It certainly was nice to get a down day for a change. I wanted to share three charts and a remark about each one. These are all short-term candlestick charts.

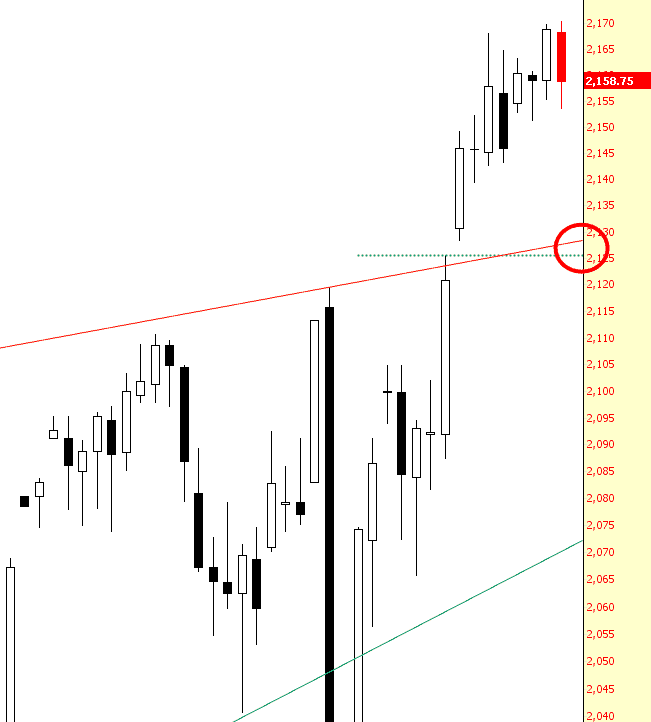

The first is the ES, which has been in a bullish uptrend since the (now laughable) Brexit event. Until and less it breaks beneath the level I’ve marked below, which is both the upper trendline of the pattern as well as the post-jobs report gap, the uptrend is intact. 2125 needs to be busted before the bears can really breathe any sigh of relief.