In my post of July 25th, I pointed out that Britain's

FTSE 100 Index was trading around a major price support/resistance

level of 5500. It subsequently bounced from there and has risen to the top of

the large "Diamond" pattern (which, I mentioned, has been

forming from 2009/10…and is, potentially, a topping pattern with a

1300 point range).

The updated Daily chart

below shows market action, to date (October 18th's close). Price is

facing immediate major headwind resistance from the upper edge of this

Diamond pattern, along with negatively-diverging RSI, MACD, and Stochastics

Indicators…one to watch for a potential breakdown, as the 1300 point range is

substantial.

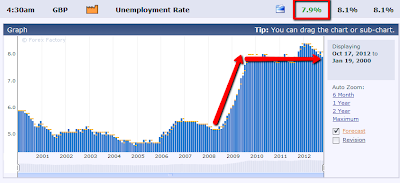

I'm mindful of the

fact that Britain is also facing a 9 billion pound debt

incurred from hosting the 2012 Olympic Games, as it struggles

with a double-dip recession, severe public spending

cuts, and an unemployment rate of 7.9% (as reported here on October 17th and shown on the graph

below)…adding, enormously, to the above headwinds.