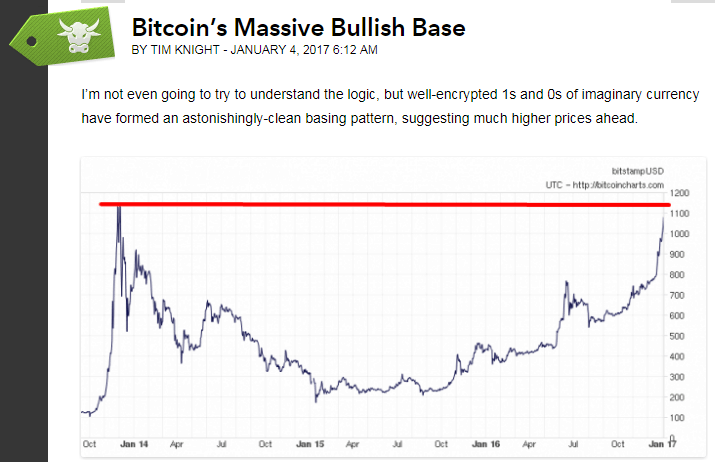

In the nearly thirteen years that I’ve been writing Slope of Hope, perhaps the most ironic post (out of over 20,000) was one I did last January called Bitcoin’s Massive Bullish Base. The reason it’s ironic is because Slope is largely dedicated to seeking out short-selling ideas for stocks, whereas the post was about going long a cryptocurrency. Only ten months and eight-hundred percent later, It turned out to be the greatest trade idea in the blog’s history, which actually doesn’t feel that great for the reason just cited.

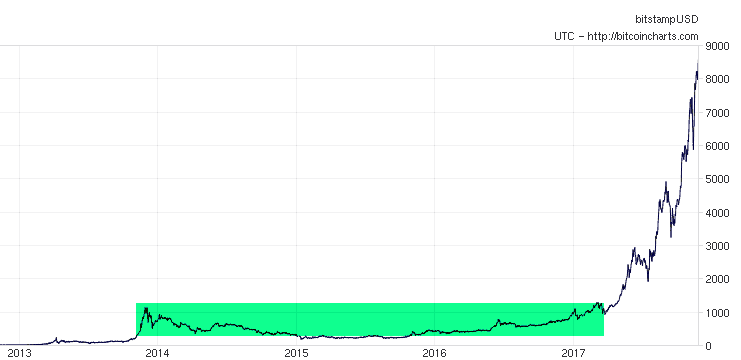

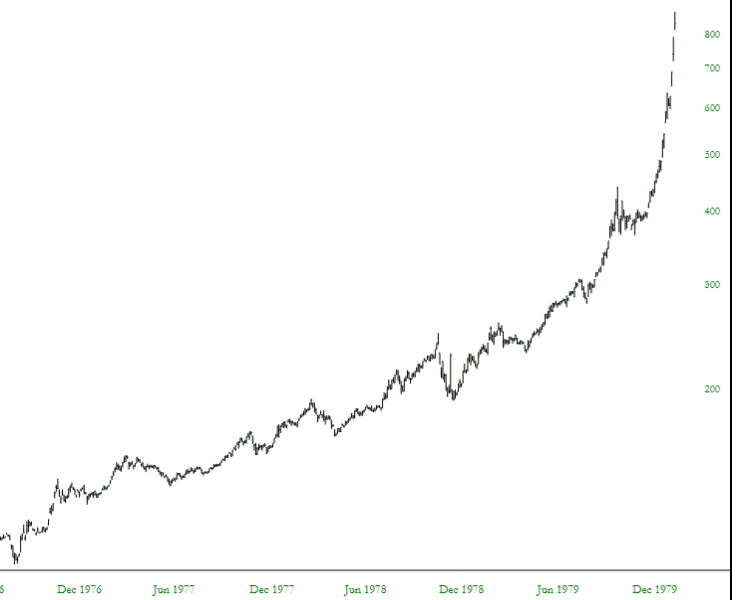

In any case, the “bullish base” had merit (just like in the old days for stocks – – remember those?) and, in the months following the post, it’s quite evident what an explosive rally we’ve had. I’ve tinted the original “base” in green.

