I’ve been writing this blog for so long (over a decade), I sometimes despair that my uninteresting life will stop yielding anything worth writing about. Yes, the blog is principally about technical analysis of stocks, but I like to share anecdotes from time to time, and every time I compose a good anecdote I figure that, welp, that’s the last shareable morsel of my life. So far, though, I wind up thinking of another one, sooner or later.

So here I am again.

I started my company, Prophet Financial Systems, in 1992 (and, for those interested, I produced an entire video series called The Prophet’s Tale which describes its history, all the way up through when I sold it to Ameritrade).

For the first few years, it was really just a historical data company that provided daily updates via modem; in other words, just about the least sexy high-tech outfit one could imagine. The Silicon Valley was a relatively moribund place in those days. Apple was very much on the wane, the commercial Internet didn’t exist, and most companies in this area weren’t any more thrilling to be at than, say, Johnson & Johnson, duPont, or General Dynamics.

Things changed swiftly in the middle of 1995, however. The “big bang” was Netscape’s public offering. A much smaller event took place just one day before that, however. An electronic discussion board was launched called Silicon Investor, run by a couple of brothers (Jeff and Brad Dryer) that had moved from Kansas to the Bay Area to chase their high-tech entrepreneurial dreams.

In a stunning example of being at the right place at the right time, Silicon Investor took off like a shot. There was nothing – – absolutely nothing – – remarkable about the web site’s design or functionality. However, it quickly became the go-to place to talk about high-tech stocks, and back in those days, there weren’t many other places to do so. The nature of communities is that once members find a home, they tend to stay there, so even as superior discussion platforms came along, the crowds still flocked to Silicon Investor.

My own tiny company, Prophet, had built a simple charting platform, and I was looking for customers. I reached out to Brad and Jeff, and we got together at the Just Desserts coffee shop to learn about each other’s businesses and talk it over. They were good guys, and we set up an arrangement for me to provide charts to their site.

It wasn’t really clear to me how popular their site was, though, until the news hit on April 23, 1998 that Silicon Investor had been bought by go2net for $33,000,000 in stock. Now keep in mind this was just a discussion board we’re talking about, little more sophisticated than the dial-up BBS’s I had enjoyed back in 1981 on my TRS-80. But the magic word those days was “eyeballs”, and Silicon Investor had lots of them, even though it had virtually no revenue.

Most (if not all) of you are wondering what go2net was. Well, in those days, search engines pretty much sucked. A few companies decide to put together a “meta” search engine, the thought being that if you execute a search against a bunch of crappy search engines, maybe the consolidated results will be semi-decent. So that was pretty much what go2net did: they would submit searches to the search engines of the day and produce a list of the results.

Of course, that was enough to create a public company (symbol GNET) which was worth hundreds of millions of dollars. (The fact that I can’t even find an image to show you what a go2net screen looked like kind of tells you how lasting and impactful the technology was). And with all that overvalued stock on hand, it was pretty simple to snap up an even smaller site like Silicon Investor for an impossibly high figure.

Now I was watching all of this with great interest, naturally, because I had my only little business, also in the Silicon Valley, and also devoted to stock market traders, that I’d have loved to sell to go2net (or anyone!) as well. I thought, hell, my site is nicer, my technology is better, and it’s very complementary – – – why not pursue the same outcome? I’ve always had this fantasy that, in this Valley, if you work hard enough, you eventually get tapped with the magic wand, and voila, you’re suddenly rich and famous (I, errr, have dispatched this notion in my mind as of now). So i figured…………the stars had finally lined up!

So I contacted Brad, and he said, sure, he’d tell the management at go2net about me and my business and see if there was any interest.

A few days later, the light on my answering machine was flashing. I pressed Play, and there was a message from go2net’s CFO, suggesting I pull some information together about Prophet and mail it to him, and if it looked promising, arrange for a meeting up in Seattle. I could scarcely believe my ears. I excitedly went to press Play to listen to the message again, but in my enthusiasm, I pressed Erase instead. ARGH! I frantically emailed Brad to tell him what had happened and to try to figure out the name of the guy who called. Brad just about died laughing at my message and looped back to me shortly thereafter with the guy’s name and email.

