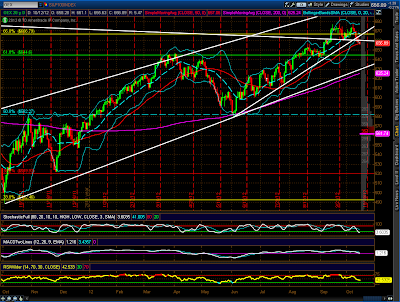

The following four charts show a top-down view of the recent breakdown of the

S&P 100 Index (OEX). Each candle on the first chart

represents a 1-month Options Expiry period, the second chart is a Monthly

timeframe, followed by Weekly and Daily charts.

The close-up view on the

Daily (fourth) chart shows that, not only has price broken below an intersecting

uptrend and downtrend support level, but there are also trend breaks on the

Stochastics, MACD, and RSI indicators after negative divergences formed in

relation to a triple top on price. What was support has now become resistance.

If it holds, we'll see further selling, likely to the lower trendline (which is

roughly in line with the 200 sma), or lower. I'll be monitoring these indicators

on the Weekly timeframe to see when they reach an oversold status to check where

price is relative to the Daily 200 sma and lower trendline, and when any

positive divergences begin to form.