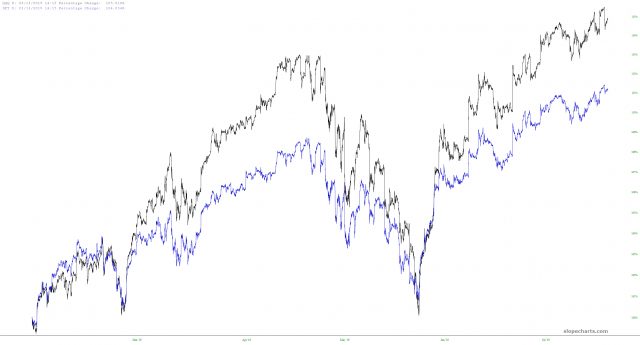

With the market at all-time highs, we are now approaching another Fed meeting. But, this one will likely provide us with a change in direction for rates, if you believe what most pundits are saying. In fact, there seems to be 100% certainty that the Fed will lower rates. Imagine that . . . the Fed is going to lower rates when the market is at its all-time highs. When was the last time this happened?

While many view a rate cut as being akin to the Fed “blessing” this market rally, history tells us a different story. What is most interesting is that the last time the Fed changed direction in rates near all-time highs was in 2007. And, when the Fed began to lower rates in 2007, it was just before the major stock market melt-down.

(more…)