So I was on my own. After providing some basic financials and product background on Prophet to the CFO, he agreed it would make sense to fly me up to Seattle to meet with Russell Horowitz, go2net’s founder. I felt like I was living in a dream, because everything was happening so fast, just like I hoped it would. I imagined it wouldn’t be long before there would be a press release about Prophet and the princely sum paid for it. I would join in the glorious maelstrom of cash flying around the west coast in the late 1990s.

“Knock ’em dead!” my wife said to me as she dropped me off at San Francisco International.

Arriving at the high-rise tower that housed go2net, I was flush with anticipation. I met with the CFO, both of the Dryers, and was escorted in to meet the big man: Russell Horowitz, which was in his late 20s and looked cherubic with a head full of curly, lengthy hair. I was dazzled by their cool office, accustomed as I was to slumming it in a spare bedroom of my house.

CFO, both of the Dryers, and was escorted in to meet the big man: Russell Horowitz, which was in his late 20s and looked cherubic with a head full of curly, lengthy hair. I was dazzled by their cool office, accustomed as I was to slumming it in a spare bedroom of my house.

I gave Russ a demonstration of the products I had created, walked him through my patent portfolio of inventions, and discussed some of my plans for future products. He seemed satisfied with what he was hearing, so he handed me back over to the CFO.

It was at that point I started to run out of answers, because the CFO was interested in seeing my financials. The only “financials” I had was a checking account, and my principal goal there was that it had a positive, and growing, balance at all times. This exposed the first real weakness in my tiny outfit, which was that I was completely unsophisticated about metrics. I didn’t have traffic data, financial reporting, or any of the other stuff that I considered too tiresome to bother with as a one-man shop. I promised the CFO I’d pull the information together and get it to him.

The second weakness, and this was more severe, was Prophet’s scope. I never sought to have a “millions of eyeballs” business. Mine was in very much a niche market, and its numbers reflected that. I was hoping that wouldn’t weigh on their decision, since I was offering them was technology and, for whatever it was worth, my own vision as to where we could take it. To this day, I believe they would have been wise to make the acquisition.

As you’ve surely gathered by now, no such acquisition took place. Although the meeting was all smiles and handshakes, it was pretty silent thereafter. I don’t know the reason they decided not to proceed. Maybe there wasn’t enough critical mass of “stuff” to interest them. But, for whatever reason, I was left on my own, slogging away in the spare bedroom, and no gigantic stock certificate was dropped into my lap.

The irony is that, over time, Prophet kept growing, and it was a pretty good little business. I know it’s quaint, but we had real revenues, real profits, didn’t require any VC funding, and we eventually sold for $8 million in cash (as opposed to really, really, really overvalued stock.) It’s rounding error in the world of Silicon Valley, but for me, it was a great outcome on what had been a long journey.

So what if go2net had, in fact, bought Prophet? I’m really not sure, because I don’t know (a) what the price would have been, although it certainly would have been much more than $8 million (b) what the holding period of the stock would have been (c) when I would have sold it, although knowing me, I’d probably be anxious to convert the stock into cash as quickly as legally permitted.