As cryptos continue to roar higher, and as Bitcoin itself vaults toward $10,000, the world is increasingly awash in excitement, come-ons, scholarly essays, scam artists, and everything in between. Anything that goes from one penny (2009 price) to almost ONE MILLION times that, is going to catch some attention. There aren’t many financial instruments that go from one thousand dollars to a billion dollars in value in the span of eight years. Bitcoin makes Amazon and Apple look like complete garbage investments.

Do cryptocurrencies represent the last bastion of an honest market? After all, you don’t have any central banks screwing around with them (like they do with stocks and bonds), and you don’t have meddlesome governments trying to get their grimy fingers and regulations wrapped around these instruments. It could be argued that, after eight years of absurd and grotesque intervention on so many other financial assets, Bitcoin finally represents a sliver of honest price discovery.

Personally, I’m of two separate minds when it comes to Bitcoin (which I’ll use as a catch-all with respect to cryptocurrencies, since it by far the largest and best-known). One is that, in the same sense that some celebrities are “famous for being famous“, like these wastes of space………….

…….Bitcoin is getting more valuable because it’s getting more valuable. Call it the Greater Fool Theory if you like, or just plenty of free global publicity, but as the frenzy feeds on itself, more and more people are piling in, terrified of missing out on what appears to be free money.

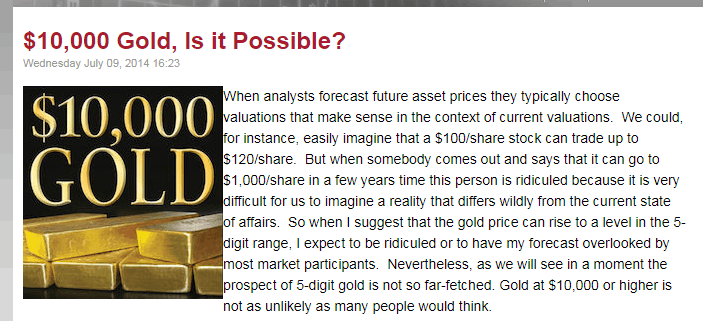

Another part of me is thinking that Bitcoin has become the recipient of all the animal spirits that gold was SUPPOSED to inherit. It wasn’t that many years ago, particularly around 2010 and 2011, that the world was going almost as crazy for gold as they are currently going for Bitcoin. Do you remember articles like this one? They were EVERYWHERE.

Writers would speculate that gold, which almost got to $2,000/ounce in September of 2011, was on its way to $3000………$5000…………$10,000. The predictions got increasingly loony, but given the insanity going on with central bank intervention, it actually made a lot of sense that “sound money” would be the place where sensible souls were squeezed into.

