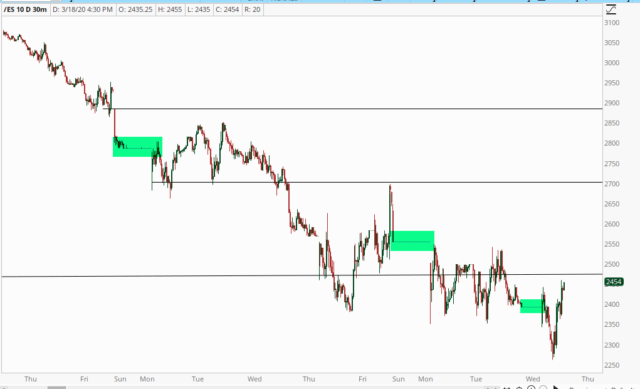

I’ve been trading for a third of a century, but until this month, I had never experienced a market halt in my life. I think this month with got all manner of circuit-breaker events (limit up, limit down, and market halts). A moment of silence as we commemorate this momentous occasion……..

I will also express astonishment………..jaw-dropping, mouth agape astonishment………….that the $1.5 trillion the ECB just hurled at the market has been received with a giant “so what?” and the ES and NQ are once again in an unrestrained free-fall.

The era of central banker dictatorship IS OVER. It’s a shame Yellen and Bernanke won’t be held to account for their sins. At least not in this world.