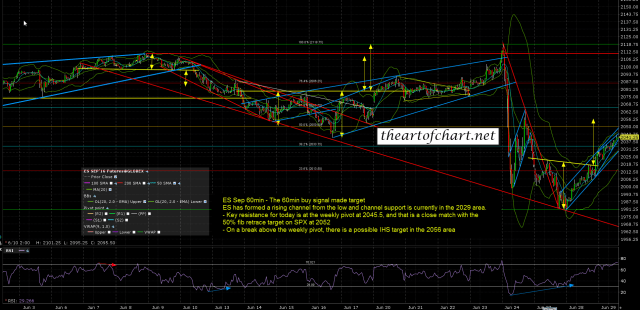

I said on twitter last night that the obvious next target on SPX was a retest of the 2050 area, and we have seen that at the open. That area is broken support at 2050, with the 50% fib retrace of the decline at 2052, and both are a match with the ES weekly pivot at 2045.5. SPX has gone a bit over there this morning. If that can be converted to support then that would open up a test of the 61.8% fib retrace target at 2067, which is a decent match with the ES monthly pivot at 2063. If 2063/4 ES is converted to support that opens up a test of the daily middle band on SPX, which closed at 2083 last night, but at that point doing any lower lows under 1991 will be looking doubtful.

What about the fundamentals and the Brexit shock? What about them? I don’t think the Brexit news is that important in itself, and that being the case, it only remains important as long as the market thinks it is. That could end at any time and may already have done so. What might be bigger news, and this could happen at any time, is if a Eurozone country, or more than one, announces their own referendum. That would be potentially very important news indeed, as the contagion from the Euro breaking up, which seems likely at some point in the next few years, could force many of the Eurozone countries to default on their sovereign debt, and that could make a significant part of the international financial system insolvent. No such referendums are planned yet though and it may still be a year or two before we see the first one. As and when we do see one then the vote is likely to be influenced significantly by the almost certain sovereign default that would follow for the majority of Eurozone countries if they were to leave the zone.

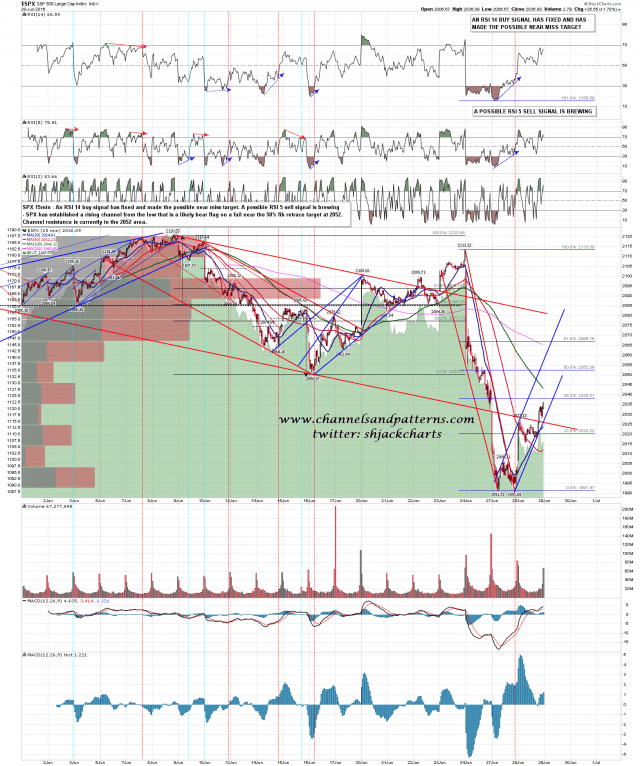

On the SPX 15min chart resistance is being tested now, and there is a typo on the chart below where it should read that channel resistance closed at 2057 last night rather than 2052. SPX 15min chart:

If the ES weekly pivot is converted to support this morning then I have a possible IHS target in the 2056 area but the next big target would be the monthly pivot at 2063. ES Sep 60min chart:

The higher this goes the less convincing the case for lower lows becomes. As long as this 2045.5 ES area / 2052 SPX area isn’t converted to support the case for lower lows is good. After that I’d be thinking 30% into the ES monthly pivot. Over that I’d see the odds at 15% or less. The best shot at lower lows is an AM high that fails hard today.