At the outset, I want to make plain I respect the rights of others to their work, and I offer this post (and its second part, for premium readers) based on Fair Use principles. This post I am composing is an overall critique of the financial prediction industry, and I am including excerpts from various works, most than a decade old in most cases, to make a point.

I would also make very clear my familiarity with “Those who live in glass houses……….’ The purpose of these two posts isn’t to laugh at predictions that never transpired. But I definitely want to make plain that respected, well-funded, and widely-read pundits can create some breathtakingly bad prognostications, and we can only realize that in hindsight.

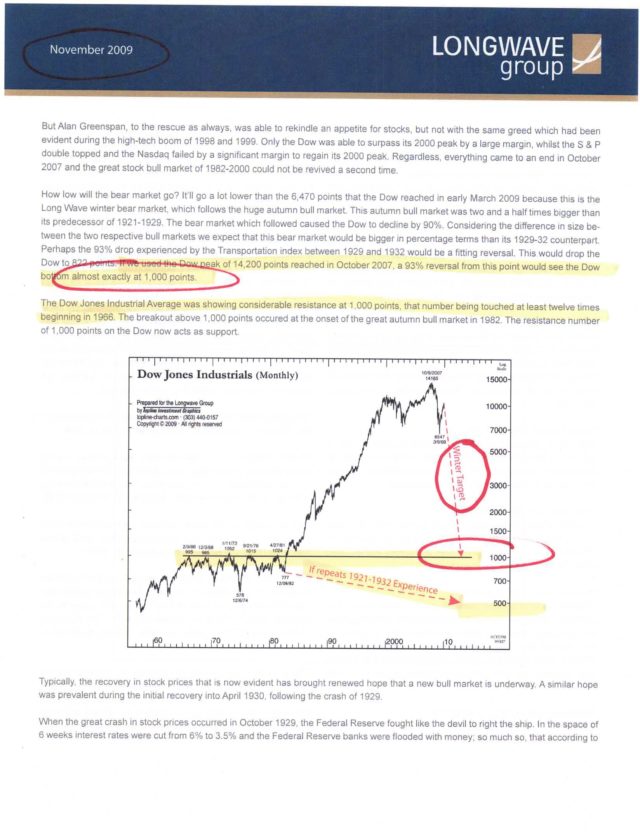

Let us begin with this page, which was part of a very, very lengthy report from Longwave Group. (As with all these images, click it for better readability; those of you with big screens will have no trouble being able to read the copy). The thrust of this report was that the Dow was heading to 1,000. The chart offers a conjectural path, which was basically similar to a lead sphere being dropped from a skyscraper.

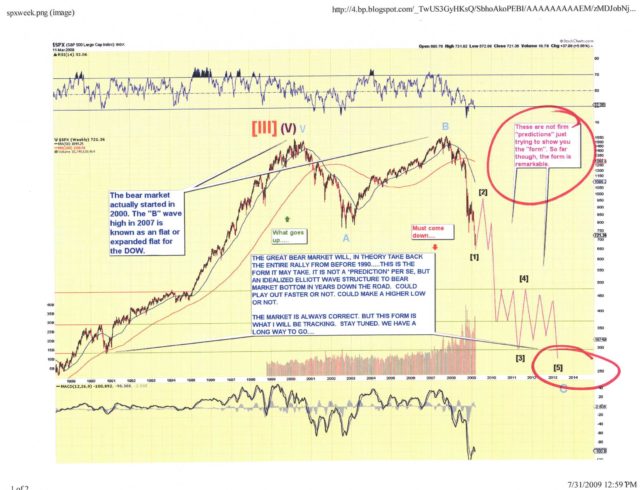

In July of 2009, there were Elliott Wave charts a-plenty to guide the way. Below is a typical one, and a rather well-rendered one as well. It speaks of a multi-year bear market to come, dragging the S&P 500 down to about 270 points. They nailed it, except for the fact that the S&P is about 14 times that price level right now. Indeed, when this chart was created was pretty much the best time to buy virtually anything with a ticker symbol.

