Lower lows on ES and NQ in globex overnight and that was bearish, kinda, or at least it would have been if the lows hadn’t been marginal on positive RSI divergence that has since delivered fixed buy signals on NQ and TF, and setting up double bottoms that have now broken up on ES, NQ and TF. The breaks are marginal on ES and TF so far with NQ almost at target, and if bears are going to turn this today then it should be here at the test of the 2350 SPX area. A hard reversal here would looks for further lower lows, but a sustained break up would likely deliver the day to the bulls. All the targets and setups are marked on the charts below.

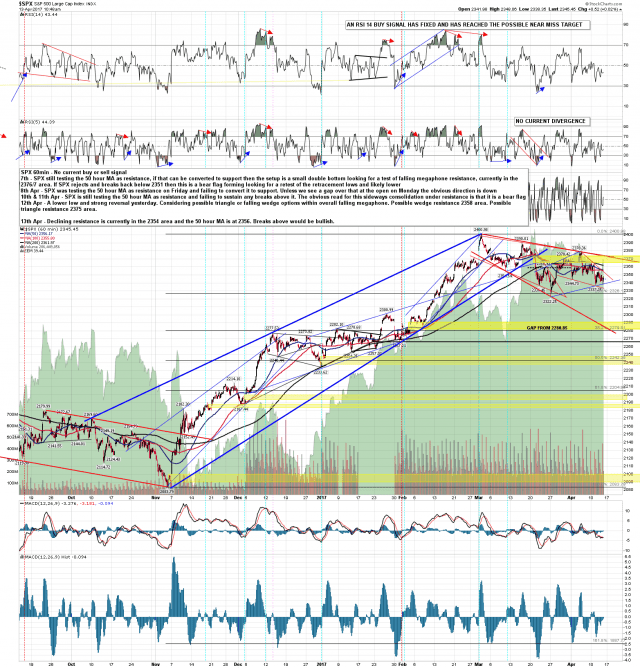

SPX 60min chart:

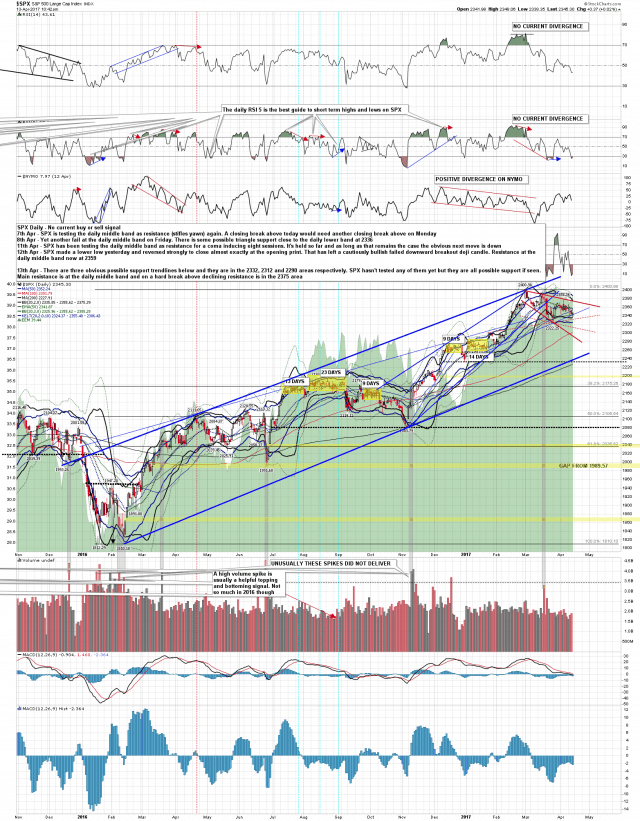

SPX daily chart:

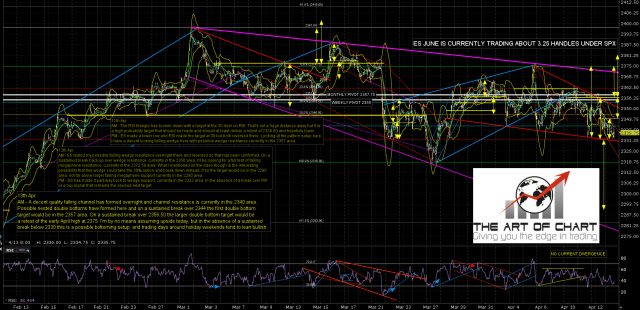

The futures charts below were produced premarket for Daily Video Service subscribers at theartofchart.net. 30 day free trials are available here. I was mainly looking at the upside risk and that’s always on my mind on the last trading day before a holiday.

ES Jun 60min chart:

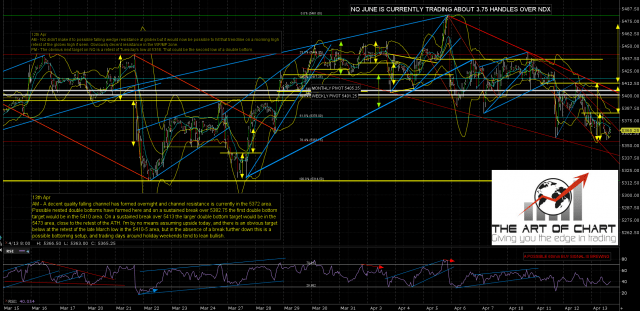

NQ Jun 60min chart:

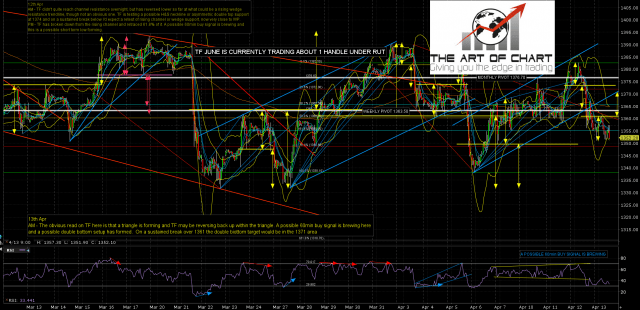

TF Jun 60min chart:

Today is a cycle trend day and the trend for the first couple of hours has 70% odds of lasting all day. There is a decent case for going lower otherwise but I’m not certain that matters today. Maybe. Everyone have a great holiday weekend. 🙂

Stan and I are doing a free public webinar after the close today on our Big 5 stocks, which are AMZN, AAPL, FB, NFLX and TSLA. If you’d like to attend you can sign up for that here.