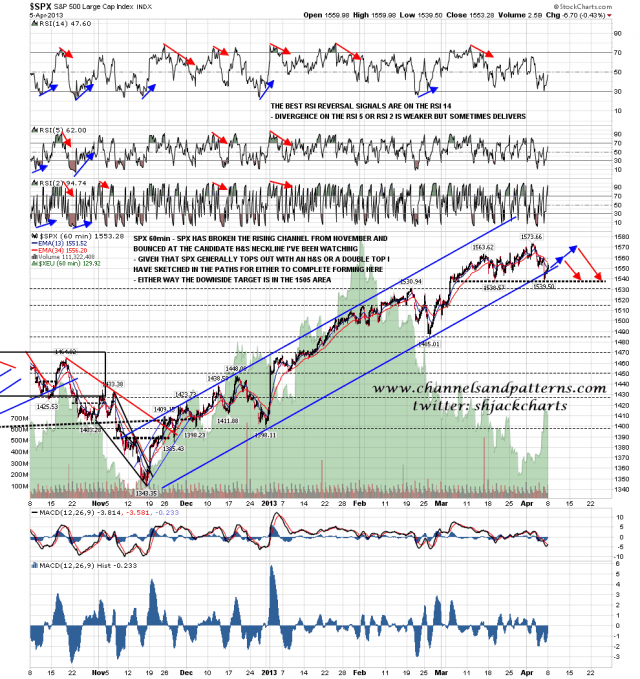

There was much talk on Friday about how the strong bounce from 1539 SPX was a sign that this market just can’t go down etc etc etc. Obviously that’s rubbish, and the reversal was an almost exact reversal at the candidate H&S neckline that I’ve been looking at for the last few days. Encouragingly for the bear side, and as I also mentioned, the low broke the rising channel on SPX from the November low, so that is no longer support for this move from there. On the SPX 60min chart the next obvious moves are, as I posted on twitter on Friday, either to make an H&S right shoulder with an ideal high in the 1562.5 area (preferred option) or to retest the high and possibly push a little further to test or slightly exceed 1576 to make the second high of a double top. Either way the pattern downside target would be in the 1505 area:

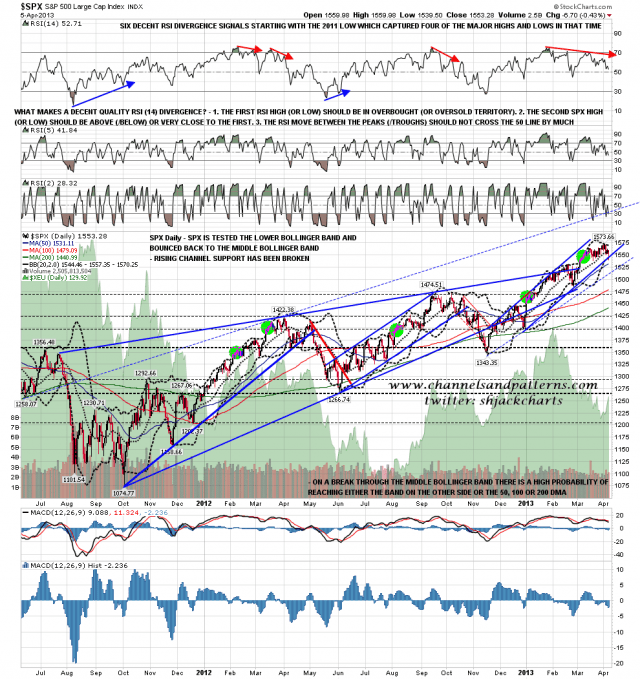

On the SPX daily chart the low on Friday was slightly below the lower bollinger band and SPX closed back near the middle bollinger band. The upper bollinger band is now down to 1570 and and I have been mentioning, the bollinger bands are now pinching in hard, generally a sign of a big move to come:

