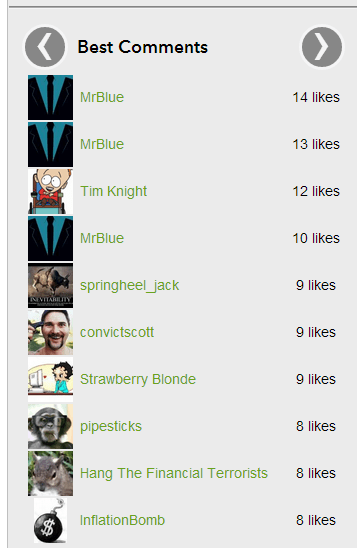

I’m pleased to announce yet another cool feature on the most feature-rich finance blog on the Internet: Best Comments. The way it works is simple: in the right column (along with the other “rotating” items you constantly see) is a new panel whose purpose in life is to show you the ten highest-rated comments over the past 7 days. Click on any of the links, and whoosh, it’ll take you to that comment in the context of the original post. This provides a great way to see what comments are garnering the most kudos from fellow Slopers.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Overshooting the Limit

Further to my post of May 22nd, the SPX:VIX ratio has now overshot its limit. As shown on the Weekly ratio chart below, price has now punched above major channel, trendline, Fibonacci, and price resistance and sits at another all-time high. As well, Momentum has advanced to an extreme all-time high level…exceeding even the exuberant levels reached in 2006/07 before the financial crisis.

Swing Trading Watch-List: YELP, IBN, GTAT, CBS, PVA

Morning Paper

Weekly Upper Band Punches

At the close on Friday there was a clear punch over the weekly upper bollinger band. These are rare, and even rarer when the weekly RSI 14 is over 70, and this is only the tenth such punch in the last twenty years. I’ve had a look at the previous nine to see what they can tell us about what to expect next.

My first observation would be that only three of those were at a short term high, though another five topped out within 2% of the punch level, before making a retracement that went at least back below the punch level and ranged in size from 3% to 21%. The exception was in June 1997 which went into an eight day upper band ride that ran up 80 points before retracing 70 points. This is a fairly bearish history, with one strong exception. (more…)