Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Swing Trading Watch-List: BYD, CTXS, CX, ETFC, EXH

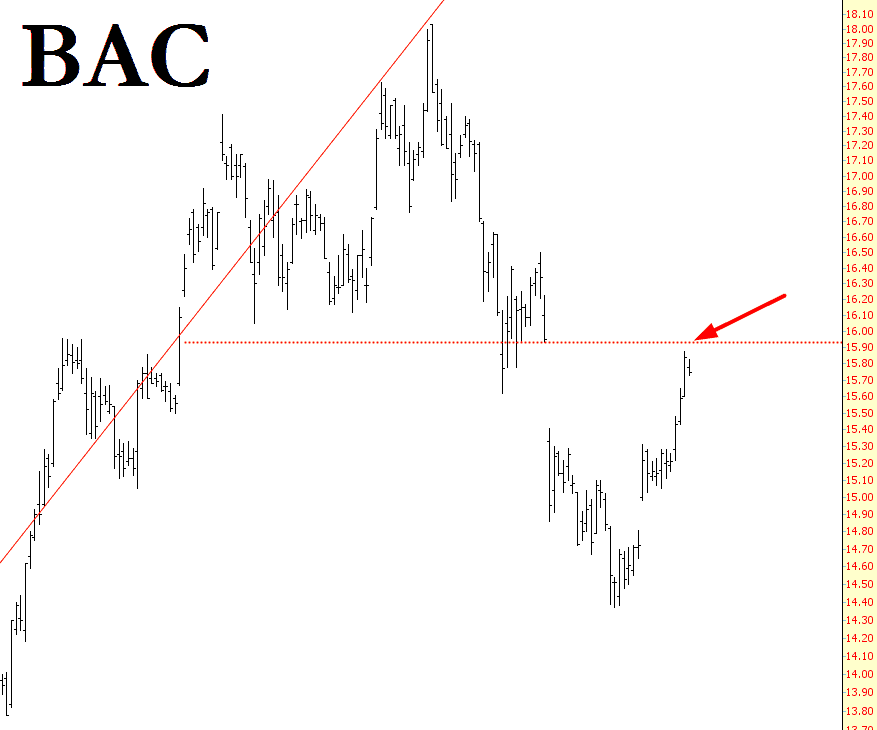

Gap of America

Stretched

When I looked at daily upper bollinger band rides a few days ago, I found twenty six examples in the last five years. The longest of those was ten days and there was only one of those. Yesterday was the eleventh day of the current daily upper band ride, so this band ride has already beaten the actuarial odds by quite a margin. Will it reverse today? Maybe, the overnight low was low than the Sunday night low, and that is a start at least.

SPX broke over resistance on the rising wedge from 1737 last week and while this may still be a bearish overthrow, SPX would need to break back below broken wedge resistance (1930 area) in the near future. Alternatively the wedge may be evolving into a channel, but in that case I would expect to see at least a test of 2000. SPX daily chart: (more…)

US Dollar and Bonds

No equity charts today as I covered that pretty thoroughly in my post yesterday. You can see that here if you missed it. Today I’m going to have a look at USD and bonds.

For the last few months I’ve had mixed feelings about USD, as there were, and still are, strong bull and bear scenarios. Last year I gave key support on USD at 78.6 and USD came close to testing that in May. However the marginal new low made in May didn’t challenge 78.6, and I’m increasingly leaning bullish. The daily RSI 5 is signalling a decent retracement here, but as long as the May low at 78.93 holds this retracement should be a buy, and I’d expect the next move up to test main double bottom resistance in the 81.5 area. USD daily chart: (more…)