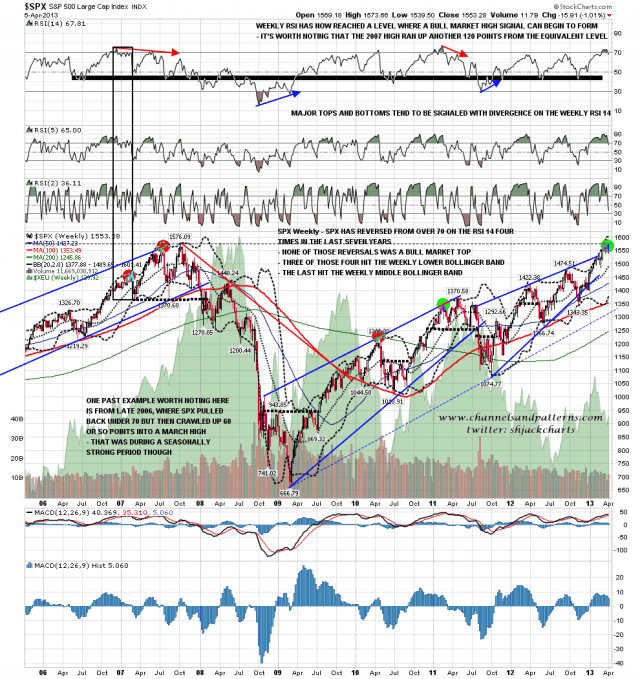

There is another more bullish outlier option I need to mention here, and you can see an example of that in late 2006 to early 2007, when the weekly RSI moved back below 70 and then SPX crawled up another 60 points before topping out in March 2007. SPX tends to be seasonally strong in that period and I’m not expecting that here, but it’s worth noting:

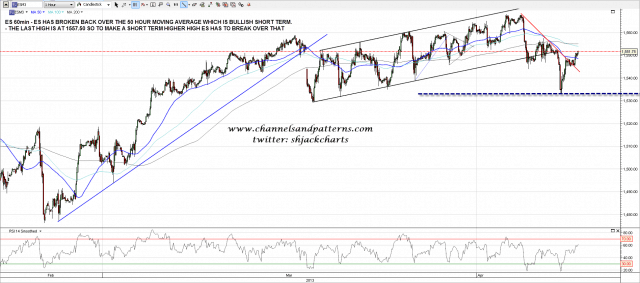

On the ES hourly chart ES is now back above the 50 hour moving average, which leans short term bullish, and the last high was at 1557.50, so ES needs to get back above that to make a short term higher high. If we are looking at an H&S forming on the SPX 60min, that is a likely level to fail:

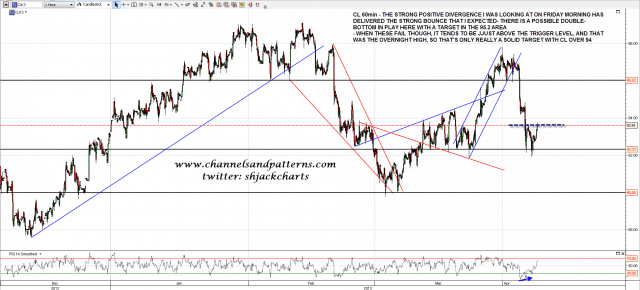

On CL the strong positive divergence on the 60min RSI played out into the strong bounce that I was expecting on Friday morning. A possible double-bottom has formed and triggered with a target in the 95.2 area. Where these fail though they tend to fail just after they trigger so 95.2 isn’t a firm target until CL can get over 94:

EURUSD made the 1.301 target I gave on Friday morning, and may be forming an IHS at a 1.304 neckline. If so it should reverse back down shortly with an ideal target in the 1.288 area:

So far everything is going pretty much as expected within my scenario where we see a decent retracement from the first test of the 2007 high. I’m leaning towards the SPX H&S scenario at the moment, with a double-top as my second scenario. Only a conviction break over the 2007 high would change that view and I’d be very surprised to see that now.