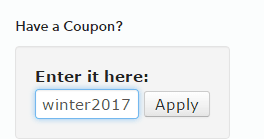

Note from Tim: I wanted to preface this thoughtful post from Rev with something that happens very rarely……..a coupon to Slope Plus for those of you considering it. I am offering a free month for you to try the service by clicking on this link. When you do, enter the coupon code winter2017 and it will give you the first month for free. (This coupon is only going to be working for a few days, so don’t lollygag). Please note this discount works for ANNUAL subscriptions as well, so you’ll save the most by going for an annual, since you get two months free already.

Besides all the normal extras you get as a Slope Plus subscriber, you’ll also be getting the very best ideas I’ve got (many of which have been doing really well, even in this market, as you’ll see once you have access). I hope you’ll give it a try. On with the regular post now…………

Happy weekend Slopers! It has been over a year since I have offered a header post, so let’s take a look at the interesting point markets are currently at.

Starting with SPX, shown below, the markets have been in a slow building parabolic rise since the Brexit lows, continuing their rise off the November election last year, followed by another leg higher to start 2017. Have we arrived at the short term top, or is there more to come?

The bears certainly had a shot at the end of this past week to end the short term uptrend. ATR’s short term sell reversal going into next week would be a close under 2353.80. For those that have been riding the trend higher this year, the next short term sell reversal would be the time to take trading profits. Until then, using ATR reversals to ride the trend as long as it last is enormously profitable in long lasting short term trends.

As I have mentioned on the site, Tom McClellan made a great call last fall with his post here, outlining his SPX to crude oil analog, which sets forward the crude oil price 10 years, and has lined up nicely to SPX for over 100 years. He recently made a follow up post here.

In the gold mining sector, it was interesting to note that /GC and /SI had an excellent end to the week, breaking out to new highs for the year, but GDX lagged, as it has continued to move lower in a short term downtrend likely brought on by earnings season for the miners, combined with an overbought condition on daily charts.

Looking at the GDX chart below, if the miners can achieve a short term reversal higher next week, it would be a superb entry for traders and investors. GDX remains in an intermediate term uptrend, with the intermediate sell reversal, 50 day, and 200 day moving average all converging around the 23.50 level. This should be solid support for next week. The short term buy reversal for GDX going into next week is 24.80. A close above this level will likely start a move to test last year’s highs.

Finally, let’s take a look at XLE. This has been the one sector of concern in my portfolio for the past month. As our host has been plundering it nicely on the short side, the intermediate term and short term trends have been with him. However, as you can see from the chart below, since breaking through the 200 day moving average last April, XLE has found consistent support as it moved down to the 200 day since. Will this time be different? ATR will tell you.

The great power I have found in using ATR over the past couple years is eliminating the unknown. We will never know all the fundamental factors that go into the movements you see on a chart, nor will technical analysis alone be able to give absolute certainty in decision making. Price alone affords us an unhindered view into the looking glass of what is actually taking place, and more accurately the level at which trends change that is of the most value.

XLE is currently in a downtrend, so therefore it could drop through the 200 day next week, and continue on the rest of this year to make new lows. Conversely, it could reverse next week from an oversold level, bouncing off the 200 day, and resume the uptrend to break last year’s highs. I don’t know which answer is correct, but I do know at which levels the uptrend will resume. A close above 71.98 would be an excellent buying opportunity.