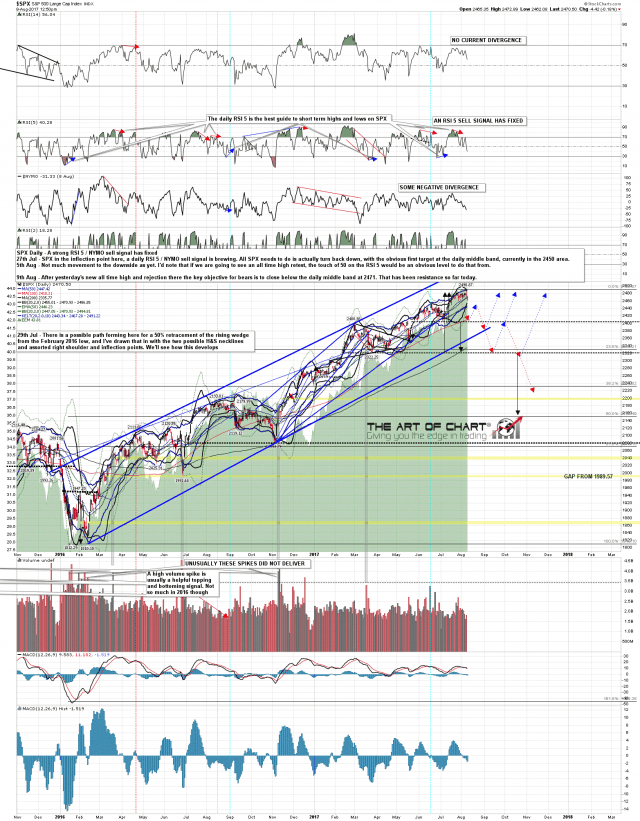

SPX spiked to a new all time high yesterday and then rejected hard from that high, and the lower highs at the same time on NDX and RUT. Today is about the bears following through on that rejection and the key objective for bears on SPX is to close the day below the daily middle band, currently at 2471. If seen, that then needs to be confirmed with another close below tomorrow. SPX daily chart:

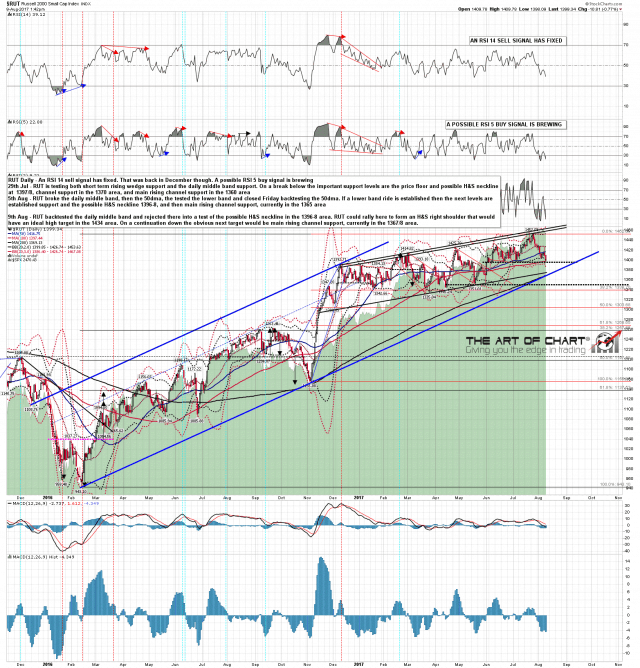

On RUT the high yesterday was at a test of the daily middle band, with a strong rejection there back into the lower band. RUT is testing the main possible H&S neckline, and there is some positive divergence suggesting that a right shoulder might form here. If so the ideal right shoulder high would be in the 1434 area. RUT daily chart:

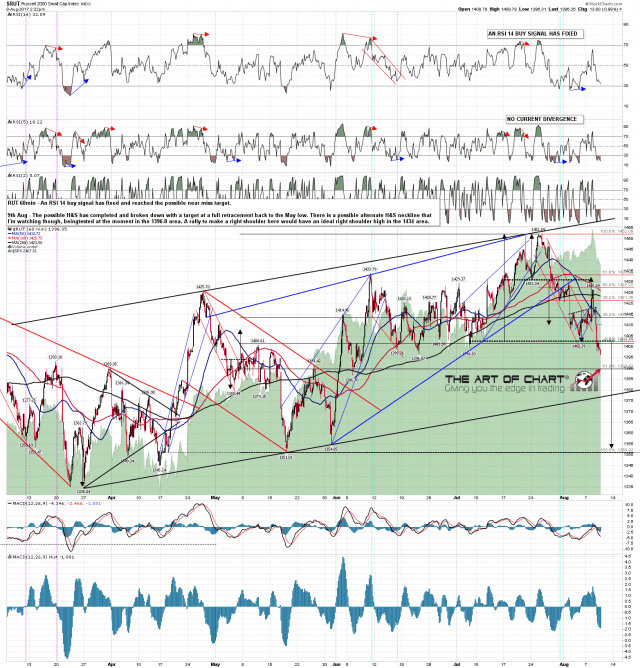

However a slightly smaller H&S has already formed and broken down on RUT. If RUT doesn’t reverse back up here the obvious targets below are smaller rising channel support in the 1378 area, then main rising channel support in the 1366-8 area, then the H&S target is at a full retracement back to the May low at 1351. RUT 60min chart:

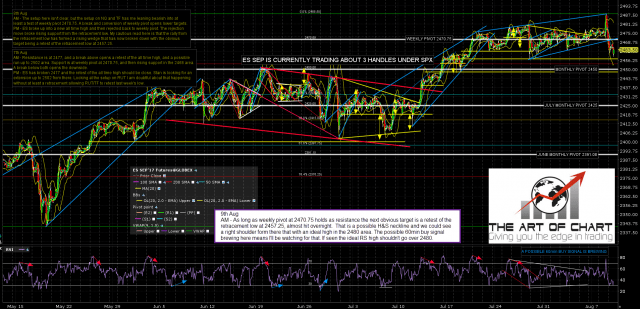

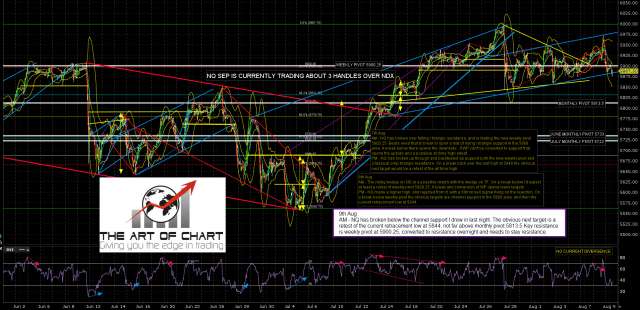

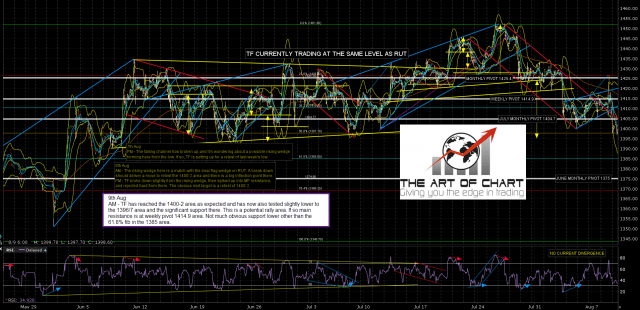

The ES, NQ and TF futures charts below were done an hour before the RTH open for Daily Video Service subscribers at theartofchart.net. If you are interested in trying our services a 30 day free trial is available here.

On ES there is a possible H&S neckline at the late July low at 2457.25. That has almost been hit and ES could form a right shoulder here. If so the first resistance would be the weekly pivot at 2470.75, and the ideal right shoulder high shouldn’t exceed 2480. ES Sep 60min chart:

On NQ the obvious next target is the late July low at 5844. NQ Sep 60min chart:

Overnight and this morning TF was testing the possible larger H&S neckline and important support area 1396-8. That has since broken slightly but not with conviction as yet. TF Sep 60min chart:

Bears have the upper hand short term here but need to use that to push through to the next support levels. A hard push down on SPX looks for the 2400-10 area.