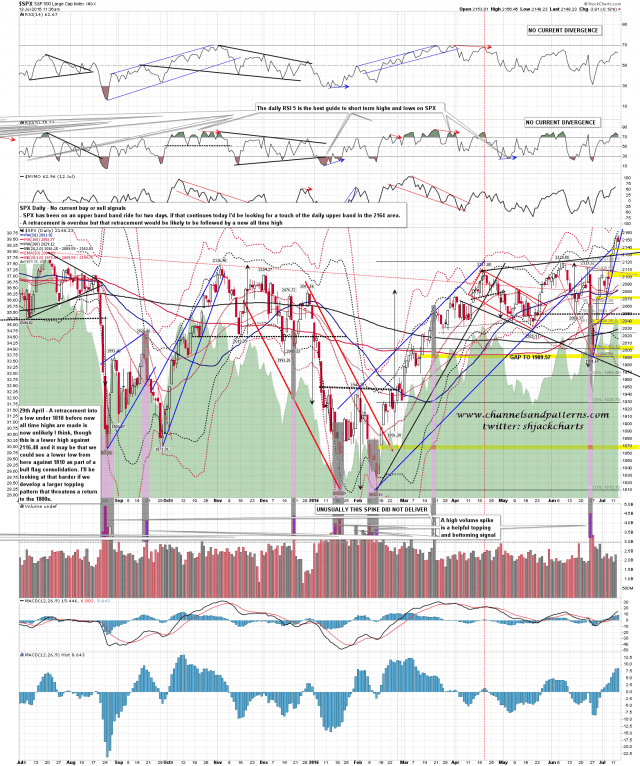

Pardon the sensational post title, but an email from a subscriber (‘L’, a financial advisor) had a grounding effect on me. He sent me this photo along with…

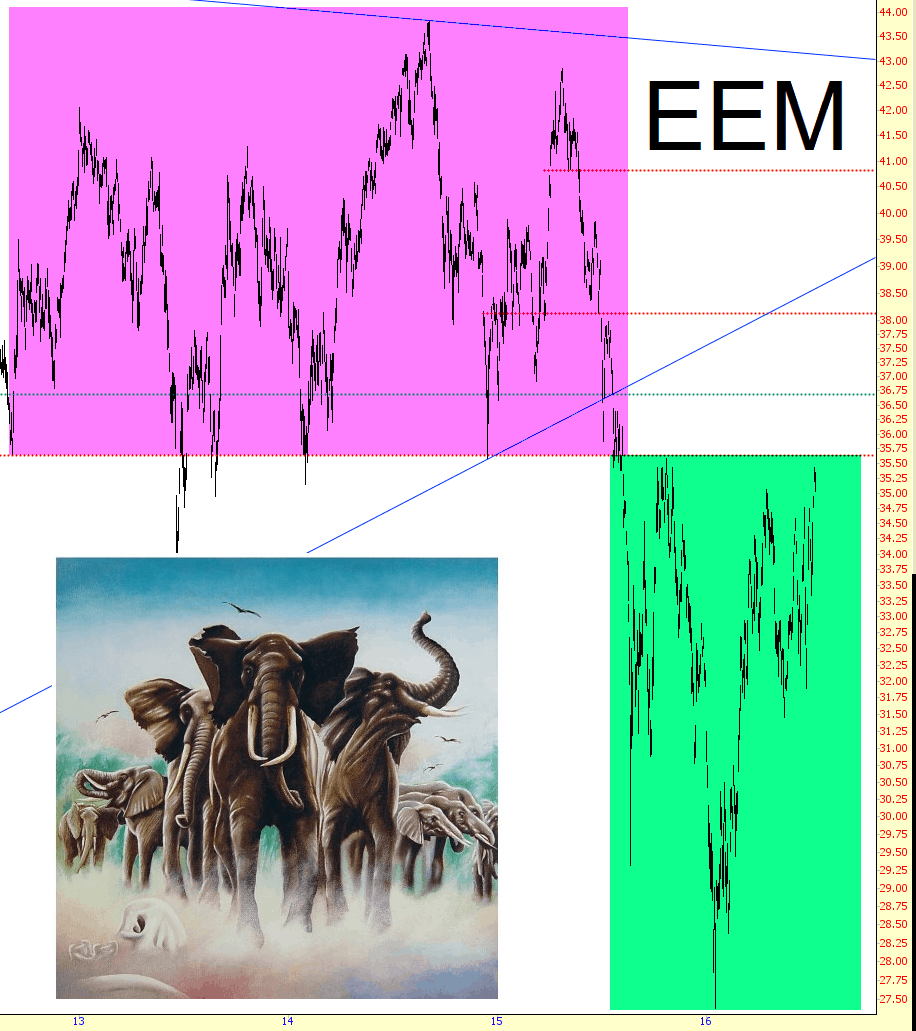

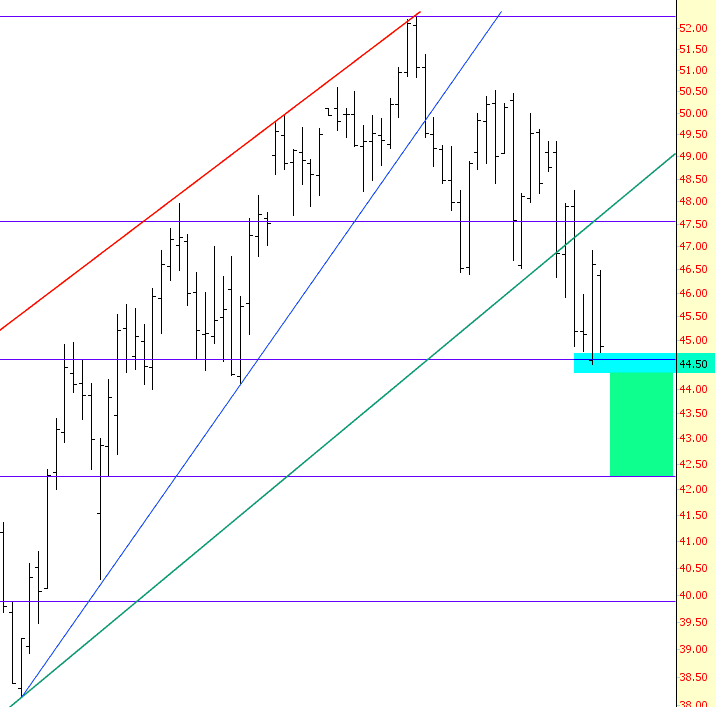

“I thought you might be interested in the breadth thrust that is going to trigger today. For some reason the Internet seems to be full of misinterpretation of a thrust. My numbers show that this will trigger today. Sets up for a 1987 scenario it seems to me. Attached is the history of it.”