The first week of Q2 was a good one for me. I made a profit in my portfolio 4 out of the 5 days, and my little options account is up about 15% in the same timespan. Let the good times roll!

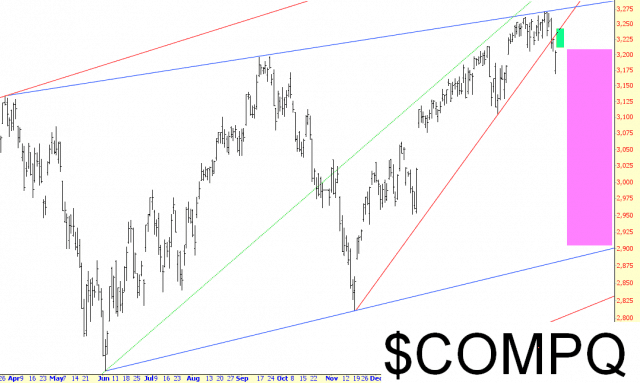

I was actually kind of pleased at the bounce we got on Friday, after the very weak opening. I’ve got many, many stocks I want to short at higher prices, and I appreciate the opportunity to do so. The break of the red trendline shown below is important, and a push back to its underbelly is going to make shorting easier than shooting bulls in a barrel.

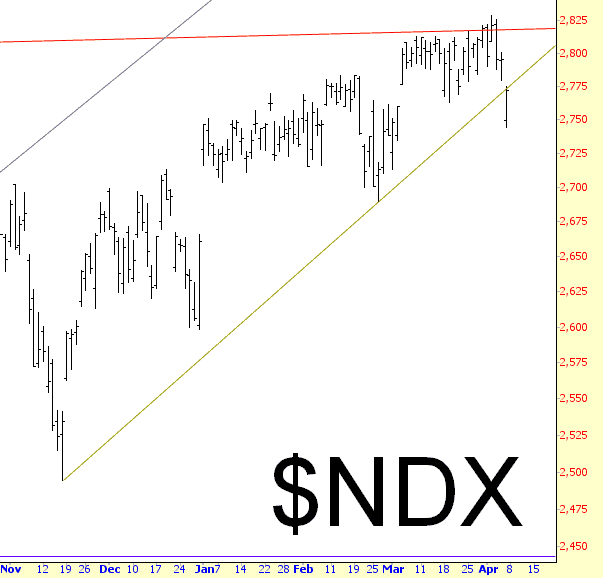

A closer look, by way of a different index, yields the same exciting news: the trendline dating back to the November 16 low has been cleanly broken.

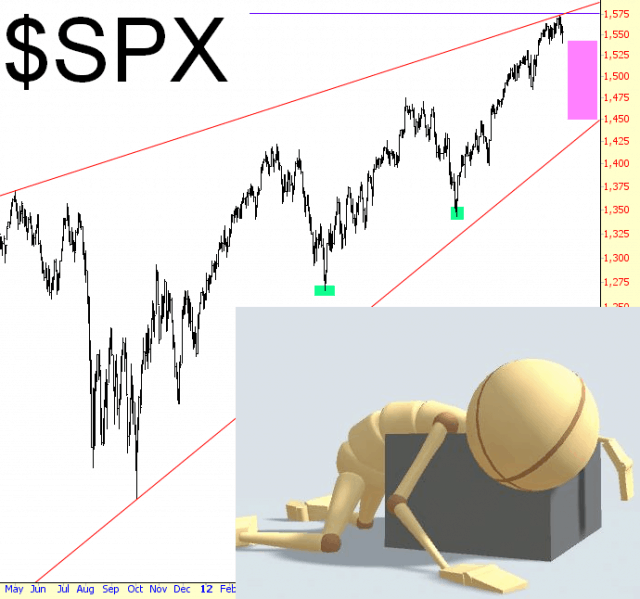

Now that the S&P has essentially pegged its prior high from October 2007, we’ve got a gigantic double-stop and, more importantly, lots of opportunity within the confines of the wedge in which we’ve been traveling for all these years. The opportunity on the downside, to my eyes, vastly exceeds the opportunity on the upside. Four years of Fed-fueled buying has left the market overvalued and exhausted.

I was very bullish on precious metals on Thursday morning – – I tweeted my nearly 10,000 followers that it was time to gobble up PMs, and I did a special post for Slope+ members about it. For myself, I bought gold, silver, and silver calls, and I took quick profits on them, knowing that I was probably getting out too soon. Sure enough, I was right, and I suspect there’s plenty more upside to come. I think GLD, shown below, is still heading lower in months ahead, but over the course of maybe the next week or so, precious metals could really jolt higher.

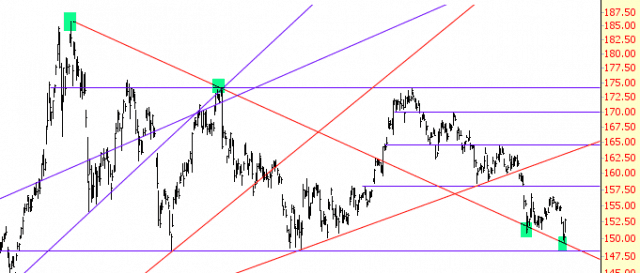

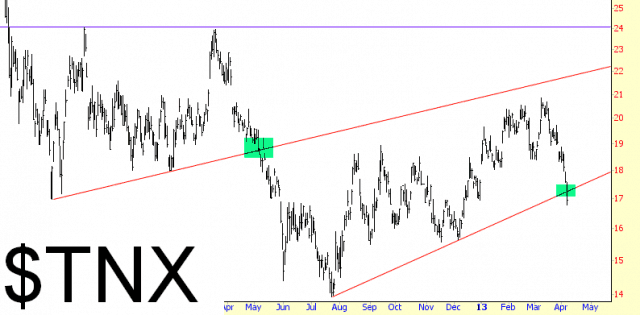

I’ve avoided trading bonds for a while, but I will point out that interest rates are cracking beneath the long-standing trendline I’ve placed below. I’ve tinted the break, as well as the similar one before it.

