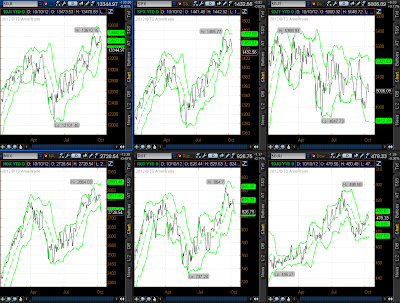

Due to an across-the-board sell-off that's occurred, so far, this week in

equities, I thought I'd take a mid-week look at the 6 Major

Indices and 9 Major Sectors to see which ones have

been holding up somewhat better than the others.

From the

Daily line chart of the Major Indices shown

below, the two Indices that haven't reached their lower Bollinger Band by

today's (Wednesday's) close are the Dow Transports and Dow Utilities. They are,

however, underperforming the other four Indices in terms of performance from

July.

The 3-day

percentages gained/lost graph confirms this. The biggest losses, so far

this week, have been in the Nasdaq 100 Index, followed by the Dow 30, S&P

500, and Russell 2000.

The

Daily line chart of the 9 Major Sectors shows

that the only ones that haven't yet closed at/near their lower Bollinger Band

are Consumer Staples, Health Care, Utilities, and Financials. The only ones that

made a higher swing closing high before this latest pullback are Consumer

Staples, Health Care, and Utilities (the "Defensive" Sectors).

The 3-day

percentages gained/lost graph shows that the largest losses have

occurred in the Consumer Discretionary Sector, followed by Industrials,

Materials, Health Care, Energy, and Technology. The sectors with the least

losses are Utilities, followed by Financials, and Consumer Staples. While Health

Care has only pulled back to its mid-Bollinger Band, it is still in the first

group (the "Offensives") which has had the largest percentage losses.

In

summary, while there has been a general sell-off in the Large-Cap,

Technology, and Small-Cap Indices in a "risk-off" environment by mid-week, the

Dow Transports and Utilities have fared somewhat better, on a percentage-lost

basis. They are the ones to watch for any signs of serious weakness, which may

take them down to their lower Bollinger Band. If that happens, they may drag the

other four Indices down further below their lower Bollinger Band, which may (or

may not) hold for a day or two as short-term support. Also, since the Nasdaq 100

has lost the most, while the Russell 2000 has lost the least compared with the 4

Major Indices, they also hold the key and bear a close watch over the next

couple of days to watch for either signs of an acceleration of weakness or

evidence of stabilization or buying/short-covering.

In

addition, the Sectors to watch for any signs of serious weakening are

the "Defensive" and Financial Sectors. If that happens, they may drag the other

Sectors down further below their lower Bollinger Band, which may (or may not)

hold for a day or two as short-term support.

Finally,

it's my opinion that any further serious sell-off below lower Bollinger Bands in

all these Indices and Sectors would likely be accompanied by a general sell-off

in commodities and foreign currencies. In this regard, 80.00

seems to be the level that would need to be held by the U.S. $,

as shown on the Weekly chart below. Several intersecting

Fibonacci fanlines, the 50 sma (red), the 200 sma (pink), the 5-Year Volume

Profile POC (point-of-control), and price consolidation ranges all converge at

this 80.00 level, so it's an important level to be captured by $

bulls and held as support.

SB's DISCLAIMER: The information contained within

my posts may not be construed as financial or trading advice. Please do your

own due diligence before engaging in any trading activity.