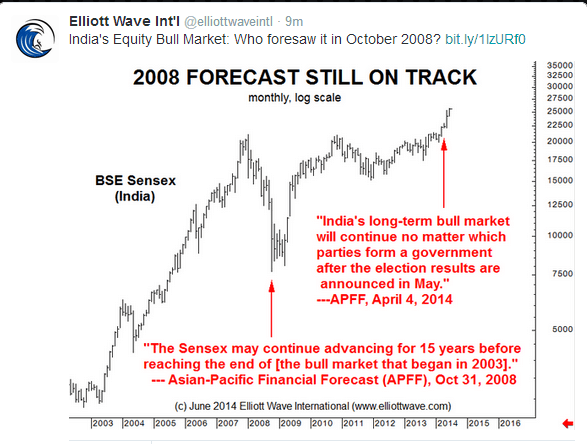

Oh, this is scary – – and too, too funny. Right on the heels of my post yesterday, none other than Elliott Wave International is bragging via Twitter about…………their LONG plays! Sentiment is now 100%, people.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Precious Metals Observations

- This is the first time in a long while (that I can remember) that the goons have not absolutely pummeled the precious metals after FOMC has baffled us with their bullshit and moved along. Then again, CoT has implied that the right goons have been on the precious metals side lately, especially in silver.

- Certain precious metals sector big picture technicals are becoming very bullish in affirmation of the big bottoming pattern (HUI) that NFTRH had on radar well before it became ‘known’.

- It sure was entertaining watching the ‘new lows coming in July’ brigade scatter and flip a switch to bullish a few days ago. Look at former darlings DUST and JDST now.

- Take a look at silver’s weekly chart.

- Take another look at silver’s weekly chart.

- Take a look at silver vs. gold, it’s over bought.

- Take a look at HUI vs. gold, it’s over bought.

- And both of them are highly constructive toward our longer term bottoming pattern, although over bought is over bought.

- Have balance.

- Have patience.

- Don’t try to make up all your losses (if you didn’t take risk management measures in the bear market) in a day. It’s not gonna happen.

- Things are changing and the dynamics coming into play just might mean more dynamic money making opportunities going forward. Opportunities to alternatively grow and preserve capital. This is what we wait for people.

- Gold is monetary value. Always was. Nothing more. Tune out the pumpers, who will now grow more vocal.

- But the associated speculations… now those can be fun. If/as the bottoming scenario solidifies, it could be an extended phase where speculation works well.

- Did I mention that the sector is getting over bought?

Spread Between Brent Crude Oil & WTIC Light Crude Oil

I last mentioned the spread between Brent Crude Oil and WTIC Light Crude Oil in this post on May 5th, 2013. At that time, price had narrowed considerably between these two.

The following 3-Year Daily ratio chart of BRENT:WTIC shows that the spread has been widening recently in favour of Brent. With the positive cross of the RSI above 50 and the positive cross-overs of the MACD and Stochastics, it would appear that this spread may continue to widen…if price can break and hold above the 50 and, possibly, 200 MAs.

Clarity

I received a flood of positive comments and emails about my Change in Tone post yesterday. I also received a handful of “What? How could you?!?! You traitor!” type remarks. So I thought I’d clarify my point of view.

Apparently some folks read my post as stating, “Hi, everyone. I am never going to short anything  ever again in my life, and I’m just going to be a permanbull from now on.”

ever again in my life, and I’m just going to be a permanbull from now on.”

The message was really more along the lines of, “I’ve had enough of this permabear schtick, and you can expect to see a greater balance between bullish and bearish ideas here on the blog. I am, after all, a chartist.” See? A change in tone.

For the record, when I wrote my post yesterday, I had 81 (count ’em, 81) shorts and 0 (count ’em, zero) longs. And the only thing that has changed since yesterday is that I have 3 more shorts. I am more disposed toward buying stocks, yes, but at these levels, ummm, I’m going to try to be a little patient except for slam-dunk patterns.

One thing that really helped me into the “Hey, OWNING stuff is pretty cool” mode is bullion. A few weeks back, pretty much at the perfect time, I bought a truckload of gold and silver bullion. It has, to date, done very well. And I confess, it’s a warm-and-fuzzy feeling seeing those prices climb, knowing I’ve got a small hillock of the stuff.

So my main point was that folks can expect less of a tilted stance and less dogma. Nothing more. Oh, and as my Slope+ readers know, I have been a “bull” for a while in one particular sector, and it has been a jackpot (which makes me feel very good, since my beloved Plus users are actually paying for my opinion). Thanks, everyone…….