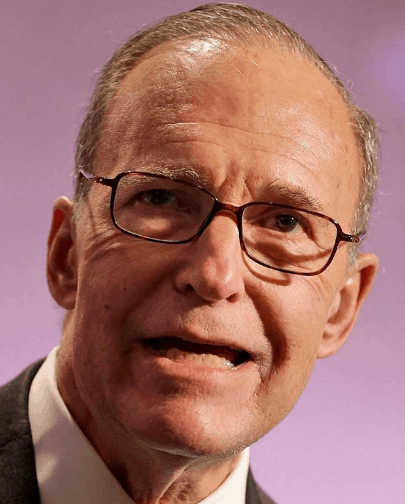

The champion of stock market bulls these days is thrice-married buffoon Larry Kudlow, who – – whenever the market is falling – – is rolled out to utter some kind of banal bromide to calm everyone down and convince them to keeping buying equities, irrespective of valuation metrics. And, frankly, it keeps working. Last week during a big morning selloff, Kudlow saved with one word: “glitch.” He completely dispatched a raft of valid economic data by shrugging it off as a glitch, and markets went soaring.

Personally, I think Larry Kudlow is an amoral, feckless nimrod. But allow me to use history, and not just my own debased opinion, as evidence. I present to you some gems of Larry’s past, just so we can see how prescient this chap really is.

February 2000: “This correction will run its course until the middle of the year. Then things will pick up again, because not even Greenspan can stop the Internet economy.”

What followed: One of the most delicious bear market plunges in history.

June 2005: “Homebuilders led the stock parade this week with a fantastic eleven percent gain. This is a group that hedge funds and bubbleheads love to hate. All the bond bears have been dead wrong in predicting sky-high mortgage rates. So have all the bubbleheads who expect housing-price crashes in Las Vegas or Naples, Fla., to bring down the consumer, the rest of the economy and the entire stock market.”

What followed: Las Vegas and Florida real estate crashed, and the economy as well as the stock market followed suit. The “bubbleheads” were right.

June 2002: “The shock therapy of a decisive war will elevate the stock market by a couple thousand points.”

What followed: The Dow dropped a thousand points.

March 2007: “At home in the U.S., there are still housing-slump worries and concerns about an inventory correction in autos and factories. Former Federal Reserve Chairman Alan Greenspan this week even predicted a recession, naming the budget deficit as the cause. Huh? The deficit is evaporating as record tax revenues are being generated by a solid economy, itself a function of the low marginal tax rates put in place by President Bush.”

What followed: An enormous recession in spite of the “solid economy.”

So these days “Kuddles” is saying everything is just peaches ‘n’ cream with all things economic. If you choose to believe him, well, there ya go.