ES made a very nice technical low on the 60min yesterday, with a potential W bottom that broke up slightly, but it all fell apart overnight. That looks very weak and ES is now testing the significant support level at 1410. If that breaks the next big support level is at 1388 ES. There is still some positive RSI divergence, but it's wilting, and will be effectively lost on a break below 1410.

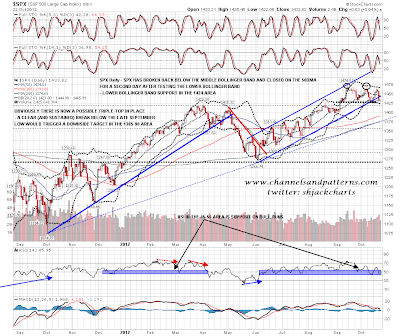

That isn't the only significant support level here however. SPX tested the lower bollinger band yesterday before closing again at the 50 DMA, and lower bollinger band support is at 1424 today:

Level support on SPX at 1426 is already being tested hard and if we open weak we will have a conviction break below it. The next big support level there is at 1396:

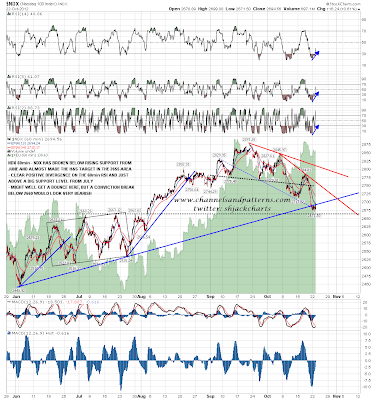

Another big support level to consider today is 2660 on NDX. This is significant and may well hold. There is some positive divergence on the 60min RSI to suggest that it might:

On Dow the low yesterday was a test of the support trendline on the broadening formation that I've posted before. The failure to reach the upper pattern trendline on the last swing up gives a 54% chance of a breakdown here however:

Last and least is the 1.30 level on EURUSD. This is a significant level but it has already broken since I capped this chart. Expect more downside:

There is a very good case for a breakdown into the next levels of support here, but at the current levels just above support, ES 1410 area, NDX 2660 area and Dow 13235 area there is a real possibility of a strong bounce. On clear breaks of these levels, and we may see those at the open, I'll be looking for a test of 1396 SPX soon.

If we get to 1396 SPX it's well worth noting that is a possible H&S neckline. If we aren't going to see a QEX rally then we might well see a right shoulder form there. Either way 1396 SPX would be a very good area to look for a bounce, with decent support levels below in the 1375, 1380 and 1390 areas.