Well, Thursday was a peculiar day. It started off nice and red, but, as usual, thanks to Fed intervention, everything shifted green. In this instance, the kabuki player they shoved in front of a microphone was Fed President John Williams. So whereas the day started off weak due to real information (lackluster earnings), it ended the day strong thanks to bluster (the vapid utterances from Williams’ lips). Whatever works, right?

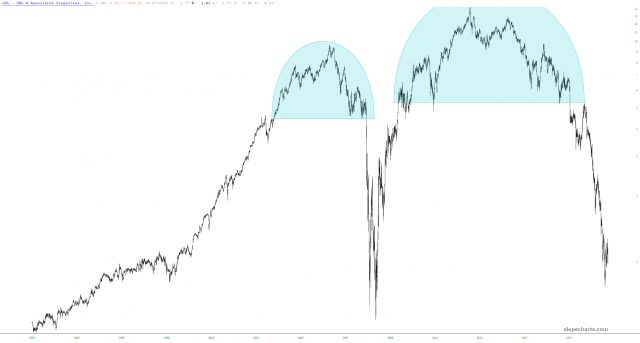

I wanted to point out the minor crossroads the market is at currently, by way of the Dow Jones Composite. Here are the past couple of years. We were at the highest point in human history just a couple of trading sessions ago, and it wouldn’t take much to set another record high. The key is whether we can cross over 9051.98:

(more…)