Piper Jaffray Raises Tesla Target

On Talk Markets Thursday, The Fly noted that Piper Jaffray had raised its price target on Tesla (TSLA) to $386 per share. Portfolio Armor is currently more bullish than Piper on Tesla; our site estimates shares could hit $413 in 6 months. Historically, actual returns have averaged about 0.3x our site’s potential return estimates though.

Adding Downside Protection To Tesla

Here’s a way you can have a shot at capturing Piper Jaffray’s upside target on Tesla over the next several months while limiting your downside in the event their (and our) bullishness ends up being wrong.

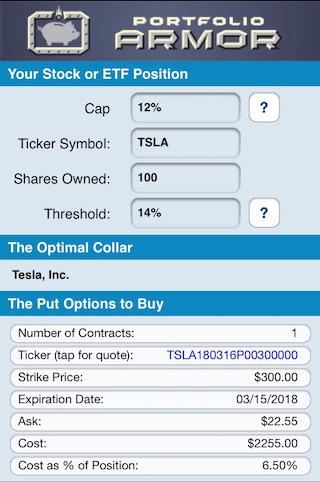

As of Friday’s close, this was the optimal, or least expensive, collar to hedge 500 shares of TSLA against a greater-than-14% decline by Mid-March, while not capping your upside at less than 12% by then (screen captures via the Portfolio Armor iOS app):

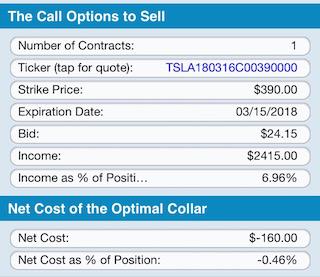

As you can see above, the cost of the put leg of this collar was $2,255, or 6.5% of position value (calculated conservative, using the ask price of the puts). But as you can see below, the income generated from the call leg was slightly higher: $2,415, or 6.96% of position value (calculated conservatively again, this time using the bid price of the calls).

So the net cost of this hedge was negative, meaning you would have collected $160, or 0.46% of position value when opening the hedge, assuming you placed both trades at the worst ends of their respective spreads.