About a year ago, not that many people had heard of WallStreetBets, and even fewer people frequented the place. Sure, as an investment subculture of the Internet, it was a fairly big deal, but the growth and media presence over the past year has been stunning.

This post isn’t about WSB in general but about one user in particular: he goes by the R-rated screen name of /deepfuckingvalue, but for the sake of semi-decency, we’ll just refer to this anonymous trader as DFV. I’m also going to assume that “he” is a “he”, since the male/female ratio of WSB is about a billion to one.

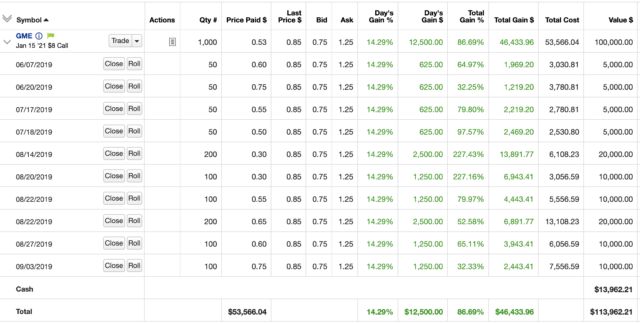

Back in 2019, from May through September, DFV took it upon himself to start acquiring long-dated, out-of-the-money call options on GameStop which, similar to WSB, wasn’t exactly on everyone’s mind like it is today. Most people back then probably couldn’t tell you if the retailer was public or not, much less what its ticker symbol was. But DFV decided that at $5, GME was a good value. He felt the same way at $4. A few thousand dollars here, and a few thousand dollars there, and he established his stake. It was his YOLO (You Only Live Once) trade, and he presumably pushed all his discretionary savings into it. (As always, click on any image for a larger, more readable version).

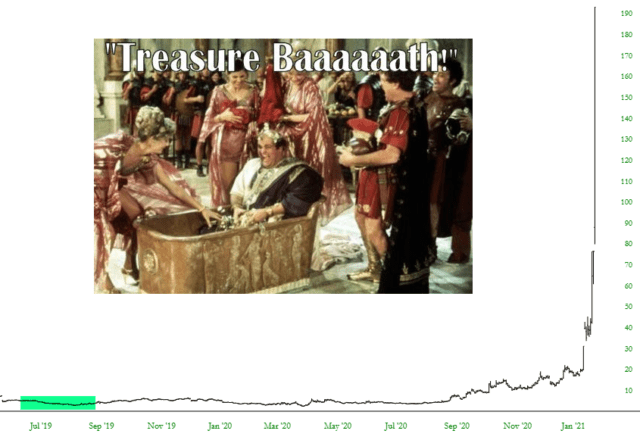

In spite of his “all in” faith of being a GME bull, DFV didn’t prosper. Below is a chart in which I’ve tinted the approximate time range where DFV was purchasing calls. The stock climbed a little bit, but once the Covid scare hit, it wiped out all the gains, and then some. DFV was deep in the hole.

In the throes of the Covid pandemic, DFV sold precisely zero of his calls. He amassed 15,000 of the things, and he saw about half of his money disappear. The only thing working in his favor was that there was plenty of time left on the options.

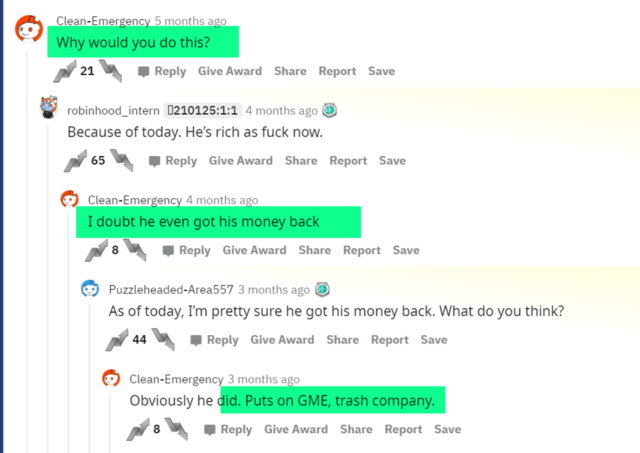

Of course, the young lads over at WSB aren’t exactly a touchy-feely group, so they lambasted the guy on a regular basis. Here are a few of the kinder comments:

Well, there’s no need to go through the day by day, week by week, month by month history of this position. DFV held fast (“diamond hands” in the vernacular of WSB-land) and saw his $53,000 grow into the six figures. He began to get some measure of fame as his gains on the aggressive position grew to 100%, 300%, and more. There was almost an audible cheer from WSB when he crossed into the million dollar mark, since diamond hands are considered one of the highest virtues with that crowd.