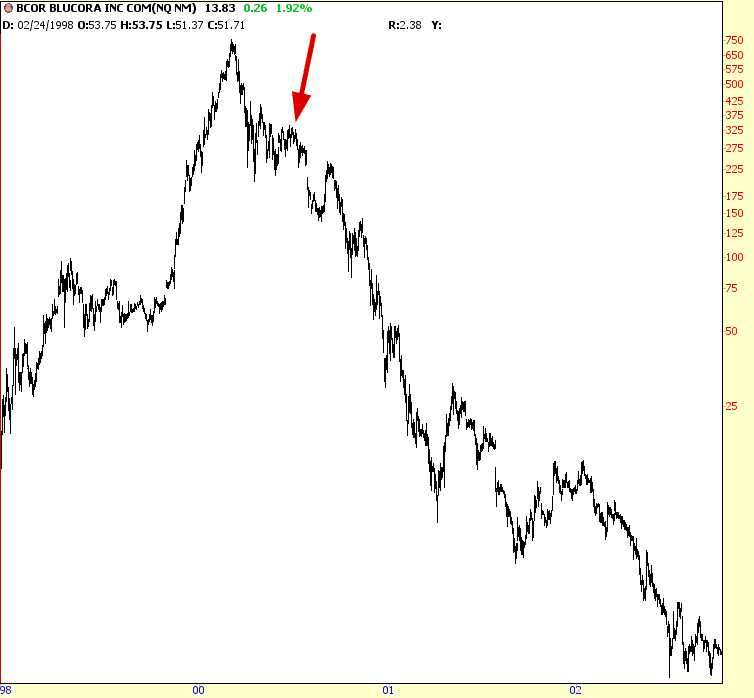

The path that go2net took, however, is plain to see. GNET stock continued to soar in value, along with all Internet companies, and it was purchased for nearly $3 billion (!) by InfoSpace (a company which itself has since fallen from grace, and which how has adopted the completely lame name of Blucora.) I’ve marked on the chart below the point when InfoSpace bought go2net:

As is plain from the chart above, InfoSpace went into a death spiral, losing something like 99% of its value. I would encourage you to read this fascinating piece of investigative journalism from The Seattle Times, published in March 2005, showing what kinds of insane shenanigans were happening with executives dumping stock through any means necessary. Here’s one particularly hilarious tidbit, illustrating (once again) the Orwellian language that investment banks use:

Merrill Lynch had made millions as a consultant in the Go2Net merger. But Blodget had lost confidence in InfoSpace, records show. He asked a colleague to remove the stock from the brokerage house’s most-favored-stocks list.

“Can we please reset this stupid price target and rip this piece of junk off whatever list it’s on?” he wrote Oct. 20. “If you have to downgrade it, downgrade it.”

It took seven weeks, but on Dec. 11, Merrill Lynch downgraded InfoSpace to “accumulate.” The decision pummeled the stock, which fell 16 percent that day.

Got that? “Accumulate” means “This stock sucks” to normal people. OK, we’re clear now.

Horowitz, of course, had made zillions of dollars through all of this. He bought a $20 million spread in one of Seattle’s ritzy neighborhoods and was featured in this bizarre report in which he fires a warning shot at a guy who he saw digging up some plants from the front of his property.

On Sept. 24, a Saturday night around 9 p.m., Horowitz saw a man digging up the plants outside the fence and along his front curb on one of his video monitors. According to the police report, he went outside, past the front fence, taking his gun as a precaution.

Horowitz “later explained that he has had two death threats in the last six months and he was fearful that perhaps this incident might somehow be related to the threats,” the police report states. A spokesman for Horowitz said they were less specific than death threats but a cause for concern nonetheless. The Seattle Police were unaware of any threats.

I suspect maybe the death threats could have been from ordinary, non-rich people who had had their heads handed to them by losing big on InfoSpace stock. But I digress.

