Perspective is everything, and we gain perspective by comparing one

thing to another. I wanted to build some sector and market perspective

for you. How? By providing you with the following:

- time series of when different sectors peaked1

- current retracement to peak in absolute terms1

- percentage decline from peak to trough

- percentage of points

lost retraced - percentage retracement to trough

1

contained in Table 1 below

Table

1

There are a couple of things that are notable from this chart

- It has been more

than three years since the financial sector topped - There was 16

months from the topping of the first sector (Financials) to the last

sector (Commodities)

The next table, Analysis of Sectors: Peak, Trough and

Comparison to Total Stock Market Index (sorted by % gain from trough),

will give you view of the sectors that have recovered the most since

their trough:

Table 2

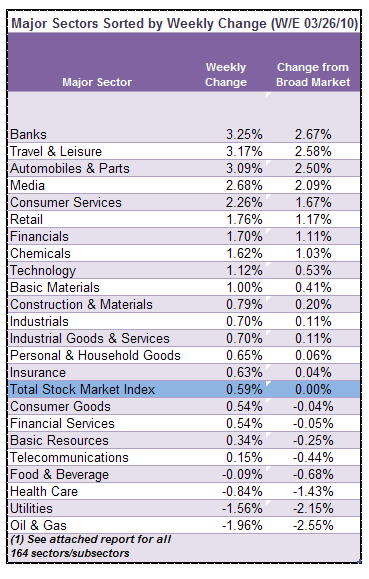

Now

that I've provided you with that, we'll return to our previously

schedule program. Below are the 24 Summary Sectors. You can find the

complete report on the 164 DJUS Sectors in addition to weekly + daily

chart books for the sectors below here.

I hope that you found this

expanded report helpful to providing to you some perspective on relative

time and price performance among the 24 sectors that I highlight for

you each week. You can also see the disparate nature of BOTH time and

price performance through a major cyclical decline and recovery. While

this information is unlikely to make interesting cocktail conversation,

it is a useful mosaic of information to inform your investing/trading

thinking.

I will post periodic updates to the peak/trough tables.

All

data courtesy of Stockcharts.com | Compilation and analysis courtesy of

me.