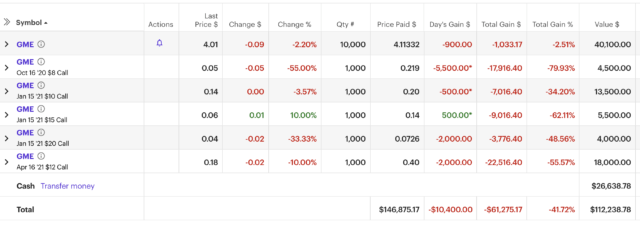

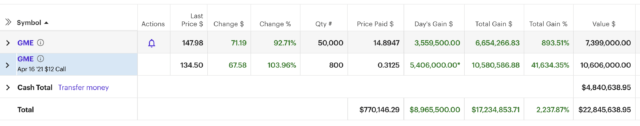

As one million become two million became three million, observers began to wonder where the dividing line was between (1) diamond hands and (2) stupidly overstaying his welcome and watching those profits diminish. In just a matter of days, however, the eye-popping $3 million windfall grew to nearly $23 million. (It should be noted that DFV sold options along the way that were about the expire, and parlayed those profits into actual GME stock and other call options, but the original cash allotted was in fact $53,000).

This chart – – deliberately presented with an arithmetic scale – – clearly shows just how long DFV held on to his stake, and how puny his initial purchase prices (tinted in green) were. I strongly suspect that ten years from now, what happened with GME will still be the stuff of legend.

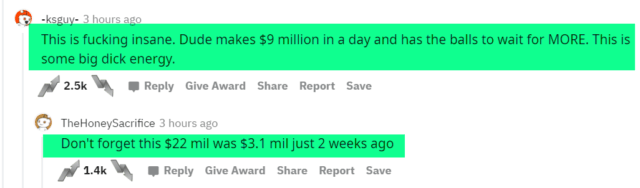

Of course, the chastisement and laughing from last summer has changed quite a bit toward DFV…………

………and, more often than not, the fraternal enthusiasm takes a hard left turn:

The actual identity of DFV, as with Satoshi, is totally unknown. Eyewitness accounts have been pieced together to yield this police artist sketch:

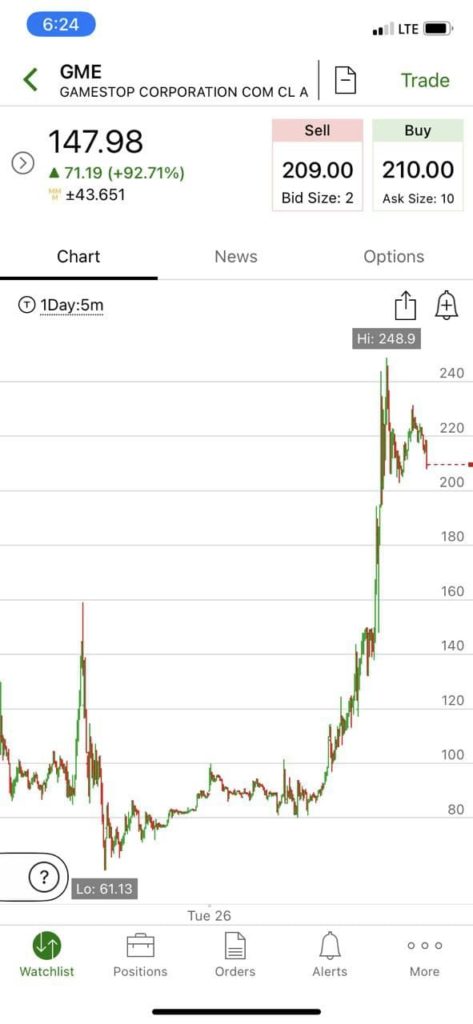

I would hasten to point out that the incredible gains stated above do not incorporate the after-hours action. I am typing this post on the evening of January 26th, and the stock got as high as $248.90, over $100 higher than the closing price. I would also point out that DFV makes another $180,000 in profit with every single dollar the stock moves up. The point being that at the peak of evening trading, DFV had another $18 million in paper profits, bringing his total winnings to the dizzying level of over $40 million.

What lessons can drawn from this? Hardly any. The old saying is that it’s better to be lucky than good, and that’s definitely the case here.

But it wasn’t just luck – – or even the solid analysis that DFV did back in 2019 – – it’s the fact that his tenacity and faith in the trade is truly a one-in-100-million-people degree of fortitude. It’ll be awfully interesting to see just how high GME goes when DFV decides it’s finally time to rent an aircraft carrier to store all those profits.