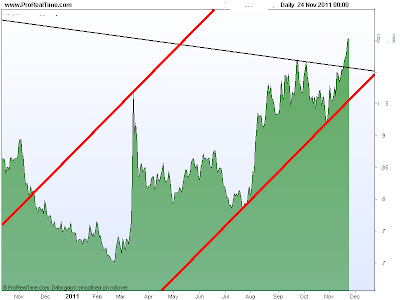

First let me go back to my post here. I drew up a simple model where I expected prices to go…Just with this simple model, you could of made a nice 6 figures in the futures market… aside from the whipsaws we had in the triangle formation(which was very irritating to say the least). Notice I had the black line drawn out before prices fell sharply on Oct 27th in which I called bullshit. And although the chart below could still be in the cards, I have a feeling we will break the October Low just from looking at certain charts…… However it is still the only bull case scenario I see from here. But again my hunch from looking at Portugal, France, and etc is that we could break the Oct low, destroying any chance of an inverted H+S formation.

The Trump Card has signaled a short sign. This is signal #1.

ZB aka 30 year Treasuries has broken regular chart resistance…but look at the RSI…it retested while we were stuffing ourselves with food. If the RSI goes back below, that is a sell sign.. So bears would want tomorrow as a confirmation…

Wow…I cannot believe the Atomic Index has broken its resistance… That is a little excessive IMO…but we have to play it as we see it.

SanJew5 Index however holds resistance!!

Also the Sanjew holds the resistance point AGAIN as it did on OCT 4th and the other bond market turning points. Keep this in mind before you get too leveraged up.

Euro Bobl

Euro Bund

EURO FX

5year Treasuries

Dow Jones Asians Titans

ALSO the END Game Index has now touched resistance again!!

First one is long term, and 2nd one is closeup.

Atomic Index's brother.

The dollar index weekly.

Summary: By analyzing the whole market, I don't feel comfortable holding bonds in the short term. Some indexes have broken resistances, yet some have held strongly such as the END GAME INDEX. The dollar index is approaching resistance again from the weekly high in June 2010 to the pivot on Oct 2011..

The euro bond market almost broke out of support and could be a warning sign of what's to come or an entry point…If the End Game, Sanjew, and Sanjew5 can break out of those resistance points however, you could easily get back in the long bond trade or short everything trade for a very, very, nice ride. But why bet when you can be patient? In fact I might get out of TMF and FAZ tomorrow and sidestep the next few trading days. It seems like we have been at an inflection point forever now….but the truth is, we are at a bigger inflection point now.

I prefer to be short Asia and financials instead of long bonds now… And if I were to play the bullish case, I would prefer to be short bonds instead of long equities…

Short side: I will love the short side if the dollar can break out of weekly resistance. I will love being long bonds if End Game, Sanjew, and Sanjew5 can break out of its resistances. But overall I prefer to be short Asia mainly.

Bullish side: Dollar is at weekly resistance. End Game Index is holding major resistance enough to kill bond bulls like the last 2 times in the 70s and 1998. Also possibility of a retest of Oct low from march 09 low and bounce but again, the market internals are saying "no."

Friday I will be looking at how the Euro bond market played out, and depending on that action I will either liquidate or hold TMF and FAZ…and possibly look to go short China or Japan.

If you like this analysis check me out at http://heavenskrowinvestments.blogspot.com/