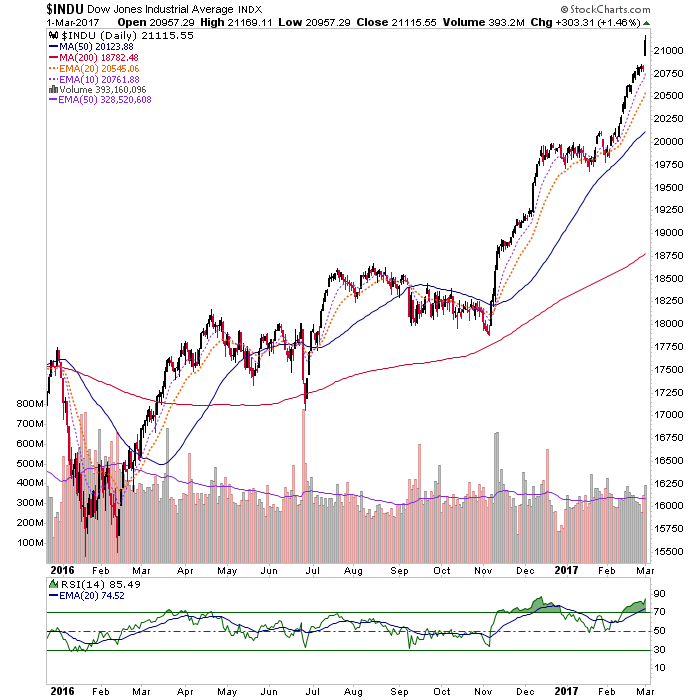

This is not a top call. My target was Dow 21,000 and this pig blew through it and flew to 21,115. This is a comparison of one bubble to another a potential other.

In 2011 silver put on an amazing run. First, it dropped and crashed the SMA 50 at the beginning of the year. Then it rebounded, became over bought by RSI (and distance from the SMA 50), tested the short-term EMA 20 and then went all Sky Lab, making a 2nd strenuously overbought reading on RSI. Then… kerplunk.

Dow dropped below the SMA 50 in September on Trump/election jitters (ha ha ha, MSM always needs rationale, don’t they?) and then on the very same Trump it rammed above the SMA 50, post-election. The resulting mini-euphoria was corrected with a sideways ease back toward the SMA 50, which held the short-term EMA 20. The resulting surge has now put a 2nd hump in a strenuously overbought RSI. Importantly, what’s missing is anything resembling climactic volume. That itself could project a significantly higher peak to come (ref. silver 2011).

What’s it mean? The stock market is going up.

What else? Where ever this overbought reading flames out the result is going to be a hard down correction. Bear market? That’s what happened to silver. But the Dow is not as impetuous as the wildest of precious metals (climactic volume needed!).

For now let’s say that the target of 21,000 has been blown through and what’s more, there could yet be significant upside (if the Dow goes all silver 2011 on us). Let’s also say that the higher and more furiously the Dow rises (with volume finally getting sucked in) into a short-term overbought situation, the worse the come down is going to be for those buying this thing today with heartfelt sincerity. *

Alternatively, if it corrects now without having taken a climax in volume, the implication would be that it is a healthy correction. It’s gonna be interesting.

* Seriously, I have seen many a market analyst change his tune simply because Trump and all that beneficial policy to come have replaced Obama and all that destructive policy that only saw the Dow go from 6,497 to 19,000. The point being, it’s a potential contrary setup of epic proportions once we get the true believers all-in (volume needed!). The market does not give a crap about peoples’ preconceptions or politics.

Subscribe to NFTRH Premium for your 30-45 page weekly report, interim updates and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com. Also, you can follow via Twitter @BiiwiiNFTRH, StockTwits, RSS or sign up to receive posts directly by email (right sidebar).