NFTRH 404 deviated from the usual format of widespread, in-depth coverage of US and global markets, precious metals and commodities in order to focus on two main themes. One was a view of building short-term risks in the gold market (possibly pending new rally highs) and the other of a developing bullish phase in the US stock market. We reproduce part of that segment here…

More on the ‘Breadth Thrust’ and Market Internals

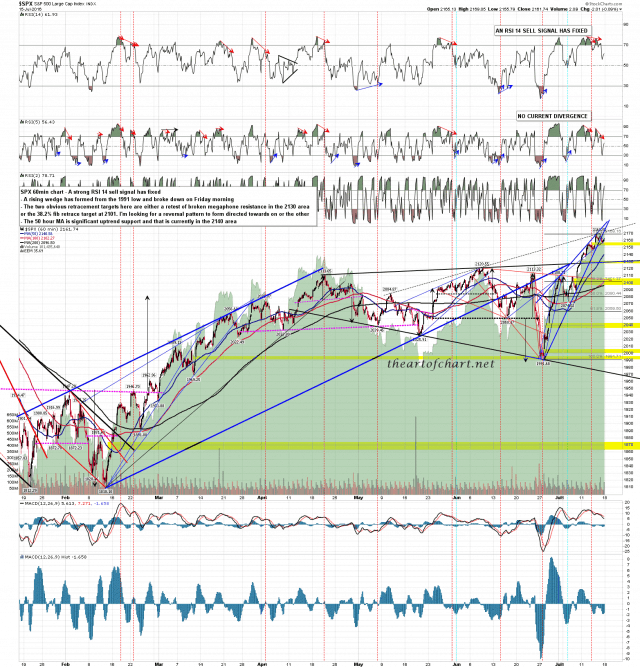

Ref. Breadth Thrust: Prelude to a Crash? (July 12)

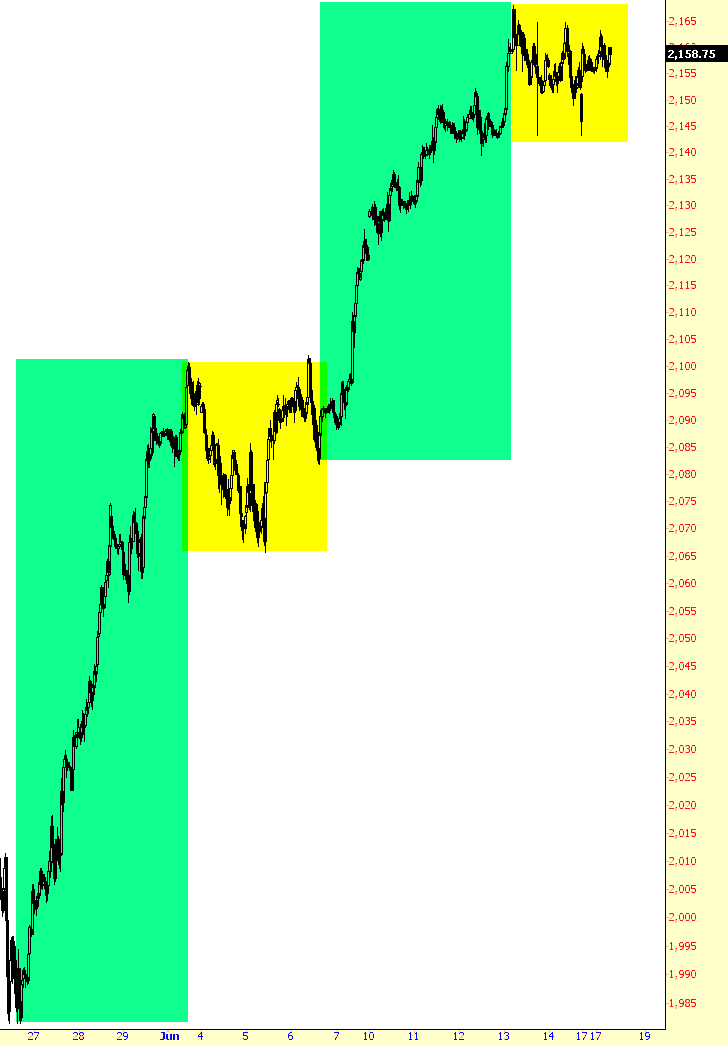

Subscriber ‘LN’ presented a view of the impending ‘breadth thrust’ signal and we both came to the same conclusion; that this is ending action in the stock market. It is at once very bullish and very bearish, depending on time frames. Below is additional information per ‘LN’, who is a financial adviser and thus, not a casual observer. I would also note that both ‘LN’ and I have similar caveats about analogs from the past projecting to the future (they often do not do it well). But for reference (emphasis mine)…

“I went back and looked at 1987 a little closer. I know the price action isn’t going to be identical but I wanted to see if they rhyme at all. (more…)