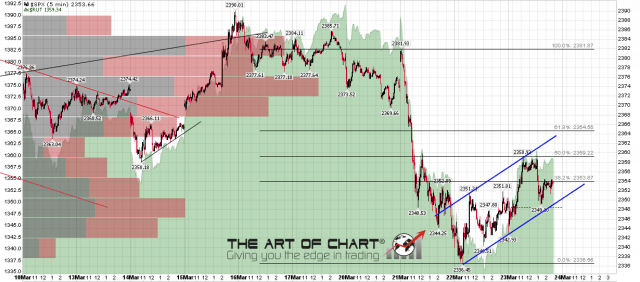

The S&P 500’s ‘Trump Trade’ is still intact per a chart guy actually worth listening to, Rich Ross, who I met 7 years ago when he worked at the firm (Auerbach-Grayson) run by my late friend, Jonathan Auerbach. Nice guy with nice, clear charts and no need to over complicate things.

Here he shows SPY above its SMA 50, which folks, is one of the reasons why I covered my own short positions. The other reasons were that the SOX was still on its short-term moving averages and Goldman and the Financials were smashing into lateral support and getting oversold.

This one chart shows why ‘the Trump trade’ is still intact (video link) (more…)