necessarily need to flip back and forth between eachother, but can back off and hit the same extreme a second time.

One more thing I noticed was that the flip from complacency to fear and back again was often affirmed by the break of a long-term trend line. Here are the downtrend line breaks that resulted in bull trends following fear reversals. Monstrous moves.

And here are the uptrend line breaks that resulted in bear trends following complacency reversals. Notice here another occurrence of a double tap extreme except to the fear zone. Nav Sarao’s flash crash “reset” the uptrend line lower. Sentiment advanced once more to the complacency zone and reversed with another uptrend line break in 2011, this time reversing all the way down to the fear zone again.

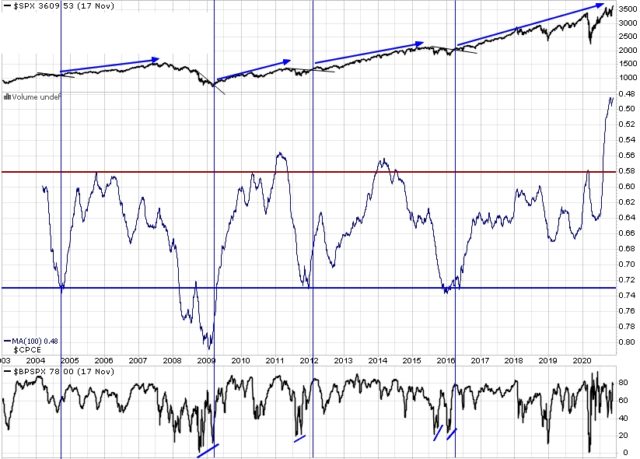

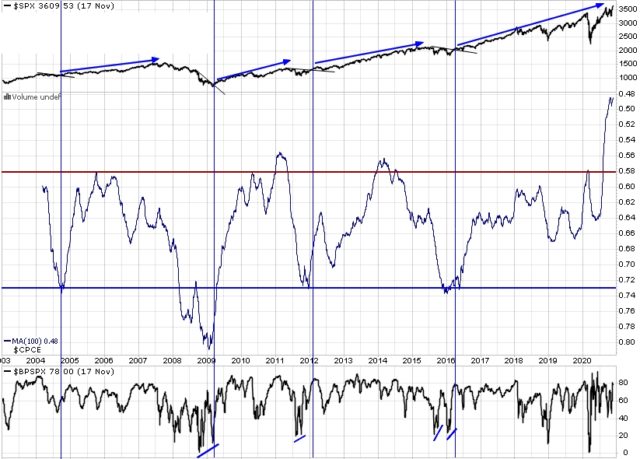

Which brings me to the finer timing. Below both of these charts, I have the Bullish Percent Index which as it so happens often has many of the same divergences at major highs and lows as the SPX:VIX. This is the fine timing signal that shows that lows are beginning to give way or highs are beginning to breakout.

They always follow the same general pattern:

- Extreme fear or complacency zone hit.

- SPX:VIX and possibly BPI show a large divergence (negative divergences from complacency zones and positive divergences from fear zones) showing that the complacency is preparing to reverse. Positioning for a reversal beforehand is prone to difficulty.

- The next BPI reversal or reversals become highly probable to induce major trend changing moves.

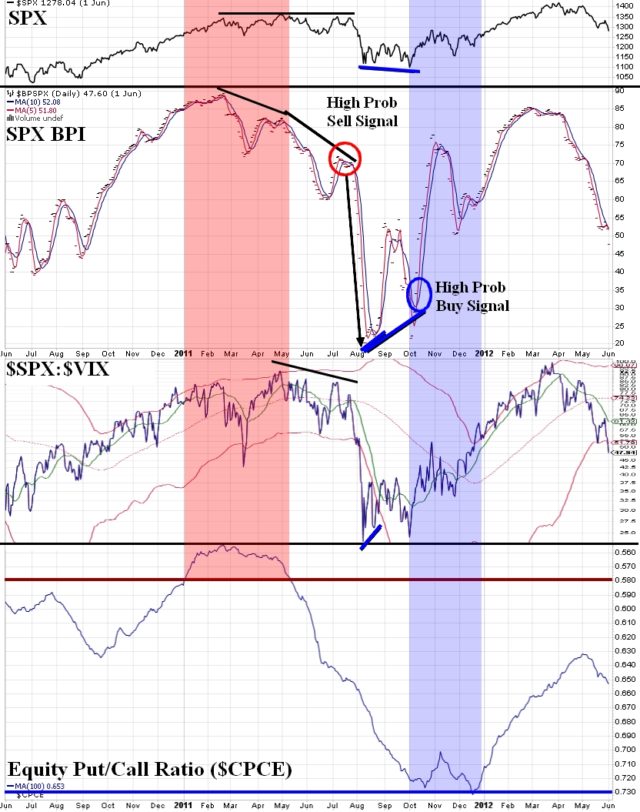

Here is an example from one of the closer together signals that reversed complacency to fear between 2010 and 2012 with the CPCE complacency level highlighted in red and the fear level highlighted in blue.

It seems now that once again, we are on the cusp of a reversal from complacency. Here is today’s market condition.

Of course, the Equity PCR is way above the typical complacency zone so I just highlighted the PCR red instead of the entire chart. High PCR + NegDiv on the $SPX:$VIX + NegDiv on the BPI = next sell signal(s) are highly reliable to produce a large sell at some point. Even the two we had already in Sept and Oct were productive, but you needed to be quick to take profits. Beware downtrend line breaks.

If you want to hold on for the majority of the decline, pay attention to the 10day SMA. In truly horrific sell offs, the Daily 10MA is often not touched until the selling is done. As long as price is below the 10MA, I will be holding short.

Some may say that some indices already hit new ATH’s and are strong because of it. I say take a look at the 2007 top and tell me prices can’t end on a high push into nothingness and extreme risk. The post-election rally was the finale for this move in my mind (at least for this bullish push), a final push of complacent exuberance into Pfffffft……..thin air.

Enjoy the fall.