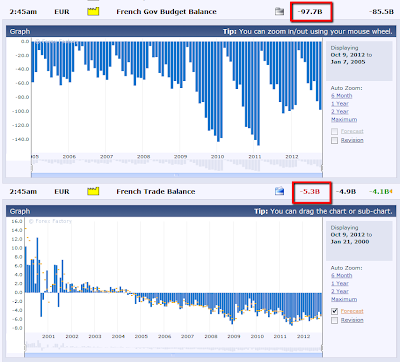

Data released

today shows that Trade Balance in France and Britain is

rather "unbalanced," as France also grapples with an ever-increasing Budget

deficit, as shown on the graphs below. Trade Balance for both countries is well

below the levels of 2007-08-09.

At some point, European stock markets

will recognize and reflect these numbers, in spite of what the ECB's promise (to

provide financial aid through the ESM program) is attempting to accomplish. I

seriously doubt that such a plan, without an immediate enaction of supportive

fiscal, banking and economic reforms, will be sufficient to prop up sagging

European growth in the near-term. At some point, economic fundamentals will

matter to the markets, lest further layers become built on to an

already-shaky "house of cards" foundation.

SB's DISCLAIMER: The information contained within

my posts may not be construed as financial or trading advice. Please do your

own due diligence before engaging in any trading activity.

I have really been hesitant in adding any new positions today to the portfolio. Going short at this point seems like a chaser's mindset, and going long when the VIX is spiking and then consolidating at the highs, doesn't make much sense either.

I have really been hesitant in adding any new positions today to the portfolio. Going short at this point seems like a chaser's mindset, and going long when the VIX is spiking and then consolidating at the highs, doesn't make much sense either.