First off, in case you’re wondering where I am……..

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

!!!

Subtitle: Brexit!!! Silver!!! Bonds!!! Deflation!!!

It’s a funny title for a segment, but it is appropriate. I don’t want to be too flippant with dismissals of inflammatory market events like ‘Brexit’ as simply hype. There is very real macro fundamental shifting going on behind the hype. But in market management, macro fundamentals play out over long stretches of time and nobody knows exactly how all the moving parts are going to affect the subject of the hype (in this case Britain and the EU), let alone the asset markets we are tasked to invest in, trade or avoid.

It’s a funny title for a segment, but it is appropriate. I don’t want to be too flippant with dismissals of inflammatory market events like ‘Brexit’ as simply hype. There is very real macro fundamental shifting going on behind the hype. But in market management, macro fundamentals play out over long stretches of time and nobody knows exactly how all the moving parts are going to affect the subject of the hype (in this case Britain and the EU), let alone the asset markets we are tasked to invest in, trade or avoid.

This is where market psychology comes into play, hence the ‘!!!’ title. As already noted, I get the feeling that the Brexit drama was an exclamation point on the global deflationary phase that has been in play since 2011, when the acute phase of the ‘Euro Crisis’ first erupted (sending gold to 1900+ an ounce). You may recall that silver and commodities had already blown off and blown out but gold pulled in the risk ‘off’ bid amid a developing deflationary force. It then blew out and global deflation ensued.

Swing Trade DOW, F, ADSK, LOCK, ENLK

Couple of Quickies

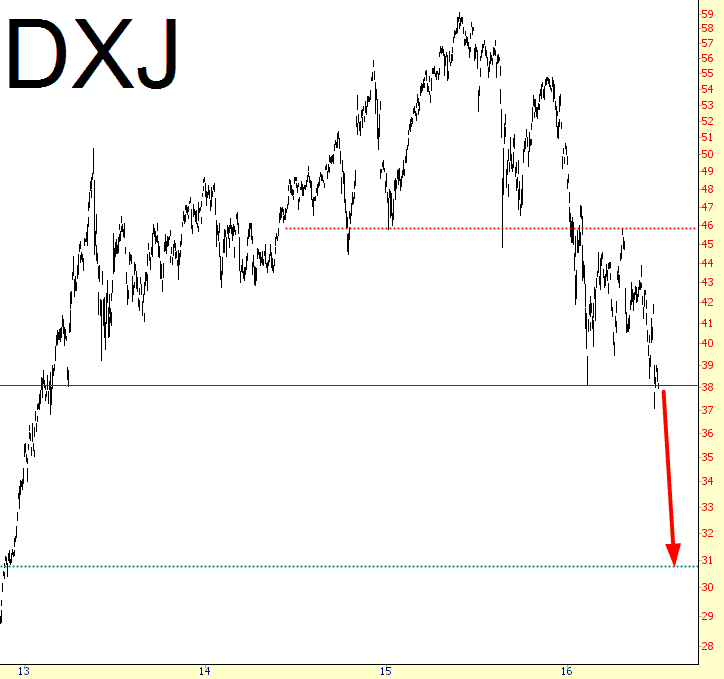

In honor of Bill and Hillary “we can get away with murder – – and we have!” Clinton, I just wanted to toss out a couple of quickies (not out a 40 story window, as Clinton Foundation henchmen would do, but here on my little blog). First there’s Japan, which is following the path to destruction I laid out months ago……..just look at that target!

Backtesting Broken Resistance As Support

ES has been retracing somewhat overnight on Brexit fears and I understand that China’s debt to GDP ratio is now in the 250% ratio, which is roughly 50% more than Greece but still significantly behind the world leaders in insanely reckless fiscal policy Japan. Given that everyone knows nowadays though that this problem can be solved just by printing enough money to buy back the debt and cancel it I have no idea why anyone worries about these things any more, but for whatever reason markets are down and people seem to think that has something to do with it.

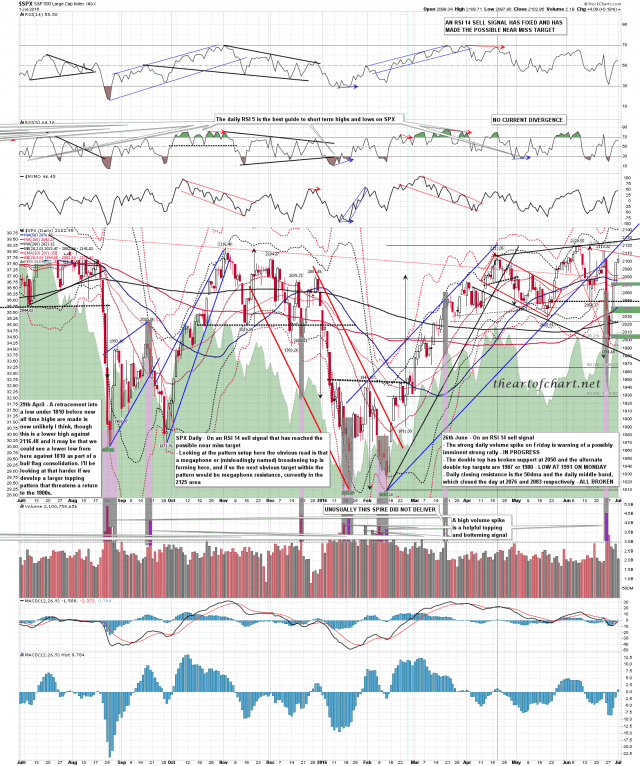

A retracement is overdue, and the first target is a retest of the daily middle band on SPX, which closed at 2083 on Friday. SPX daily chart: