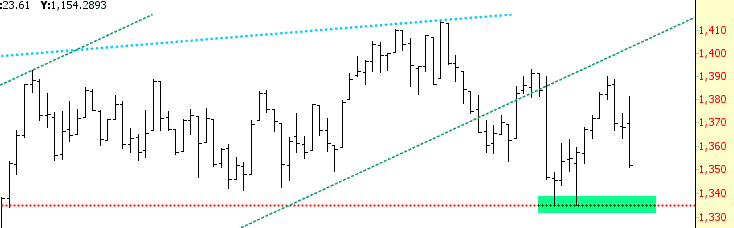

Since I’m super-short right now (70 different positions and nearly 300% margined), I thought I’d put up a brief post to examine what the next important “break” level for the Russell 2000 would be. Specifically, we need to break about 1335, as highlighted here: