I’m got some awfully cool news about Slope.

In the nearly 14 years this site has been around, we’ve never done alerts. Now we do. This is the newest feature to emanate from SlopeRules. What I’m about to show you is the first method of establishing alerts. There are other, better methods coming very soon.

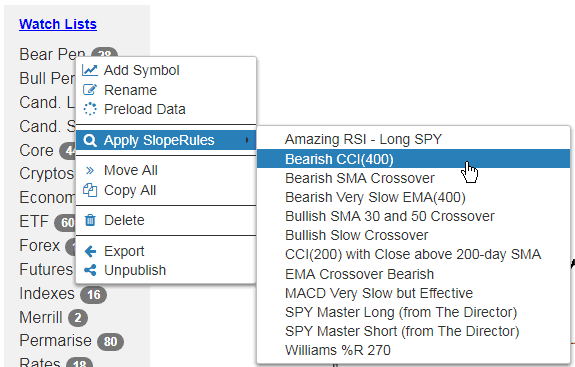

In order to create an automatic alert from Slope about any of your symbols which are “triggered” by a SlopeRules rule set, start by choosing the watchlist you want to monitor. Right-click on the watchlist, and choose which SlopeRules in your library that you would like to apply.