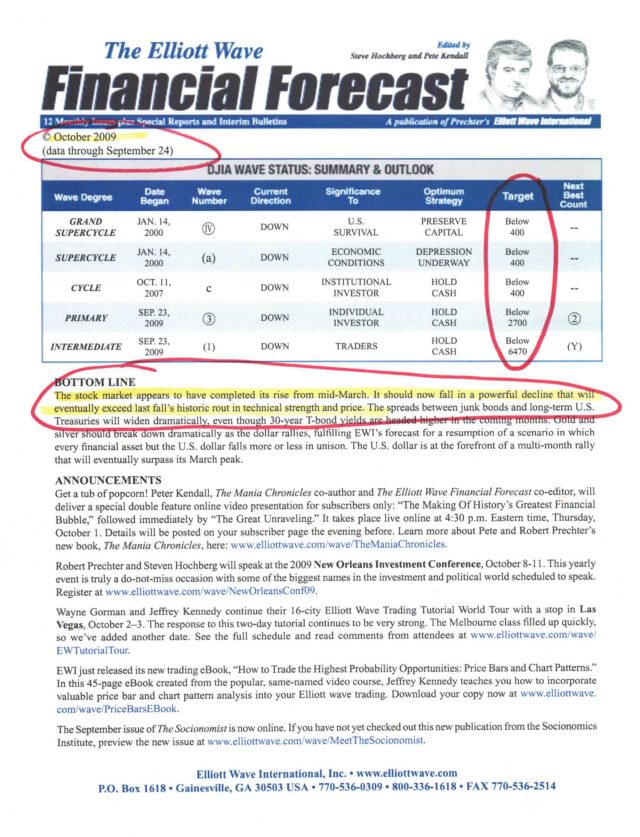

Speaking of the Elliott Wave method, there is of course one organization which draws its very name from that fabled technique. I had literally hundreds of pages of printouts from these chaps (all resting neatly in my recycling bin now). I spent a long time last night going through those stacks, and virtually without exception they spoke about a monstrous bear market beginning Right………….About………….NOW.

I noticed two common elements to all these EW predictions, and it is indeed a devilish combination: ONE, they were well-thought out, well-reasoned, well-illustrated, and incredibly convincing, and TWO, hardly a single one transpired, and certainly none of them to the degree suggested.

Below is a good example, written in October 2009. It declares that the rise from March (when the S&P hit 666) was over, and that prices would “fall in a powerful decline” (as declines are prone to do). I would note that the price target ‘below 400” refers to the Dow Industrials, which is hovering around 30,000 as I am typing this. You know. 30,000. Which is 75 times the value 400. The math checks out.

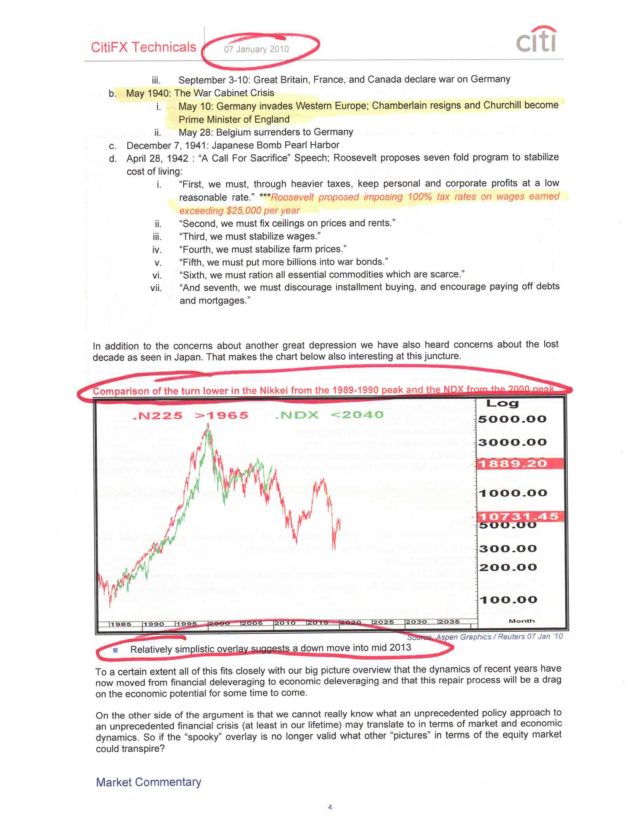

Early the next year, in January 2010, no less a body than Citibank offered up a lengthy market analysis which was anchored to a compelling analog between the U.S. market and that of the Nikkei 225. As they state, their prediction was for a tumbling equity market in the U.S. “into mid-2013.”

