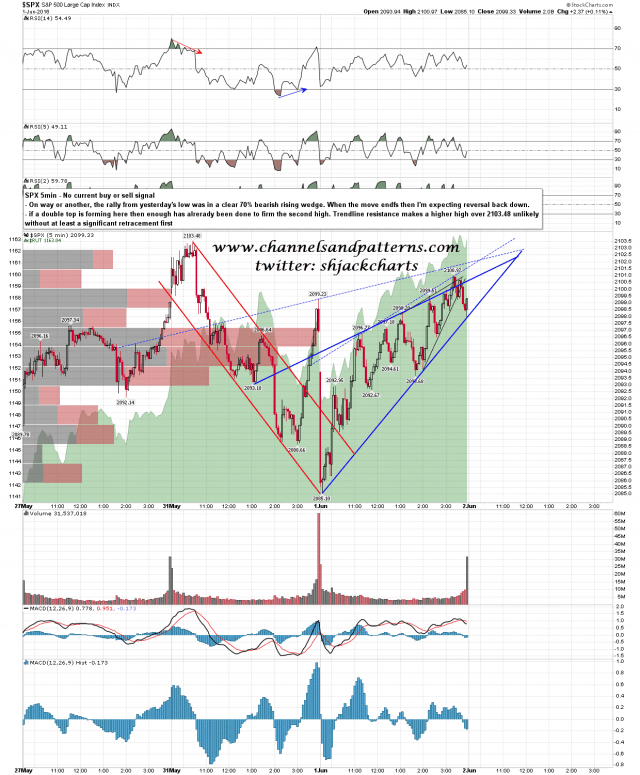

SPX rallied yesterday towards a retest of the 2103.48 high as I was suggesting it would in my morning post. The rally was within a clear 70% bearish rising wedge, and that could go a bit higher still though a full retest of 2103.48 looks a bit ambitious. Rising wedge support was intact at the close last night. Once it breaks SPX should be in the short term topping process, and the downtrend should resume. SPX already did enough yesterday for this to qualify as the second high of a little double top. SPX 5min chart:

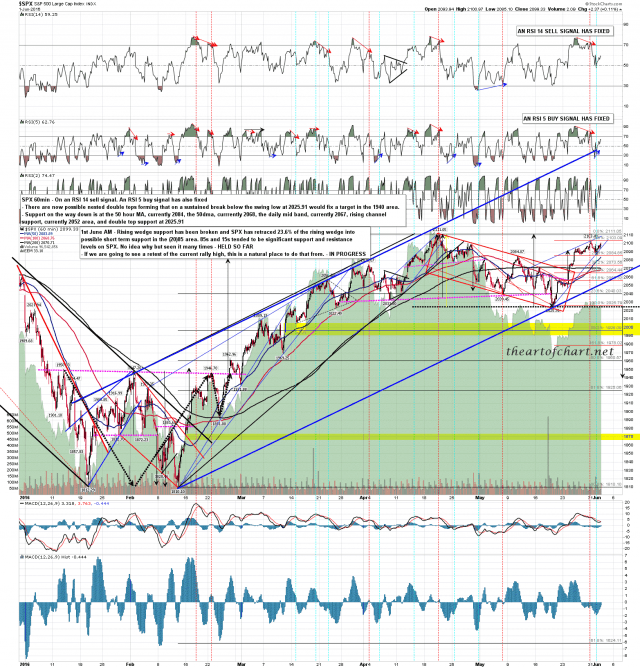

On the bigger picture SPX is obviously still on daily and 60min sell signals and the daily upper band ride ended yesterday. That’s bearish though these can sometimes resume after a small gap. SPX 60min chart:

What the bulls do have in their favor here is that the possible 60min buy signal on ES that I mentioned yesterday morning has fixed and not yet made target. That may deliver a bit more upside before SPX heads lower. ES Jun 60min (last night’s chart):

Overall this is still an impressively bearish looking setup, at least in the short term. If we are to see the downtrend resume today I’d be expecting that any new high over 2103.48 would be marginal and I’d be looking for an AM high that dies.