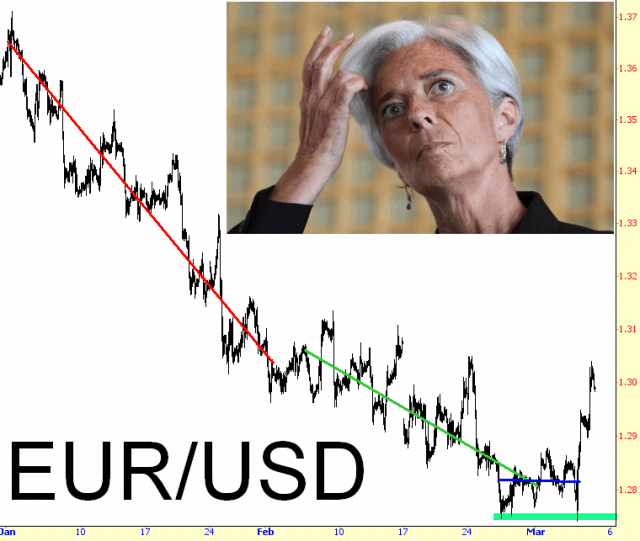

One worry spot for me is the Euro which, if it becomes meaningfully stronger, could make things harder for us equity bears. I’ve drawn a few center lines below to try to illustrate the gradual strengthening (in the midst of prolonged weakness) that is happening. I hope it doesn’t last, although I will hasten to add that the correlation between the Euro and U.S. equities has gotten awfully sloppy and, thus, as my mother used to say, could be neither here-nor-there.

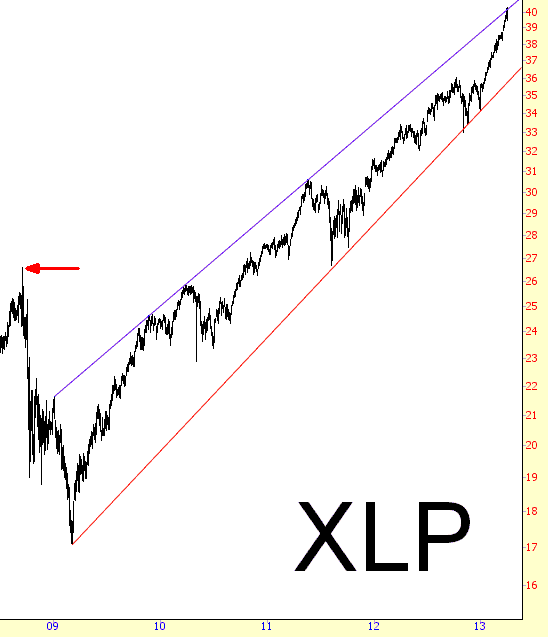

If you want a succinct look at how nutty this Bernanke-based market has become, look no further than the consumer staples ETF, shown below. The arrow marks the peak before anything happened with the financial crisis. I’ll say that again, because to me it just seems incredible – – the arrow that’s way, way below current levels is when we were TRILLIONS less in debt, and WAY better of an employment situation, and had a FAR stronger economy. So………f*ck me, right?

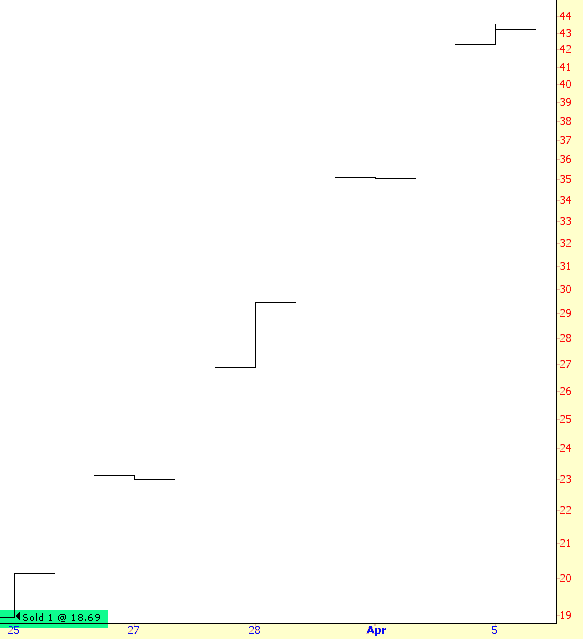

And in the Good God, Tim, You’re Dumb contest, we have this week’s winner – – my wimping out of my single AAPL put at the worst price possible. It’s up about 130% since then, or about $2,500 in cash that I could have jingling in my pocket in exchange for a bit more testicular fortitude. And, just to add salt to the wound, I imagine this will continue to zoom higher in value as AAPL falls toward my oft-cited target of $390.

My current positioning is 70% committed, 30% cash, with the entire commitment in small short positions. I have beefed up my personal options account with more positions, and I intend to put the pedal to the metal on the large portfolio (that is, my hedge fund) as good prices come to me. I am excited about the week ahead!