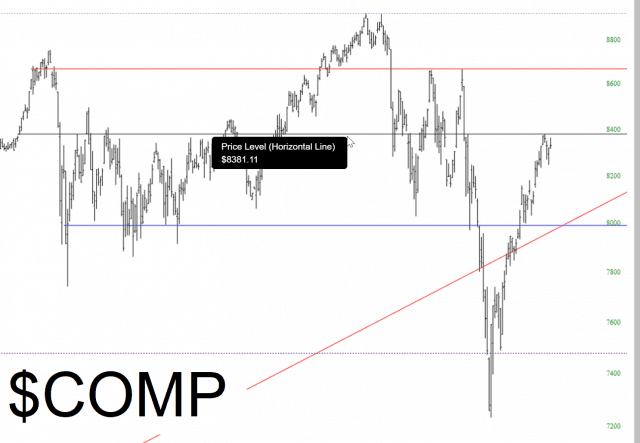

In last weekend’s article, we focused on the relentlessly advancing S&P 500 (SPX) from its December 26 low at 2346.58 into an important Fibonacci price and time resistance zone at 2713.70 on January 31.

The 2713.70 level represented a 62% SPX recovery of the entire September-December decline, while January 31 represented day number 89 since the September 2018 all-time high, and the day that the December-January recovery rally time period equaled 38% of the overarching total timeframe from the September high.

We discussed the likelihood that the confluence of such meaningful Fibonacci price and time relationships could and should stall or reverse the relentless SPX six-week advance, and as such, would be a yellow caution flag for the bulls. (more…)