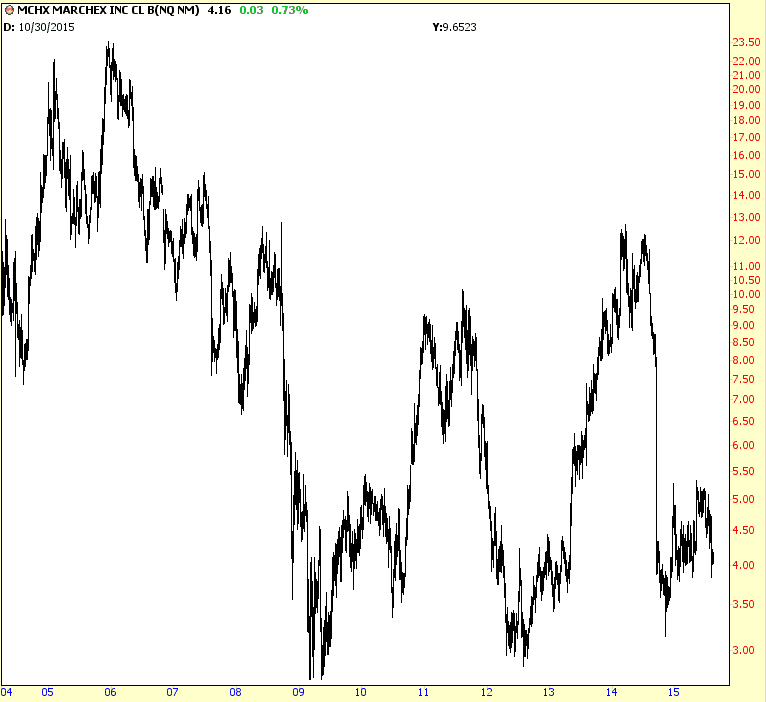

Not wanting to sit idle, Horowitz moved on with some other original go2net people to put together a new Seattle firm named Marchex which also went public (He seems quite proficient at it!) As you can see, Marchex’s performance isn’t going to win many accolades these days, except from securities litigators:

You may wonder how the Dryer brothers wound up after all this. I have no earthly idea. I don’t know if they managed to dump their stock and be set for life, or if they hung on through the bitter end and wound up with pennies on the dollar. I was so disappointed at the non-sale that took place, I just fell out of touch with them completely.

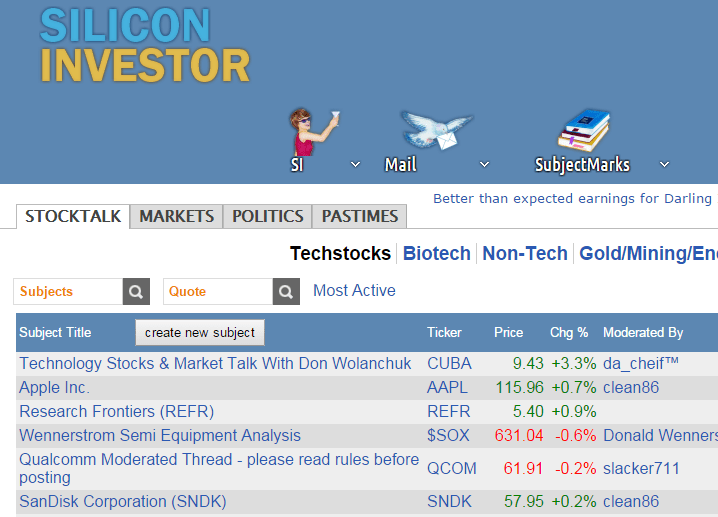

I was curious, however, to see how the site looked. I hadn’t even peeked at it since the Internet bubble, and I figured 20 years – twenty years! – after its founding, it was probably pretty slick by now. Here’s what it looks like today.

So, yes, the site above was once considered one of the hottest properties on the web. I read that it was re-sold to a firm for $250,000 in cash a few years ago. That’s still probably about $200,000 too high.

We are, of course, in the throes of a bubble right now that makes the Internet bubble look like child’s play. There are still companies like Clinkle (which I’ve written about repeatedly) which garner tens of millions of venture capital and fizzle into nothing, and Facebook’s $22 billion acquisition of the Whatsapp mobile app (with all of $10 million of revenue behind the business) makes acquiring Silicon Investor for $33 million seem like the most prudent investment of the century.

I enjoy my work, and I enjoy building small businesses (I am engaged in a new one at this very moment, far removed from my everyday blogging), but I’ve accepted that I’m never going to be touched by that magic wand. I’ve observed things around here long enough, though, to realize that the wand is sometimes a wand, and sometimes it’s a bludgeon.