“If I had a world of my own, everything would be nonsense. Nothing would be what it is, because everything would be what it isn’t. And contrary wise, what is, it wouldn’t be. And what it wouldn’t be, it would. You see?” –Alice in Wonderland

“If I had a world of my own, everything would be nonsense. Nothing would be what it is, because everything would be what it isn’t. And contrary wise, what is, it wouldn’t be. And what it wouldn’t be, it would. You see?” –Alice in Wonderland

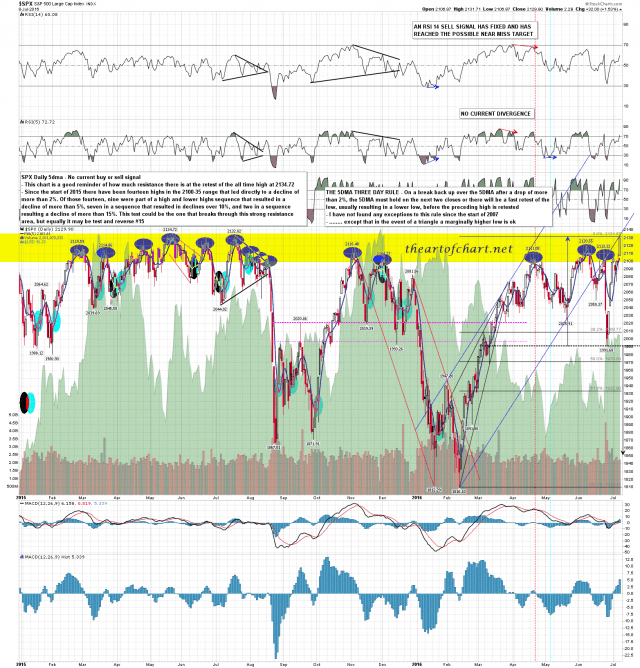

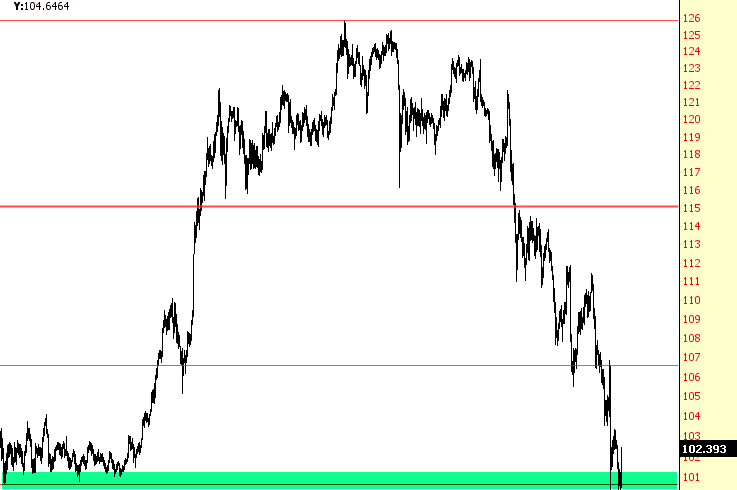

Silver out performs gold as both rise with Treasury bonds, which are in turn rising with stocks, as Junk bonds hit new recovery highs while USD remains firm as inflation expectations are out of the picture. This is highly atypical, maybe even unprecedented.

Some, deeply dug into their particular disciplines and biases, might say it is dysfunctional, as this backdrop simply does not make sense using conventional methods of analysis. Why again did I name this service Notes From the Rabbit Hole?