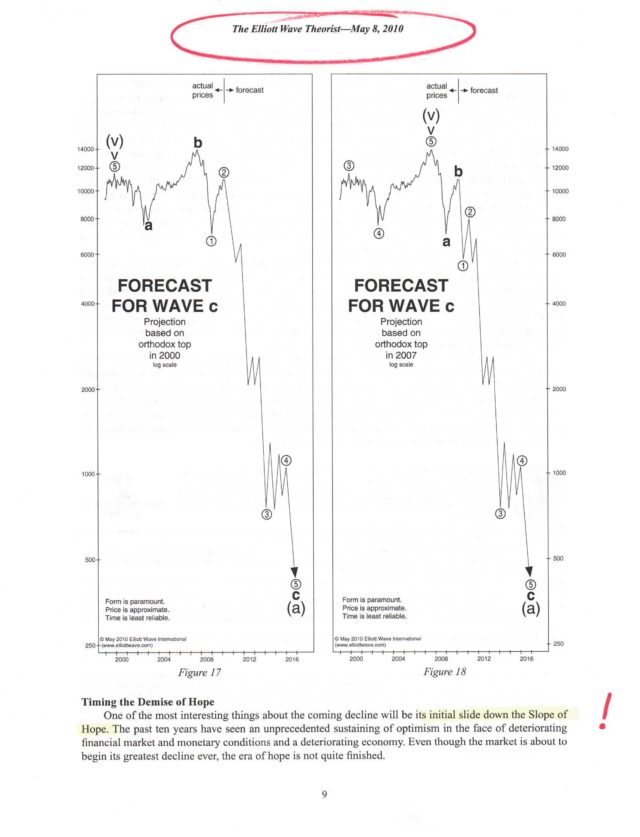

A few months later, in May 2010, our friends in Gainesville produced yet more charts showing the path the Dow Industrials would take on their stomach-dropping run to the 400 level. Again, the charts and arguments were beautifully rendered. But the winners over the past eleven years have been those who bought……….ANYTHING. At virtually any time.

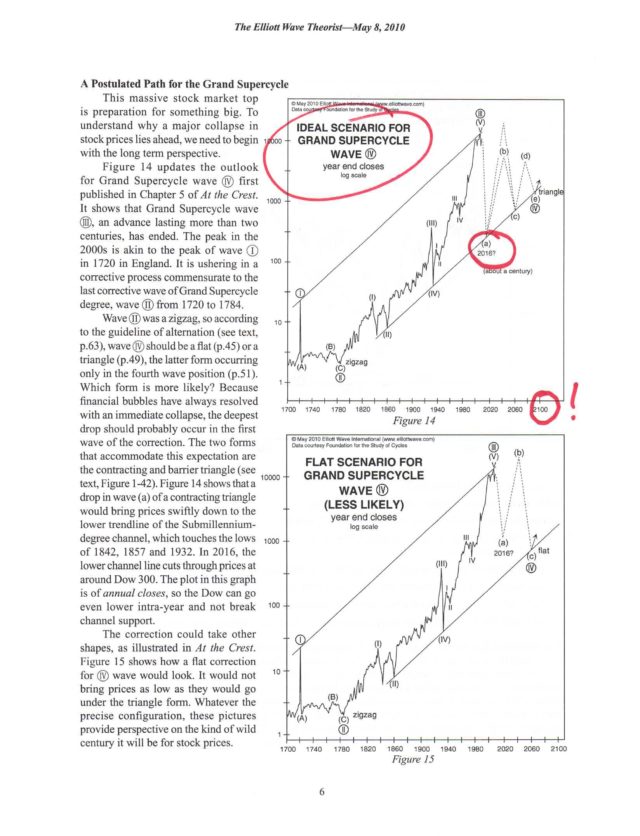

Maybe you want a longer-term prediction. Look no further! Elliott Wave saves the day once again. Here they offer the ‘ideal” path, plotted all the way out to the year 2100. So, yeah, I have yet to know of anyone who can reliably pick the market direction a month from now, but we’re expecting to belief that this quasi-religion can guide us for the next eighty years of market activity, a timespan during which about a trillion unexpected things are going to happen.

The experience of going through these stacks was, to be kind about it, illuminating. At this point, if one of these fellows predicted for me that McDonald’s could serve me a hamburger, I’m not sure I would believe it. I’ve got lots more, and I’m going to put those together right now in a post for all of Slope’s paying members.

Just remember, folks: if you decide to go into the prediction business, just remember your magic escape key has one word: relabeling. That’s all ye need ever know.