Before I get started, I wanted to mention that I just received the full-color version of Silicon Valley Babble On, and it is just gorgeous. If you’re one of the well-to-do Slopers out there, you might want to spring for this luxury item, because it looks absolutely fantastic. It’s not cheap at 79.95, but here’s a link if you’re interested.

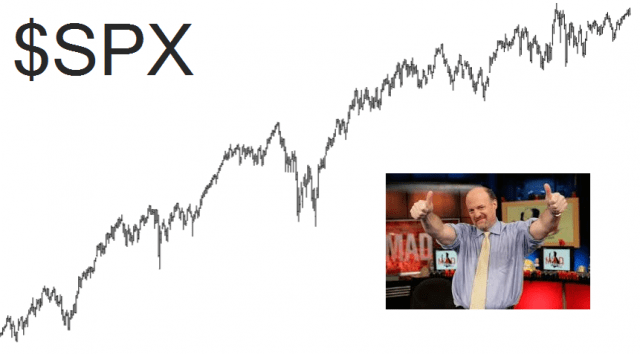

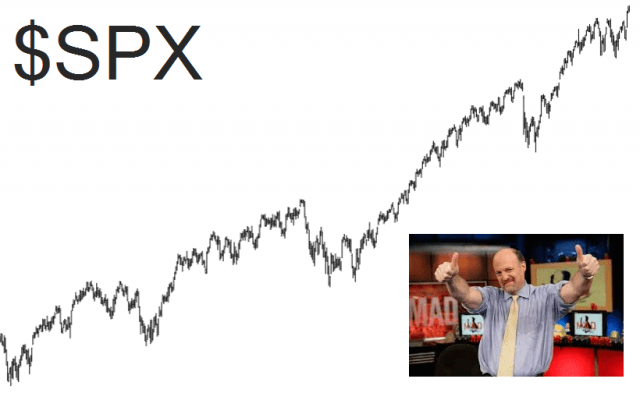

Now I’d like to share with you three charts of the S&P 500 cash index. I have deliberately left off the axis labels, so you’ll know neither the times nor the prices.

There are a couple of things these charts have in common. First, they are all ascending mightily without any sign of reversal. And, second, they have tubby old Jim Cramer giving the thumbs-up. This is the same Jim Cramer who I distinctly remember in early 2009 meekly being interviewed and declaring that he would never let anyone he loved buy stocks again for the next five years.

There is something that the first two charts have in common, however, that the third one may not: they were both precisely ending their bull runs. In other words, were you to see the subsequent price bars, you would have seen them crumble into a pair of absolutely delicious bear markets that destroyed trillions of dollars.

The point I am trying to make is little different than the tired old saw we’ve all heard: “no one rings a bell at the top.” Tops are much, much harder to call than bottoms, because by their very nature, they are in sky-high unchartered territory where everyone is making money, the market is going up every single day, and the only thing that stops the party is that the selling finally overwhelms – – – ever so slightly – – the buying.

So what about the third chart? SHRUG. Maybe today is the exact top. maybe it isn’t coming until we’re at 3,200 on the S&P.

I will make one other remark, however. The most bearish of the bearish sites out there, ZeroHedge, has become utterly milquetoast lately. They still are “Bad News Central” and love stories about hurricanes, radiation, heat waves, floods, droughts, and any other disasters. But their snarling bearishness has sputtered down to almost nothing.

Indeed, I was completely bowled over by reading this article over on ZeroHedge, which is so doe-eyed bullish that I would have otherwise thought I was reading it at MarketWatch or Yahoo Finance.

As for my own shorts, I remain focused on very specific sectors – – real estate and energy – – and am working with baseline assumption that bonds will continue to weaken and interest rates will continue to rise.