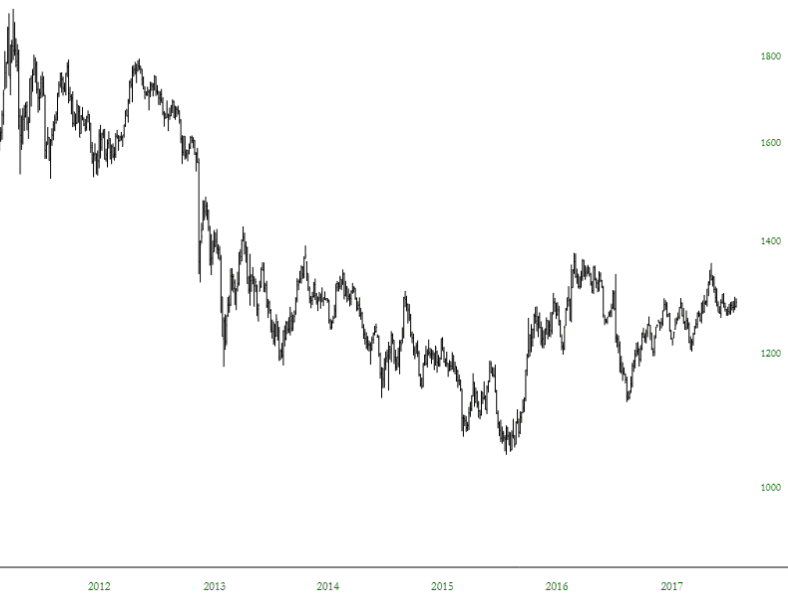

As you well know,. however, just when gold mania was peaking at about $1900 per ounce, it went into an almost-any-asset-is-better bear market of its own, stumbling, fumbling, and languishing its way down to a complete lame-o loss of 35% over a period of about six years. Gold has, particularly compared to just about any other asset imaginable, completely sucked.

My declaration that it “sucked” is risk-free now, because any five-year old kid could draw the same conclusion. It would be foolhardy to say the same thing during its heydey, though, even as it was descending in 2012, 2013, etc., since gold bugs were fanatical about their rightness. It took years before someone could shamelessly roll their eyes at precious metals and get away with it, because PM types had a zealotry few religions could match. Now they have fallen into embarrassed silence. There’s only so long you can declare that change is “just around the corner”.

This zealotry is present with cryptos these days. Just try to hop onto Twitter or a comments stream and bash (or even question) cryptos. You’ll be torched. So there has been, it seems, a transference of these passions from the world of precious metals to the world of cryptos, and it’s easy to see why; cryptos have made investors tons of money, where gold has let all of its believers down unless they bought it, I dunno, 1999 or something.

It’s an odd thing, though. I mean, let’s face it, gold should be intrinsically more appealing to the human spirit than a bunch of 1s and 0s. Put a stack of gold coins in front of a bunch of five years old that are playing, and put down a few sheets of paper with SHA-256 hash codes printed on them, and watch to see what the kids find more enjoyable. Gold looks pretty, it feels substantial, and it seems like………money.

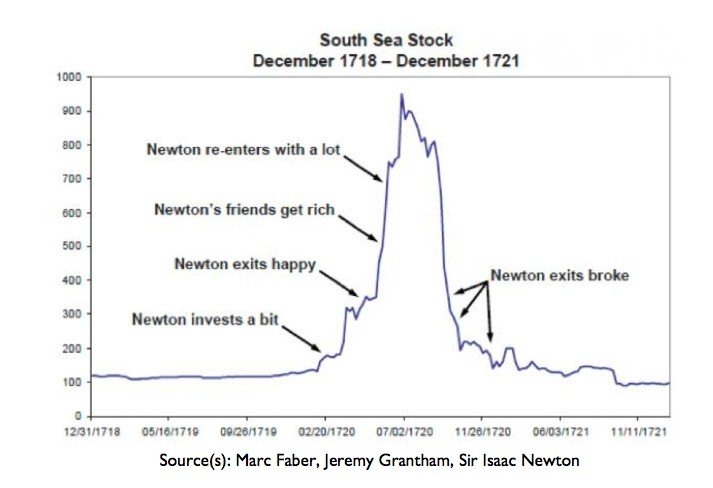

Jump back forty years, and you can witness a time when people regarded gold with the same fervor as Bitcoin…….doesn’t this chart look familiar?

