Early in the weekend, I was asking myself how I was going to handle positioning before the big Brexit vote on Thursday. Well……..umm…….problem solved! It’s quite evident that the assassination of Jo Cox took care of the problem the ruling class in Britain was having with this whole “Brexit” nonsense, and, as with all things, we’ve glorious returned to the status quo.

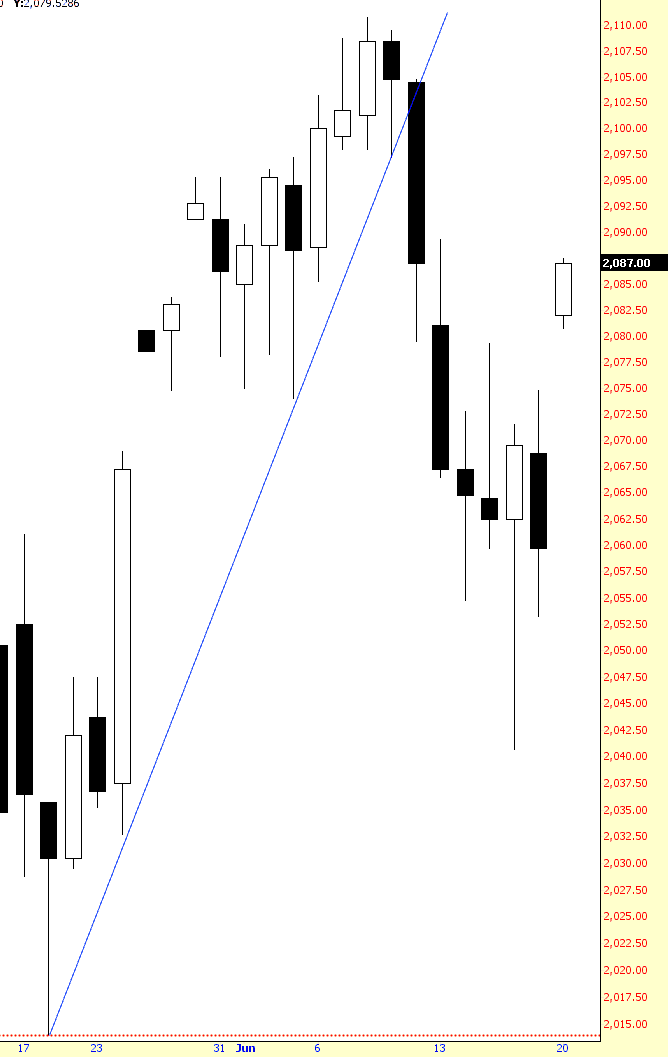

As such, the ES has undone five days of losses with a monster lift-off:

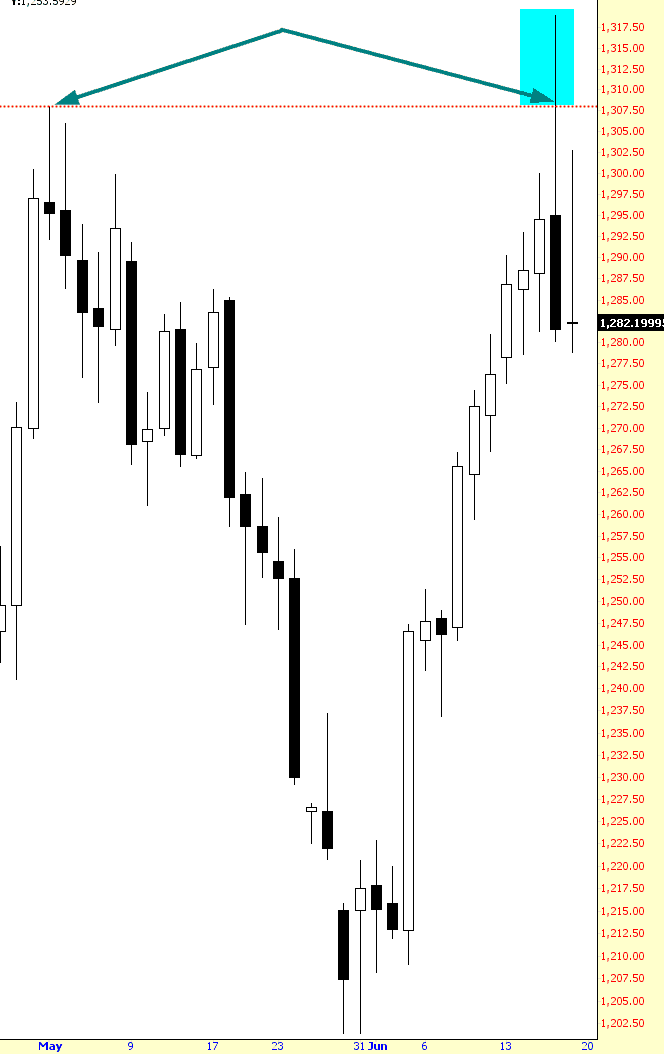

In turn the “flight to safety” (gold) was a failed bullish breakout. Frankly, I still think precious metals have terrific prospects in the years to come, but for the moment, the $100+ gains enjoyed in recent weeks are being taxed by a rush into risk assets yet again.

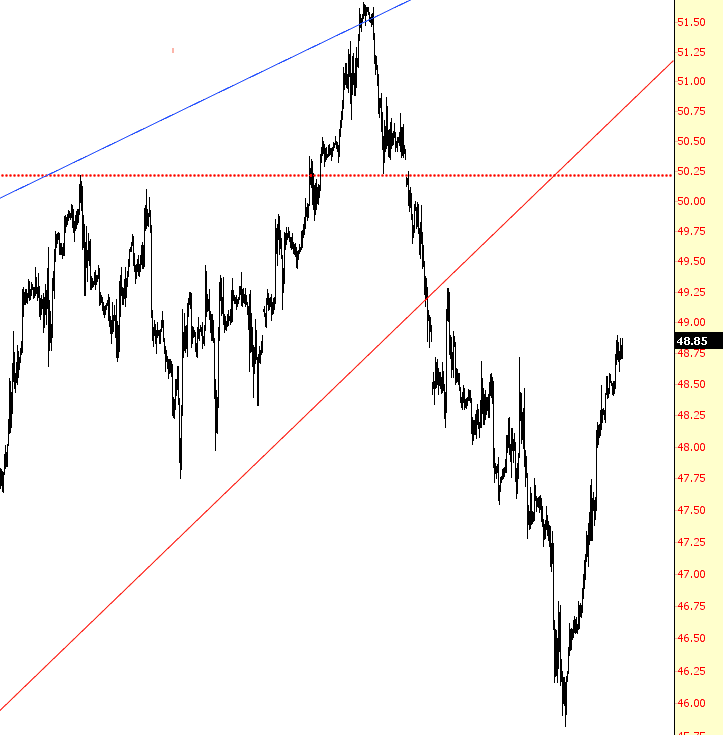

For a different perspective, below is the front month for crude oil, which is an intraday chart unlike the daily candlesticks shown above. I think this particular rally is just as vulnerable as gold’s was.

In any event, I’m going to spend my time pre-market widening up the stops on my portfolio. I’m relatively “light” right now, but short to be sure, so I’m prepared for my morning whipping. All the same, these rallies based on things that DIDN’T happen have been, in my experience, not big trend-changers. I suspect the rally we would have had next Friday morning based on the Brexit failure was simply rescheduled to today.