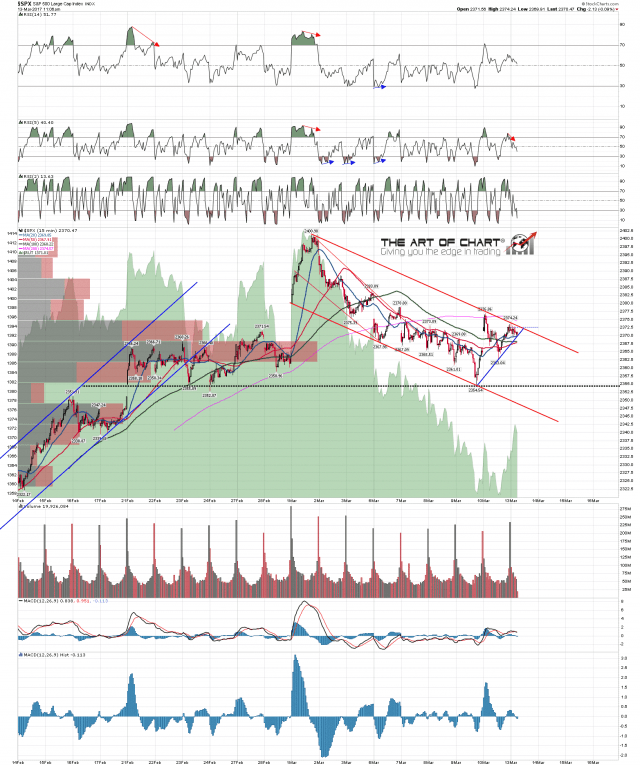

I had to redraw it slightly but Friday’s falling channel on SPX has held so far this morning. As this channel is a likely bull flag channel on the bigger picture I’m watching it very carefully. The short term rising support within the channel has broken down and if channel resistance continues to hold then the next obvious target is channel support, currently in the 2349 area. SPX 15min chart:

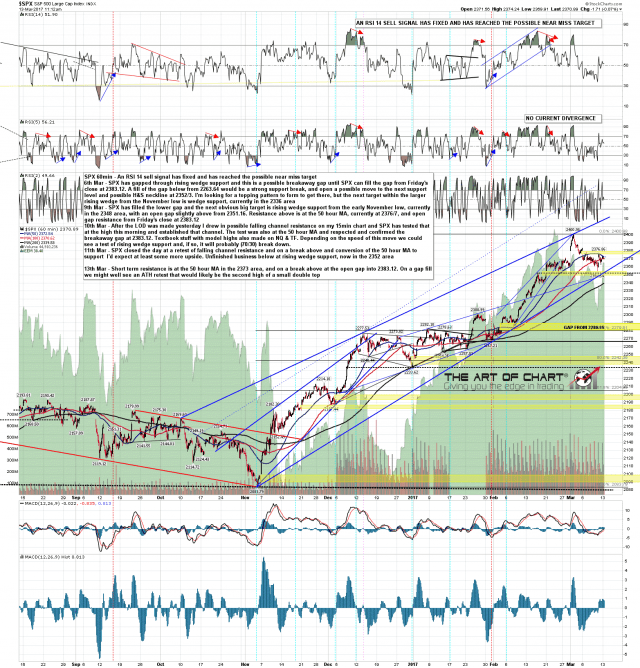

On the hourly chart this has been a thorough backtest of the 50 hour MA and I’d note that the next obvious downside target at rising wedge support is now in the 2352 area, above flag channel support now at 2348. Whichever way this goes this is a bull flag channel and the next obvious target on a break above it is an ATH retest, most likely to make the second high on a small double top. SPX 60min chart:

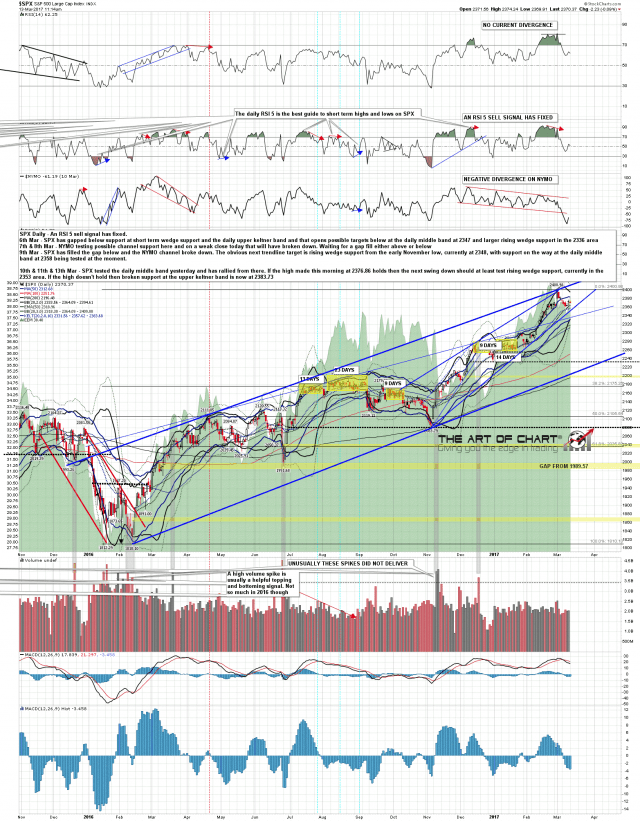

On the daily chart the middle band has held as support so far. That’s currently in the 2364 area and that is key support (daily closing basis). A closing break below opens lower targets. If it holds then we likely see that ATH retest sooner rather than later. SPX is still on a daily RSI 5 sell signal. SPX daily chart:

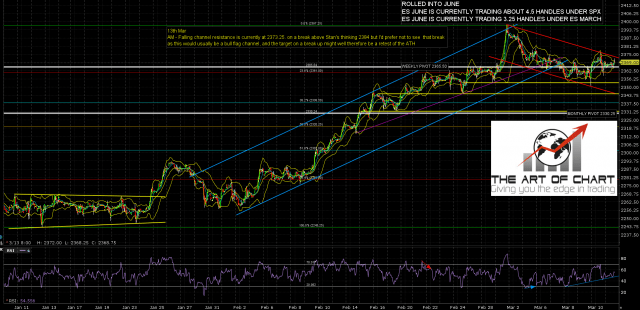

On ES channel resistance is a bit higher. now in the 2373 area. ES Jun 60min chart:

On NQ the obvious next target is a full ATH retest, though the tests we’ve seen so far might be close enough. Possible nested double top setup forming. NQ Jun 60min chart:

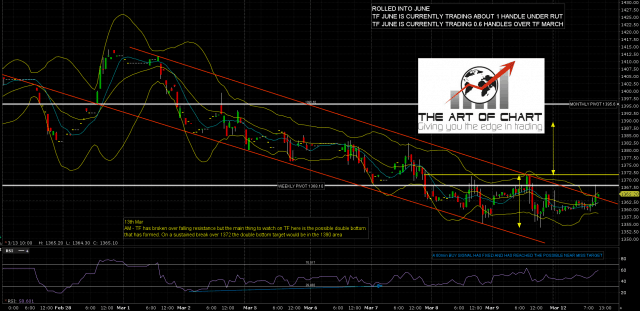

TF is now trying to break over the double bottom resistance at 1372. On a fail there this is a Jack (In The Box) bear Flag setup that should deliver a retest of the current retracement low at 1354. On a sustained break over 1372 the double bottom target would be in the 1390 area. TF Jun 60min chart:

Cycles are leaning short this week and overall the setup here favors the downside but if we see a break up that should be respected.