First, a warning: I’m going to be on a whirlwind across-the-country trip tomorrow, so I will probably not be as prolific as normal. In the span of 24 hours I’m going to fly across the U.S., have some meetings, and fly all the way back home. Ugh. But I wanted you to know.

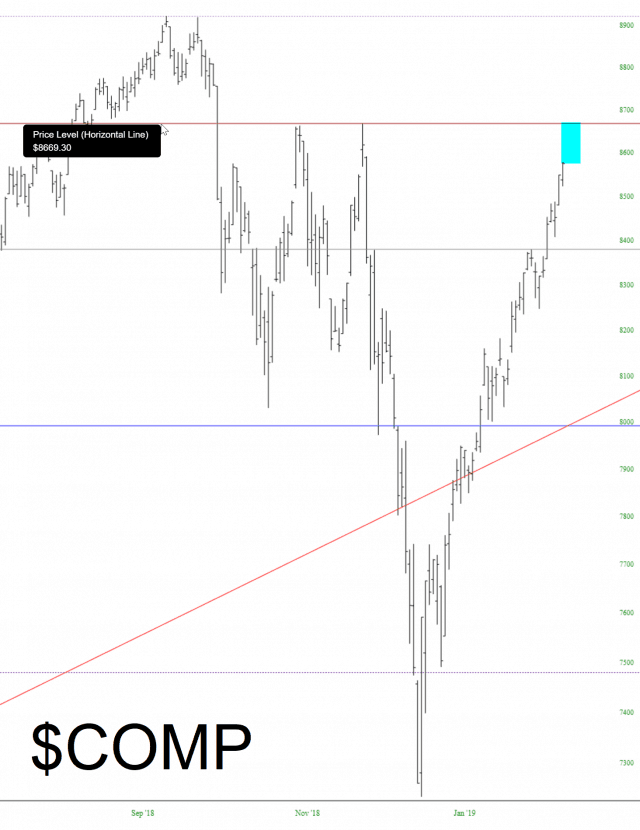

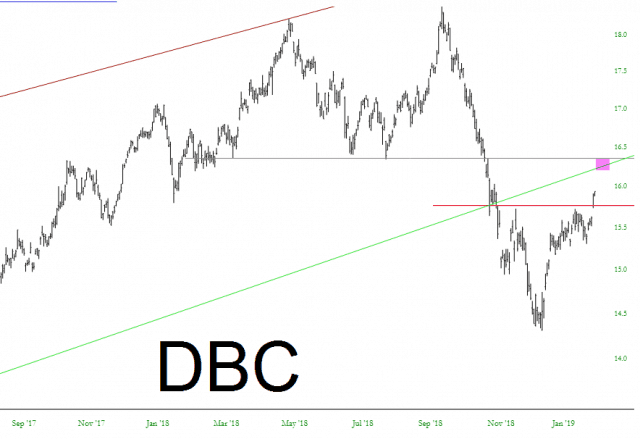

Speaking of “ugh”, the markets continue to creep higher, sometimes a lot, sometimes a little. Today was one of the “little” days. The overbought indicators are very stretched, as you’ll see below, but overbought readings can stay overbought for a long time. They are by no means a guarantee of a reversal.