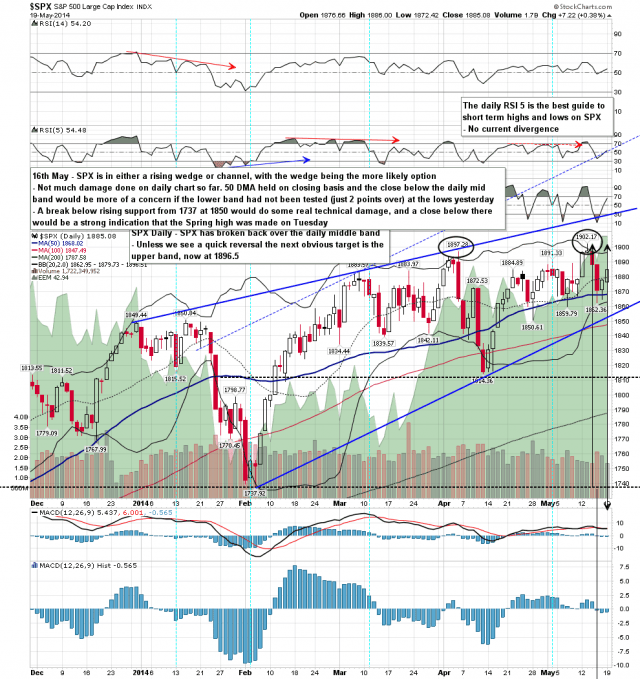

SPX broke back over the daily middle band yesterday, and bears need a swift reversal or the next obvious target will be a test of the daily upper band, now at 1896.5. SPX daily chart:

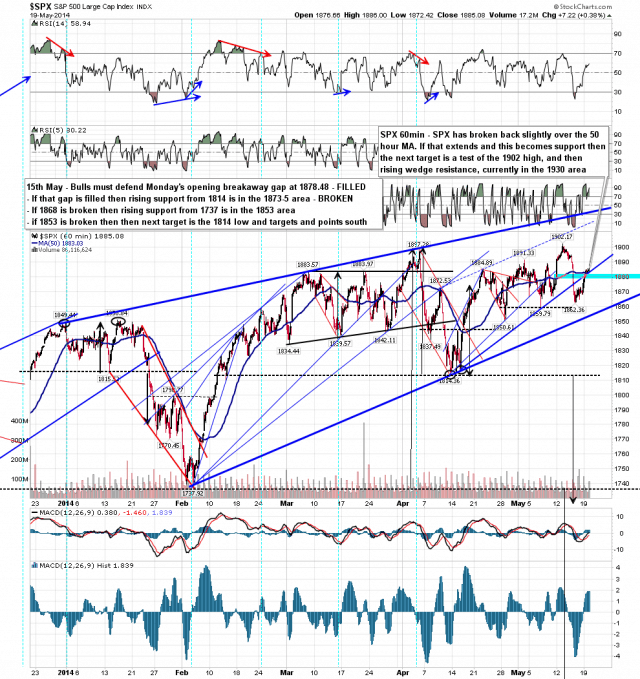

That wasn’t main resistance here however. What I’ve been looking at for that is the SPX 50 hour MA, which was broken slightly at the close yesterday with the close two points above it. If bulls can follow through and turn the 50 hour MA into support, the next obvious target will be a retest of the high, and on a conviction break above that, a test of rising wedge resistance, currently in the 1930 area.

Bears need a swift reversal here to start the next leg down. A break below the 1859 low and then the 1850 low will open up the downside. SPX 60min chart:

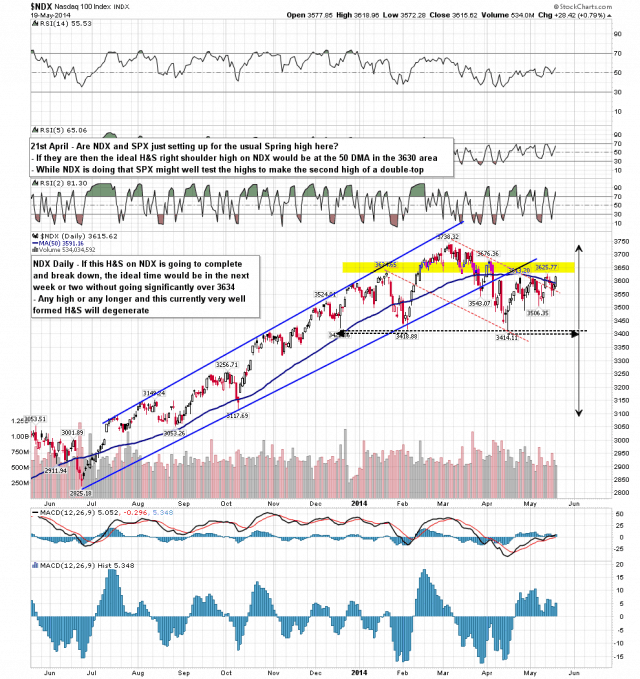

Time is running short for the current very nice looking topping setup on NDX. I posted this possible H&S forming on NDX on 21st April and so far the right shoulder is ideal, and as long as NDX goes no higher and the neckline in the 3415 area is reached in the next week or two, this will be a textbook H&S. Any higher or any longer and the quality of this H&S will erode. NDX daily chart:

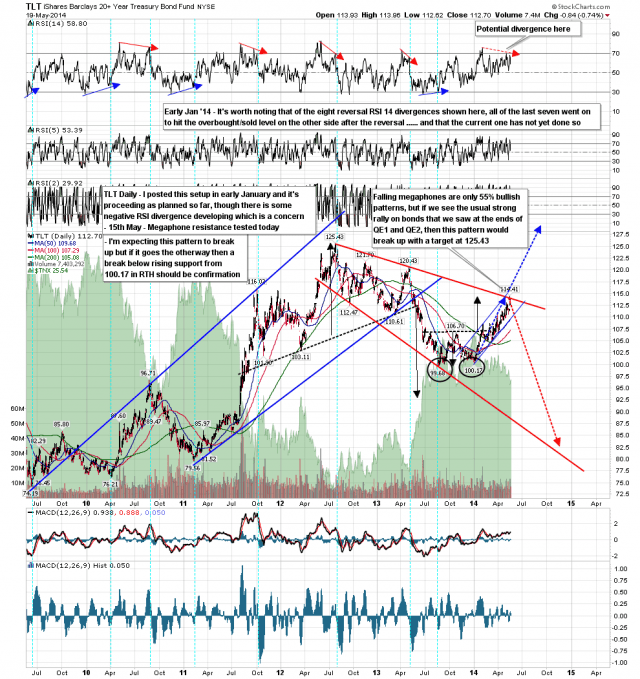

TLT reached my megaphone resistance target late last week, and I’m expecting this to break up through that soon. I was asked yesterday what would change my mind, and I replied that a break below rising support from 100.17, currently in the 110 area, should mean that TLT is returning to megaphone support. We’ll see how that goes. TLT daily chart:

If the current topping setup on SPX, NDX and elsewhere is going to play out, then it needs to happen shortly, and the best chance to do that here is for SPX to fail here at the 50 hour MA. If we see a swift and hard rejection there today then the next leg down should be starting, as long as bears can then break below 1859 and 1850. If bulls break up and hold above the 50 hour MA, then the alternate scenario with SPX going for a test of rising wedge resistance in the 1930-40 area should then be more likely.