If you think Bitcoin is heading for some kind of blowoff top, perhaps gold’s history can suggest what’s next. If financial history repeats itself, perhaps something like this is in store:

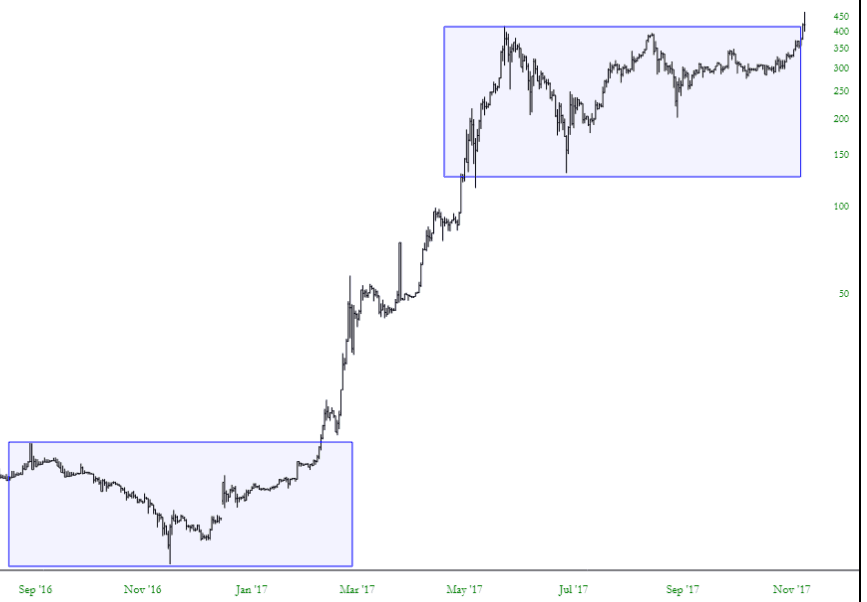

I’m pretty ambivalent about cryptos myself, because I’ve never bought one, and God knows even I’m not fool enough to try shorting any of them. As a chartist, just as I was impressed by Bitcoin’s bullish base, I’m likewise impressed by the breakout we’ve seen in Ethereum:

All the same, with all the mayhem surrounding this phenomenon, particularly the celebrities trying to come up with their own cryptos (my favorite: Coinye West), it sure does have all the typical attributes of a fad-based bubble. If so, the fall should be more interesting than the rise. Whether this happens or not only time can tell, but I, for one, don’t want to follow a genius like Newton on a road like the one he took four centuries ago.

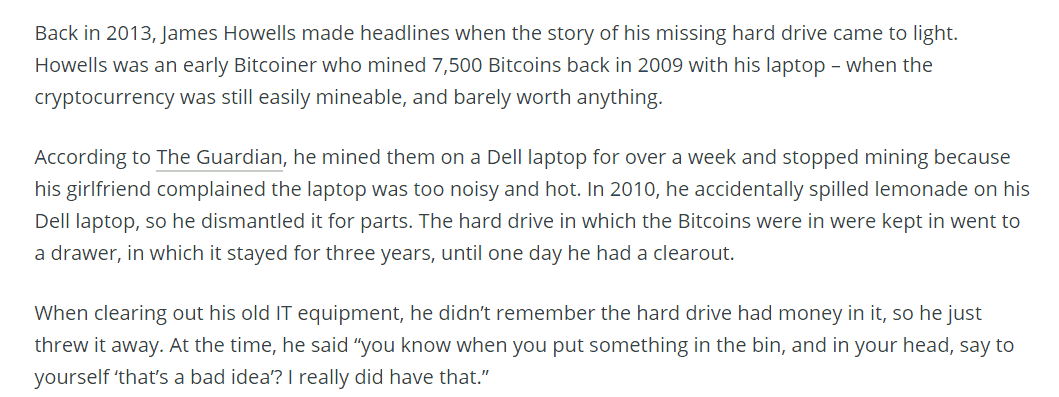

One last thing – – there are two kinds of stories you’re going to be hearing about a LOT these days. First are the stories of the guys who bought (for basically nothing) or stumbled upon Bitcoins and hung on to them and are now worth millions, tens of millions, hundreds of millions, or more. And the second – – which will help cheer you up if you read any of the first kind – – are more along these lines: