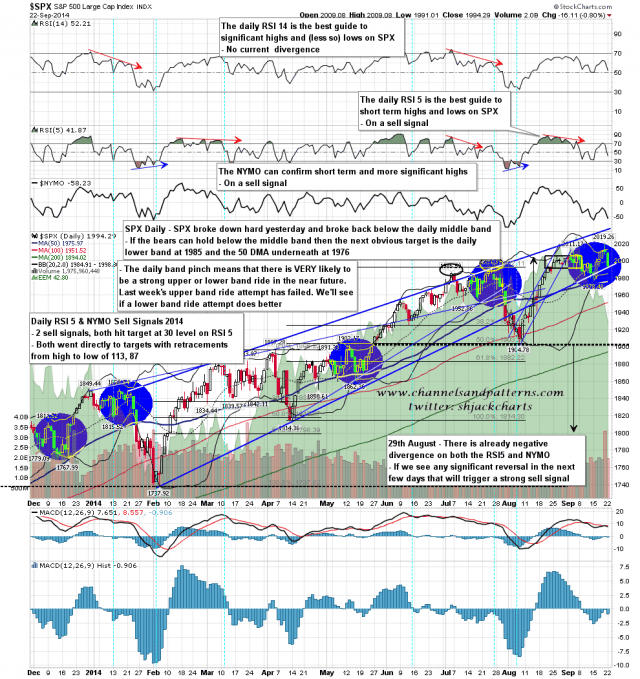

SPX broke down hard yesterday and closed near the lows, giving bears their first complete day in a while. SPX broke back below the daily middle band and, as long as we don’t see a daily close back above it, the next obvious targets are the daily lower band at 1985 and the 50 DMA at 1976. The band pinch here means that it is very likely that SPX will start an extended band ride in the near future. The bulls had a shot at starting an upper band ride last week and couldn’t sustain it. If bears can get SPX to the lower band then they get a shot at starting a lower band ride instead. SPX daily chart:

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

The Macro View and the Stock Market

Excerpted from the September 21 edition of NFTRH, #309, which went on to do extensive technical and macro work across all the key markets…

Last week we noted that Uncle Buck would be front and center in the analysis, not because the strength in the (anti-market) currency was not expected (it was), but because our big picture theme of an ongoing economic contraction had remained intact (ref: gold vs. commodities ratio) over the long-term.

It is important here to remember that NFTRH would only be on its big picture macro themes as long as indictors implied they are still viable. I will be damned if I will let us follow a Pied Piper off an ideological cliff, no matter what readers (including me) might want to hear. We must dedicate to know what is happening, not what our hopes, dreams, egos, etc. think or worse, hope will happen. (more…)

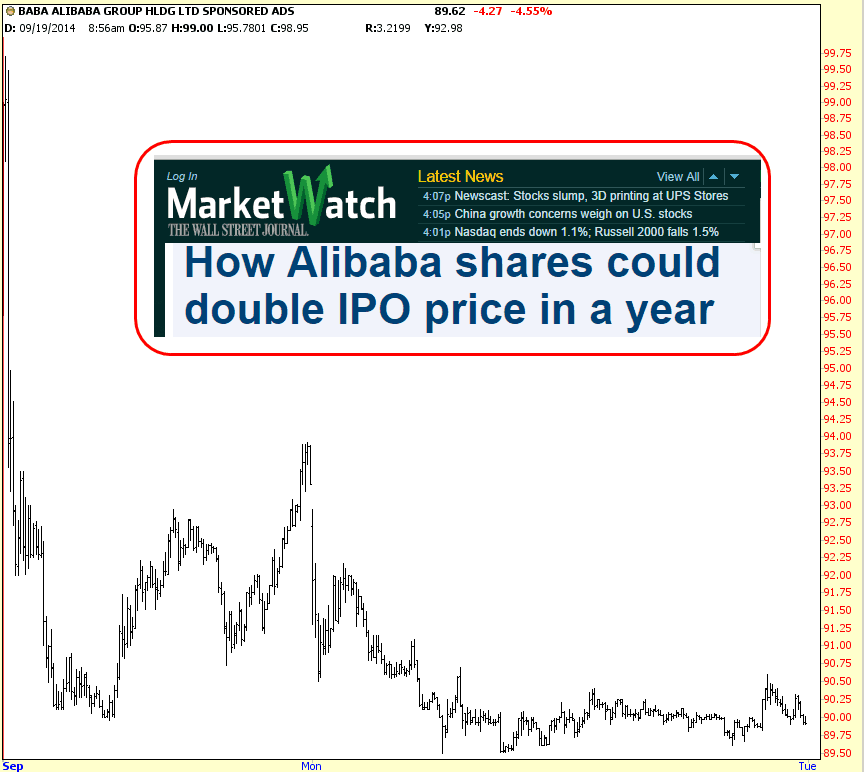

What Shameless Pinheads

The 4C’s That Never Happened – And Those That Did

We didn’t get what I first postulated yet, what we did might be even more illuminating.

In my earlier article the 4C’s I set up the premise that if a Yes vote took place in Scotland there were possible ramifications within the markets than what was being expressed, as well as reported, throughout the financial media.

Well it turns out the cause for any worry has now been voted and booted away so far down the road it would make a can envious. However, what did we really get?

In my opinion we might have been shown there is even far more need to be concerned, for once again, the powers that be have seemingly demonstrate they truly are – the one’s in control. (more…)